America’s reinvigorated debate on carbon pricing

Don’t look now, but the conversation around carbon pricing has some momentum in the United States. Both sides of the aisle are taking the idea as seriously as they have in a while. The IPCC report, youth mobilization, and the possibility of a Green New Deal has energized Democrats and sent Republicans off in search of more pragmatic solutions.

Last week’s town hall on CNN highlighted this ongoing sea change, as first-tier Democratic contenders spoke to the virtues of carbon pricing in broad daylight. Out of nowhere, a lively, constructive, and substantive debate has emerged. Just as interesting: That emerging debate in the U.S. carries echoes of Canada’s journey with carbon pricing.

Town hall consensus

“Yes, and …” was the bottom line when Democratic candidates were asked about carbon pricing. It is now a fundamental building block of a serious climate plan, with some contenders offering full-throated defenses. Mayor Pete Buttigieg explained how to make a carbon tax progressive, and even touted the merits of technology-neutral approaches to climate change. Senator Elizabeth Warren emphasized the polluter-pay principle, and pointed to the successes of state-level carbon markets. Former Congressman Beto O’Rourke made the case for cap-and-trade over a carbon tax.

The Democrats aren’t done with this airing of ideas, either. Another climate town hall is already scheduled.

Bipartisan bills in Congress

The conversation isn’t confined to one political party. Seven carbon tax bills have appeared in Congress over the last 18 months, three of them bipartisan. Top GOP economists and thought leaders have very publicly thrown their weight behind a fee-and-dividend model known as the Baker-Schultz Plan, and members of congress are slowly warming up to market-based solutions.

The conversation among American legislators has also quickly developed intriguing levels of nuance and depth. These bills are wrestling with the right questions. How to recycle the revenues from carbon pricing back into the economy? What’s the price trajectory? How do we address competitiveness impacts?

Take a look at the plans for recycling carbon revenues in a few of the Congressional bills below (Canada’s federal model is on the right). Dividends, payroll tax cuts, infrastructure spending, R&D, climate adaptation—everything is on the table. A grand bargain seems more feasible than it has in some time.

