How emitters respond to carbon pricing and to revenue recycling

A carbon price pretty clearly creates incentives for emitters to produce fewer GHG emissions. But there’s more than one way to reduce emissions. In today’s blog, I’m going to dig into the vault, and pull out an old piece of modelling analysis that didn’t quite make it into our reports, because it was a little too deep in the weeds (Fair warning: #wonkishness alert). It illustrates different ways that firms and households might reduce GHG emissions. That’s useful in helping to understand how emitters might respond to a carbon price. But it also offers insights into how different approaches to revenue recycling might change those responses… both for better and for worse.

Carbon pricing doesn’t prescribe specific actions

One of the key reasons that a carbon price can reduce GHG emissions at low cost is its flexibility. A manufacturing firm can choose more energy-efficient equipment. Individuals can choose to buy an electric vehicle rather than an internal combustion car. A utility can choose to generate electricity with gas or wind rather than coal. Or an emitter can choose to continue to emit and pay the price to do so.

But the point is that they have choices. Unlike, a prescriptive regulatory approach, which might require specific actions, a carbon price doesn’t pretend that government can identify the lowest cost options for individual firms or households. It lets emitters decide themselves. And that lets them avoid the highest cost modes of abatement.

Emitters can respond to prices in multiple ways

To illustrate, it’s useful to unpack the kinds of emission-reducing actions that might be available to emitters. We can group these actions into four main categories:

- Improved emissions intensity: Emitters can reduce their emissions by adopting new technologies and processes that allow them to produce or consume goods but produce fewer GHG emissions. A household, for example, can reduce its emissions from its passenger vehicles by purchasing an electric or hybrid vehicle instead of a gasoline-fueled vehicle.

- Indirect emissions reductions: Alternatively, firms and consumers can use goods and services that require fewer emissions to produce. These actions don’t reduce emitters’ own emissions, but do reduce emissions elsewhere in the economy. As an example, the consumption of electricity does not produce emissions directly. Depending on how electricity is produced, however, reducing the consumption of electricity can reduce emissions at the point of electricity generation.

- Reductions in economic activity. Emitters can also produce or consume less. Some activities might be so emissions-intensive, that they are simply un-economic under a carbon price. Reducing economic activity tends to be a very expensive way to reduce GHG emissions.

- Leakage: Finally, trade might replace domestic firms’ economic activity. In other words, competitiveness pressures might cause investment or production to shift to jurisdictions with weaker carbon policy. Such a shift might reduce domestic GHG emissions… but not global emissions.

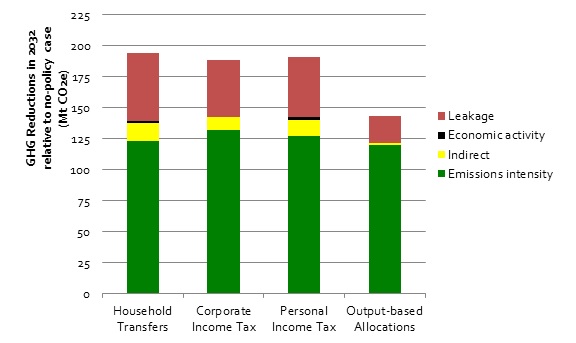

Figure 1 draws on modelling analysis that informed our report on revenue recycling, Choose Wisely (the report includes simplified version of this figure). It decomposes expected emissions reductions across Canada under a carbon price that rises to $100 per tonne into the four categories that I discussed above. And it does so under four different scenarios that consider various ways in which revenue generated from the policy could be recycled back to the economy.

Figure 1: Decomposition of emissions reductions

A couple of trends jump out right away.

First, most emissions reductions from the carbon price are not the result of reduced economic activity. Firms would much rather find ways to improve their emissions intensity and continue to produce goods and services than to simply shut down. That’s one of the reasons why the costs of carbon pricing are relatively low (Figure 6 from the same report, here, shows the small changes in growth rates expected under each scenario).

And second, leakage appears to be a problem worth paying attention to. If Canada were to act alone, with a carbon price rising to $100 per tonne, there is risk of shifting production, investment, and emissions to other jurisdictions such as the United States. Fortunately, the figure also shows a potential solution to this problem of competitiveness.

Revenue recycling can affect emitters’ choices too

Figure 1 also offers insights as to the implications of revenue recycling choices for outcomes.

Most importantly—and as we’ve argued elsewhere—there are solutions for the competitiveness problem. In particular, providing output-based allocations or rebates for emissions-intensive and trade-exposed sectors can reduce leakage by more than half. By subsidizing production, this kind of approach to revenue recycling can maintain incentives to improve emissions performance, but reduce the incentive to respond to the policy by shutting down production or shifting it to other jurisdictions.

Still, output-based allocations aren’t a silver bullet, either. As the figure illustrates, they also lower indirect emissions reductions. Think of it this way: this kind of approach essentially means that emitters don’t pay the carbon price on all the emissions they produce. That doesn’t change their incentive to reduce emissions. But it does lower the cost of policy on a per tonne basis, which means they may only pass on smaller increases in prices. And as a result, those consumers have smaller incentive to substitute toward less GHG-intensive goods and services.

It’s all about careful design

The bottom-line here comes in two parts, just like ecofiscal policy in general: the price on pollution and the use of the revenue.

The analysis reminds us pricing policy gives emitters choice in how they reduce emissions. And that flexibility is critical for minimizing costs of policy. Pricing policies don’t presuppose the best ways of reducing GHG emissions (for example, reducing output in specific sectors). Want more emissions reductions? Raise the price (or lower the cap), and let the market figure it out.

The analysis also illustrates both solutions and a warning for revenue recycling. Certainly, recycling can address concerns around leakage and competitiveness, which are particularly live given policy discussions south of the border. But used too broadly, output-based allocations can also undermine emissions reductions. That’s one of the reasons we’ve argued that this kind of support should be targeted, transparent, and temporary.

Comments are closed.