Carbon pricing in Canada: What works, what doesn’t and what we can learn from it

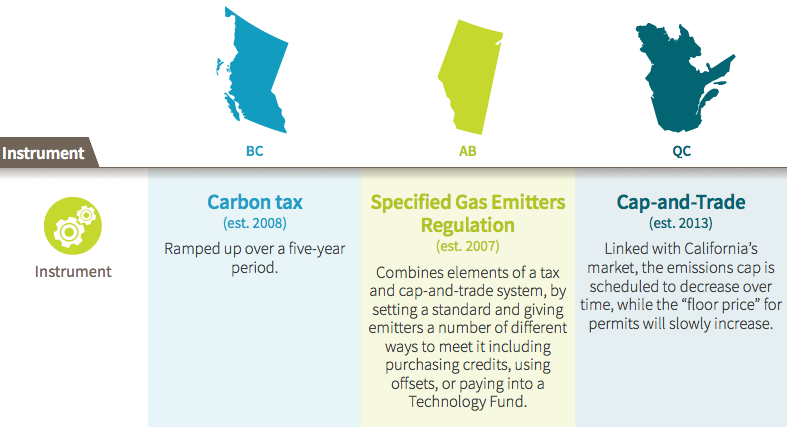

To judge the success of different carbon pricing strategies, Canadians don’t need to look far. In 2007, Alberta implemented its Specified Gas Emitters Regulation (SGER), a flexible performance standard, which has elements of both a carbon tax and a cap-and-trade system. B.C. has had a carbon tax since 2008, and Quebec just recently launched a cap-and-trade system.

Although it’s too early to draw conclusions from Quebec’s experience, we can see striking differences between the results in B.C. and Alberta.

In the six years since B.C.’s carbon tax took effect, the province’s fuel use per capita has dropped 16 per cent, while it increased by three per cent in the rest of Canada. In its first four years, the B.C. tax reduced greenhouse gas emissions resulting from gasoline-use by three megatonnes. In contrast, preliminary analysis suggests that Alberta’s SGER has had no significant impact on carbon emissions.

And contrary to many opponents’ dire predictions, the carbon tax does not appear to have hurt B.C.’s economy. Since 2008, employment has increased and GDP grew by 1.8 per cent compared to a national average of 1.3 per cent.

What lessons can we draw from these two examples?

Lesson #1: To change behaviour, price matters

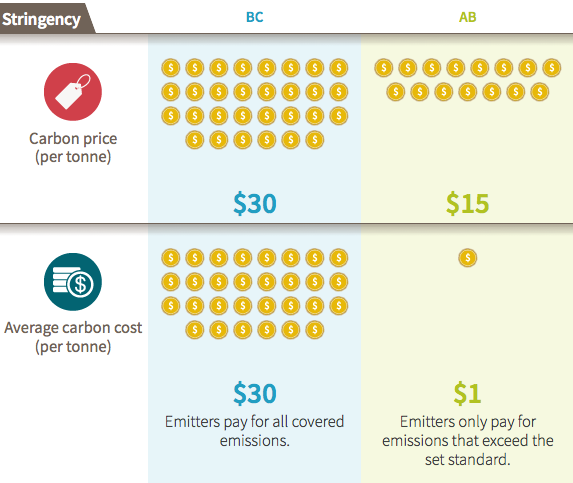

To get firms and individuals to reduce emissions, the price imposed on carbon has to be significant (although not so significant that it creates economic shocks). B.C. set its price at $30 per tonne. Alberta’s emitters pay $15 per tonne — and only for a small proportion of their emissions.

Lesson #2: Broad coverage is key

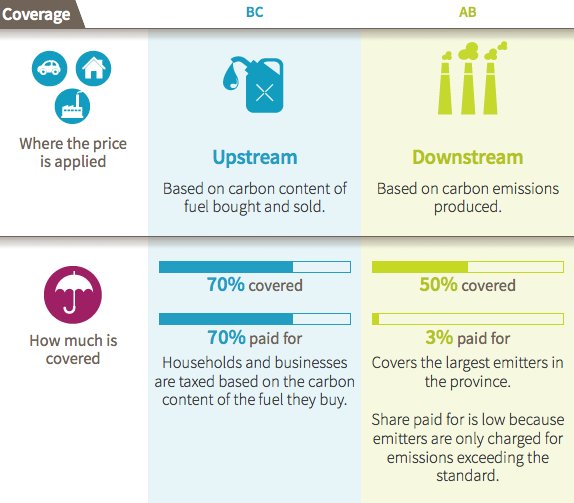

The broader the coverage, the better the results. Alberta’s SGER applies only to large emitters (facilities with emissions greater than 100,000 tonnes a year). As a result, the policy covers 50 per cent of the province’s carbon emissions, and emitters only actually pay the price on the 3 per cent of emissions that exceed the set intensity threshold, hence its lack of impact. In contrast, B.C.’s tax applies to about 70 per cent of the province’s emissions.

Lesson #3: Close the loopholes

Where we see the real difference in policy between Alberta and B.C. is in the average carbon cost. That is the effective price paid per tonne of carbon, which factors in firms’ planning decisions. In B.C., all regulated emitters face the same price: $30 per tonne, so the average carbon cost is the same.

That’s not the case in Alberta. The few large industrial emitters who are regulated under SGER only pay the $15 per tonne for emissions above the 12 per cent improvement in emissions intensity required by the policy. As a result, the average carbon cost in Alberta is just $1.14 per tonne.

The bottom line

These made-in-Canada examples and others elsewhere show that having an effective carbon pricing strategy is not so much about the choice of a carbon tax over a cap-and trade system or a hybrid model. What matters to achieve the desired results is policy stringency: setting a price high enough to affect emitters’ behaviour and aiming for as broad coverage as possible.

View the entire Carbon Pricing Infographic.

About the Author

France St-Hilaire is Vice President of Research at the Institute for Research on Public Policy, as well as a Commissioner of Canada’s Ecofiscal Commission.

1 comment

[…] make in Paris, the road back will be anything by linear. That is as true on the international stage as it is here in Canada. Provincial governments are adopting different carbon pricing policies at different […]

Comments are closed.