Source: Columbia Center on Global Energy Policy, 2019; Finance Canada, 2019

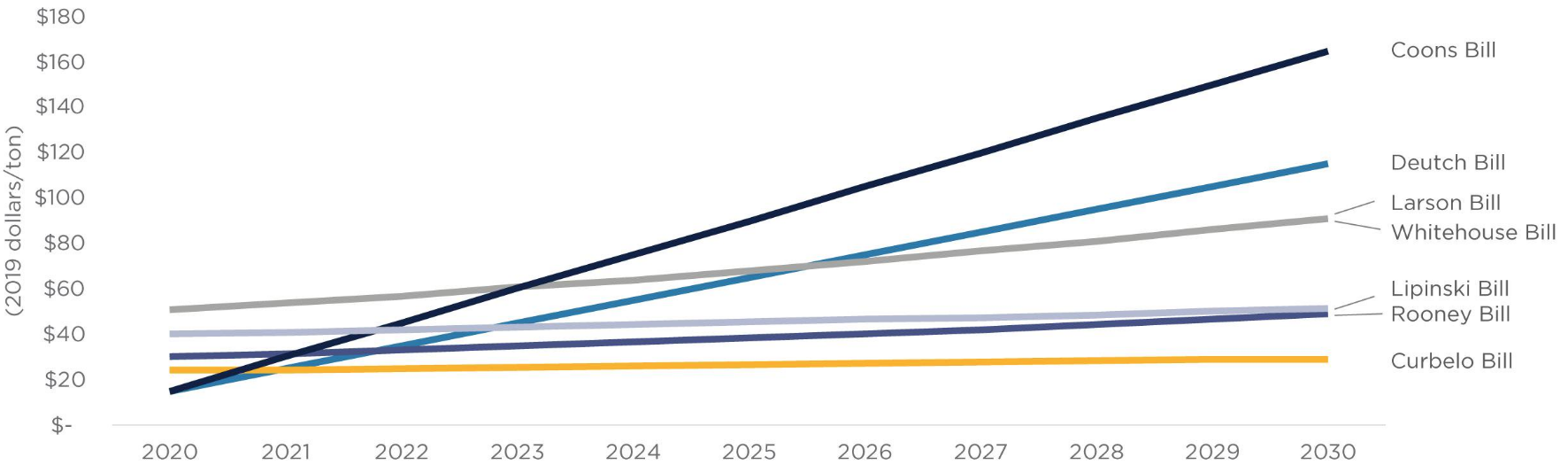

The price paths differ as well, but some design features are common across the bills. For instance, all four bills in Figure 1 contain an inflator that kicks in if emissions aren’t shrinking fast enough. Where the carbon price starts and how fast it rises is another worthwhile debate.

Price paths for various federal carbon tax proposals

Source: Columbia Center on Global Energy Policy, 2019

There’s another growing consensus around addressing competitiveness impacts. Several of the bills contain provisions for border carbon adjustments, also a key feature of the Baker-Schultz Plan. (Canada has taken a slightly different approach to competitiveness.)

49th parallels

The details differ, but the bones of these proposals aren’t too different from the approaches we’ve taken here in Canada. Broad areas of consensus are coming into focus. All plans contain a steadily rising carbon price as a foundational element, with safeguards for businesses competitiveness and protection for households. Perhaps the most striking resemblance is between Canada’s federal carbon price rebate and the pure dividend model of the Baker-Schultz Plan.

Carbon pricing has always been a good idea with some challenging politics. Now it’s trickling into the mainstream. As the consequences of rising temperatures grow increasingly evident, many of the world’s largest countries seem to be circling around a common set of approaches. While the U.S. inches towards critical mass on carbon pricing, other jurisdictions are ramping up as well. China and India are both experimenting with pollution pricing, and carbon prices in the European Union’s ETS hit an all-time high this summer.

Keeping up?

Ambitious climate policy may be back on the menu in the United States. Time will tell how it all plays out, but recent developments are promising. As ideologically diverse actors converge around carbon pricing and the details of its design, meaningful progress seems less farfetched than it has in over a decade.

Canadian climate policy debates have long wrestled with the challenge of asymmetric policy in North America. Indeed, concerns around North American competitiveness are one of the main reasons that “output-based” carbon pricing makes sense here in Canada, even if the U.S. remains mired in inaction.

But in the not-too-distant future, it may be the United States’ turn to follow Canada’s lead on carbon pricing.

2 comments

My impression of USA vs Canada on decarbonizing:

USA current:

x expensive mishmash of regulations and subsidies in areas without carbon pricing

x regulations and subsidies tend to miss the cheapest form of abatement: energy efficiency

x longer delay getting started, no long-term price signal in non-priced sectors means non-future-proof equipment still being sold and more stranded asset costs later when trying to catch up quickly

x leakage between states with carbon pricing -California cap & trade- and nearby states, reducing effectiveness

Canada current:

* single benchmark reduces interprovincial leakage, maintains efficiency

* starting early with escalator signalling future price to reduce stranded asset costs later

* OBPS output based pricing system for EITE emissions intensive trade exposed reduces international leakage

* backstop: revenue recycling to equal rebates ‘progressive’, meaning low-income comes out ahead even when carbon price escalates.

So on one hand I’m feeling great about Canada getting the jump on USA on this file – and skipping the expensive mishmash and heel dragging. But on the other hand still worried about leakage to USA in non-EITE/non-OBPS mid-intensity trade exposed price sensitive sectors – like agricultural commodities. Until USA catches up I recommend close monitoring and temporary responses where leakage is extreme ie 20%.

i endorse this comment, Doug! Thanks for weighing in.

Comments are closed.