Getting the Facts on Carbon Pricing and Business Competitiveness

By Chris Ragan, Chair, Canada’s Ecofiscal Commission

The Ecofiscal Commission’s first carbon pricing report, The Way Forward, made the case that provincial carbon pricing leadership is both a practical and effective way to make urgent climate policy strides. But different carbon prices raise valid concerns about business competitiveness. Today we’re releasing new research to shed light on those concerns.

Our findings: business competitiveness challenges are likely smaller than often thought, but nonetheless present decision-makers with important considerations as they develop new provincial carbon pricing polices.

The Road to Paris and Back is Anything but Linear

Our new research comes as governments across the world prepare for next week’s Paris Climate Summit. Addressing climate change is a clear priority for the world’s nations. This is evidenced by the fact that more than half of the 155 countries that have submitted Intended National Commitments include or consider carbon pricing within their plans.

However, no matter what commitments or decisions governments make in Paris, the road back will be anything by linear. That is as true on the international stage as it is here in Canada. Provincial governments are adopting different carbon pricing policies at different paces.

Provincial leadership protects our long-term economic interests by getting policy in place now, which can be ramped up and coordinated over time, steadily encouraging low-carbon innovation. But in the shorter-term, it does beg the competitiveness question.

Different Carbon Prices and Competitiveness Pressures

Will a higher carbon price in one province lead businesses to move elsewhere to remain competitive? This question is critical to the twin goals of reducing greenhouse gas emissions while maintaining a healthy economy. If businesses or investment flee a jurisdiction to avoid paying a carbon price, provinces could suffer real economic costs with no overall environmental gain.

Our new paper, Provincial Carbon Pricing and Competitiveness Pressures, illuminates the nature and scope of this challenge both for businesses and governments. Here’s what we found.

