Carbon pricing works in the U.S.

Carbon pricing is emerging as the tool of choice to reduce emissions. More governments are relying on carbon pricing, and more evidence is piling up that it works. Ecofiscal’s latest report highlights three case studies, including one on California. Today, we’ll dive deeper into the U.S.’s other cap-and-trade system: the Northeast’s Regional Greenhouse Gas Initiative (RGGI).

Modest beginnings, steady improvement

Conceived in 2005 and implemented in 2009, RGGI (pronounced “Reggie”) is actually North America’s oldest cap-and-trade regime. It currently operates across nine states: Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island, and Vermont. Unlike the Western Climate Initiative’s linked cap-and-trade system, RGGI’s carbon price does not apply across the economy, just to large electricity producers. It’s a small slice of the economy.

RGGI had humble ambitions. An unfortunate mix of an overly generous cap, an economic recession, and a rapid switch to lower-emissions fuels led to depressed permit prices, no higher than $3.35/tonne. For comparison, California’s permit prices are closer to $15/tonne (all USD). But unlike WCI, which provides some allocations for free, the system auctioned all permits from the beginning. As a result, RGGI functioned somewhat like a carbon tax rather than a cap-and-trade system in its early days. Producers had sufficient permits —which they paid for — but no trading was necessary.

RGGI received a facelift when it entered its third iteration in 2014. States slashed the cap to 90 million tonnes – less than 50% of its initial level – and implemented mechanisms to stabilize permit prices. Auctions are selling out, and permits have gone for as much as $7.50/tonne. While permit prices are now more predictable, they’ve continued to fluctuate as the federal government pulls 180-degree regulatory spins.

A number of benefits

Yet despite some hiccups, RGGI is working. Emissions are falling, there is observable and attributable fuel-switching among electricity producers, and air quality has improved.

Since implementation, power plant emissions in RGGI states have fallen over 50%. One economic analysis, isolating for RGGI’s effects (including its revenue recycling program), found it was the primary contributor to this decline. The Pennsylvania shale boom and the recession were also factors. Overall, emissions in RGGI states have fallen an additional 16% relative to the rest of the U.S.

RGGI’s impact on emissions registers nationally. The same paper attributes 2% of national emissions declines between 2009 and 2011 to RGGI. Other economic analyses have found that every $1 increase in the permit price would reduce sector-level emissions by an additional 1.9%.

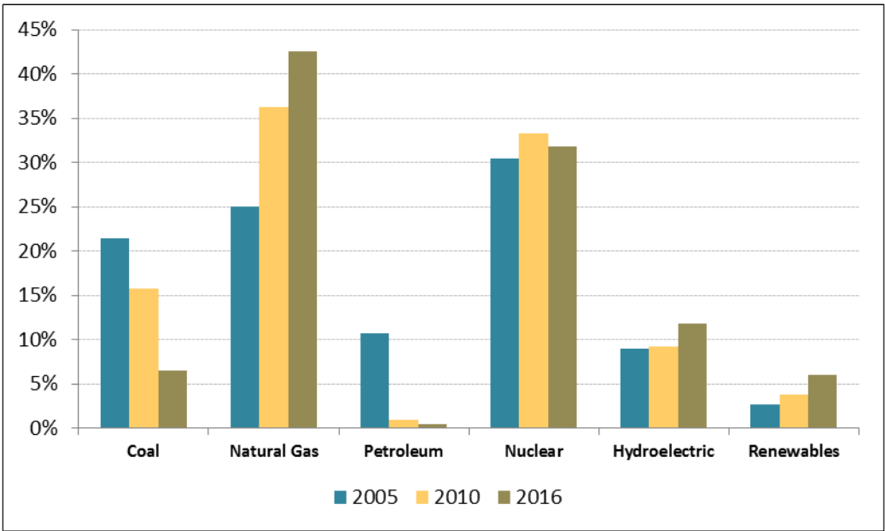

The electricity mix in RGGI states looks very different than it did just a decade ago. Two economic studies suggest that RGGI had a measureable, though modest, impact on this shift. The shale boom and falling price of renewables also played a role. In the short-run, producers lowered their output in response to RGGI. In the medium-term, they’ve undertaken a massive fuel-switching operation, using less petroleum and coal, and more natural gas and renewables. (Producers are also importing more electricity; more on that in a moment.)

Figure 1: The electricity mix in RGGI states

Source: FAS, 2017

Lastly, RGGI’s has delivered significant health benefits. One study pegged the cumulative benefits from improvements in regional air quality at $5.7 billion. For context, RGGI auctions have generated $2.7 billion in revenues.

RGGI hasn’t been an economic barrier, either. In fact, a new study finds that from 2015 to 2017, the overall benefits for RGGI economies exceeded costs by $1.4 billion.

Leakage a concern

RGGI’s experience also highlights a challenge for carbon pricing design, one that Ecofiscal has spent some time studying: leakage. Every study on RGGI cites leakage as a concern.

From 2012 to 2014, RGGI states imported 34% more electricity relative to the baseline period. However, because imports came mostly from hydro and renewables, emissions from imported sources actually fell (very slightly). Leakage of coal-fired power, however, likely offset RGGI emissions reductions by as much as 25%, according to one back-of-the-envelope calculation.

This is a design issue for RGGI, not an indictment of cap-and-trade. We have a number of solutions available to address leakage. RGGI states simply chose not to implement them, possibly due to the emphasis on revenue recycling over stringency. Still, the net effect on emissions is positive, and RGGI’s experience offers lessons for other, future cap-and-trade systems.

Onward and downward

RGGI has become a fixture of state-level climate policy. Member states have committed to tighten the cap by 30% between 2020 and 2030, with additional mechanisms to improve stringency and flexibility across time.

In the meantime, RGGI has its sights set on expansion. Virginia is looking to become the first southern state to join the program. New Jersey will rejoin after a hasty departure in 2011. As the cap falls, and membership increases, emissions will fall further, faster. It may not end up becoming the model for federal policy, but RGGI is another successful data point. Carbon pricing works; even in the U.S.

To learn more about how and why carbon pricing works, check out our report.

Comments are closed.