Small in Scope

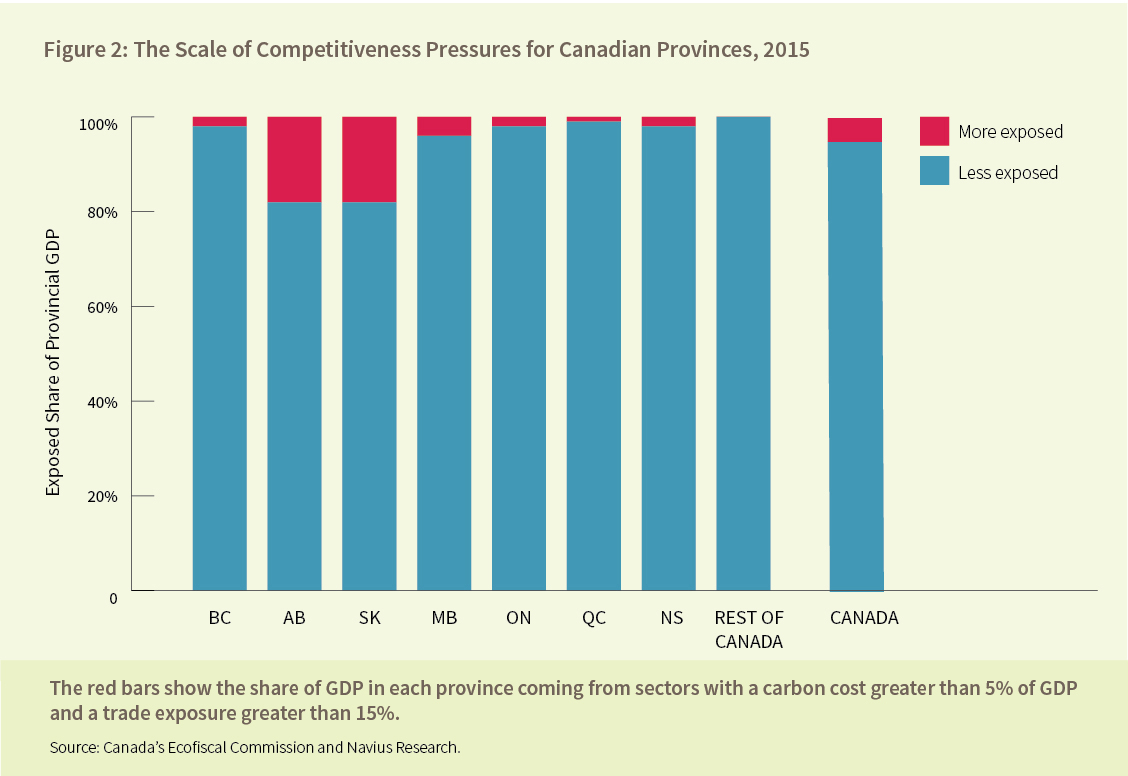

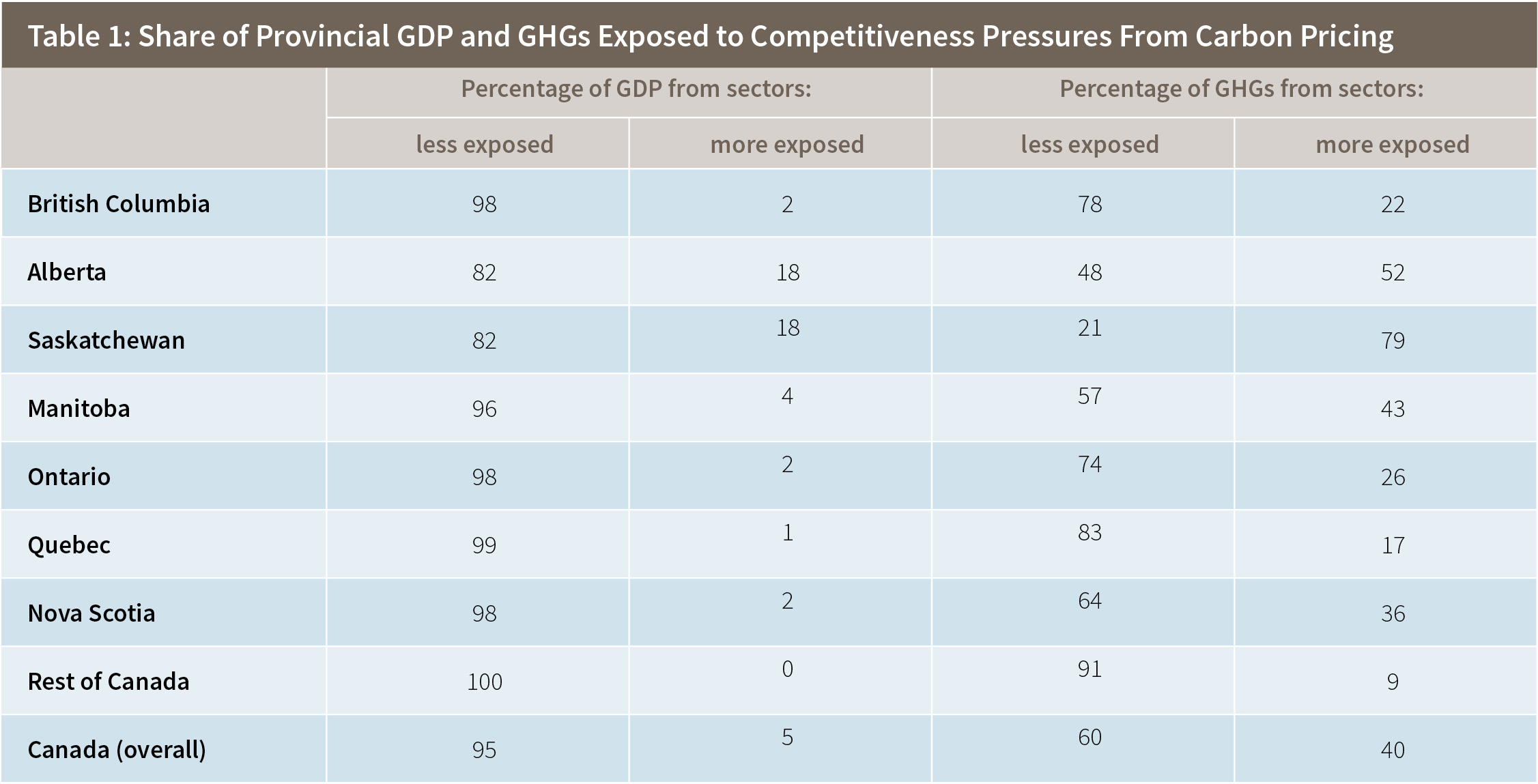

In the context of a $30 per tonne carbon price, only a small number of sectors, representing less than 5 per cent of Canada’s economy, are likely to experience significant competitive pressures.

Why? Services and non-traded goods make up a huge share of Canada’s economy. These businesses are not carbon intensive, which means their carbon costs (how much they would pay under a pricing regime as a share of their GDP) are very low. At the same time, many of these businesses compete mostly in local markets—which means a level playing field.

Interestingly, more stringent policy doesn’t really change this story. Even with a $120 per tonne carbon price (a figure way beyond what any jurisdiction is currently considering), 90 per cent of Canada’s economy would still be virtually unaffected by competitiveness challenges.

But we should not gloss over the significant differences between provinces. Our research hones in on four economies: British Columbia, Alberta, Ontario, and Nova Scotia. Not only are different sectors in each province potentially exposed, but the scope of the exposure also differs—not inconsequentially for Alberta (18 % of its economy is potentially exposed compared to 2% in BC, ON, and NS). As always, these local details matter.

Significant for Policy

One uniting trend: the relatively small number of potentially vulnerable sectors in each province produces a significant share of GHG emissions.

This isn’t terribly surprising—those higher emitting, trade-exposed industries are most likely to face competitiveness challenges. However, it is important.

We know that effective carbon policies are broad—covering as large a share of the economy as possible. That means not excluding industries, even those that could face genuine competitiveness pressures as a result.

If those pressures aren’t addressed, however, we do risk displacing those industries, losing the jobs and investment that come with them, and—equally important—missing a significant opportunity to transition high-emitters to a lower-carbon economy.

The Way Through: Follow the Three Ts

The good news is, governments can address these challenges with targeted, transparent, and temporary support measures for genuinely vulnerable industries. These could include free permits (under a cap-and-trade system) or carbon tax rebates. But the “three Ts” are the key to getting this right.

Targeted means only extending supports to industries that are genuinely vulnerable.

Transparent means using objective data to identify those vulnerable industries, and ensuring that information is out in the open. Significantly more work is required on this front. Our research is based on publicly available sectoral information. But detailed provincial and firm-level data is required to properly assess genuine vulnerability.

Temporary means putting a firm time limit on supports, both enabling and creating a strong incentive for low-carbon innovation.

Provinces are stepping up to the plate nationally and internationally, driving important carbon pricing momentum. A key takeaway from this new research is that provinces must move thoughtfully through carbon policy design. But they can do so with confidence, knowing that their carbon-pricing policies will reduce GHG emissions while driving the innovation we need to secure the long-term competitiveness of Canadian business.

Read the Carbon Competitiveness ReportAbout the Author

Chris Ragan is an Associate Professor of Economics at McGill University and the Chair of Canada’s Ecofiscal Commission, which seeks to advance policies that achieve better results for Canada’s economy and environment.

Comments are closed.