China’s sprawling approach to climate policy

It is indisputable that getting global emissions under control requires getting China’s emissions under control. So what is China doing about it? Not only is the nation of 1.4 billion getting serious about climate change, its policy approach often resembles Canada’s. The details warrant careful unpacking. Here is the present and future of China’s climate policies.

A quick recap

China has a roadmap to 2030. They articulated four commitments as part of their Nationally Determined Contribution under the Paris Agreement, all with a target date of 2030:

- Reach peak emissions as soon as possible

- Derive 20% of energy use from non-fossil fuel sources

- Slash emissions intensity per unit of GDP by 60% from 2005 levels

- Increase forest stock volume by 4.5 billion cubic metres

So what policies does China have on the books to achieve these targets, and what policies are on the horizon?

A national price on carbon

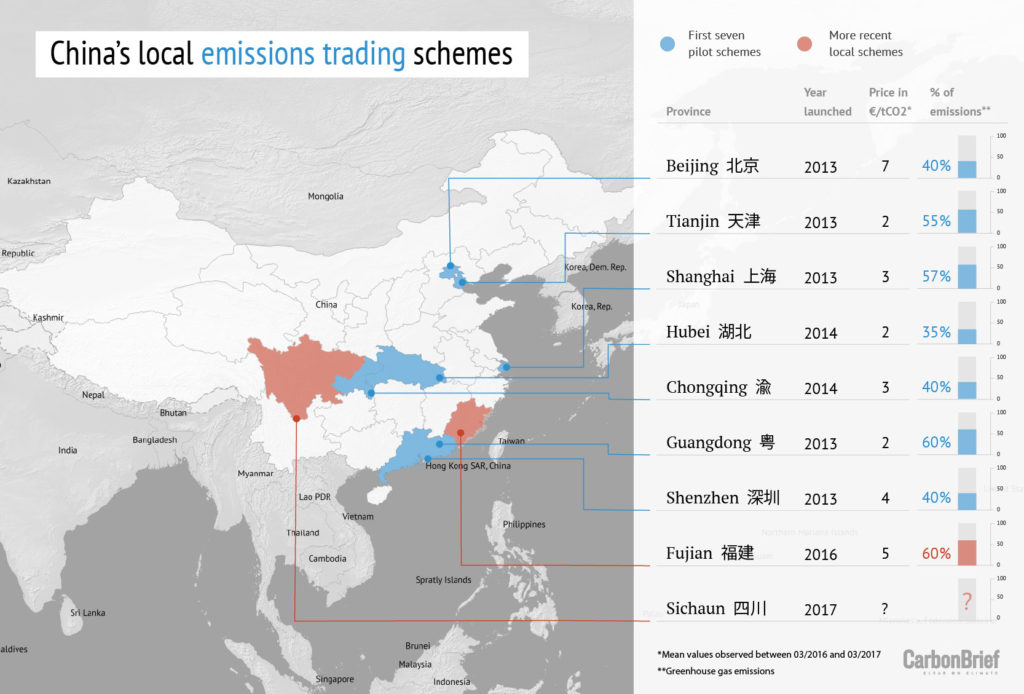

China has had a national carbon pricing system in the works for almost a decade, with nine emissions trading pilots now operating in major industrial regions. In late 2017 it announced plans to scale these pilots into a national program. The first permit swap will take place in 2020.

Source: Carbon Brief, 2018

Source: Carbon Brief, 2018

The literature cited some early bugs during the pilot programs, including lack of a real-time price and data management issues. Provinces also needed a unique ex-post adjustment mechanism to accommodate the rapid growth of firms without flooding the market with permits. Most of these issues aren’t unique to China; they’re learning from and borrowing the best features of other carbon markets. Other cap-and-trade jurisdictions also took years to get their systems working properly.

China will crawl before it runs. The program will initially incorporate power generators that emit over 26 kilotonnes of CO2e annually, which adds up to 1,700 facilities and 3,000 megatonnes of CO2e. Even with this narrow coverage it will dwarf the E.U.’s cap-and-trade system, which covers about 1,800 megatonnes.

Eventually, carbon pricing will apply to about 80% of China’s emissions. In the coming years, China will extend coverage to the chemical, petrochemical, construction, steel, nonferrous metal, paper, and aviation industries. Key challenges moving forward include establishing clear baselines and procedures, balancing stringency and price stability, and table-setting for international linkage.

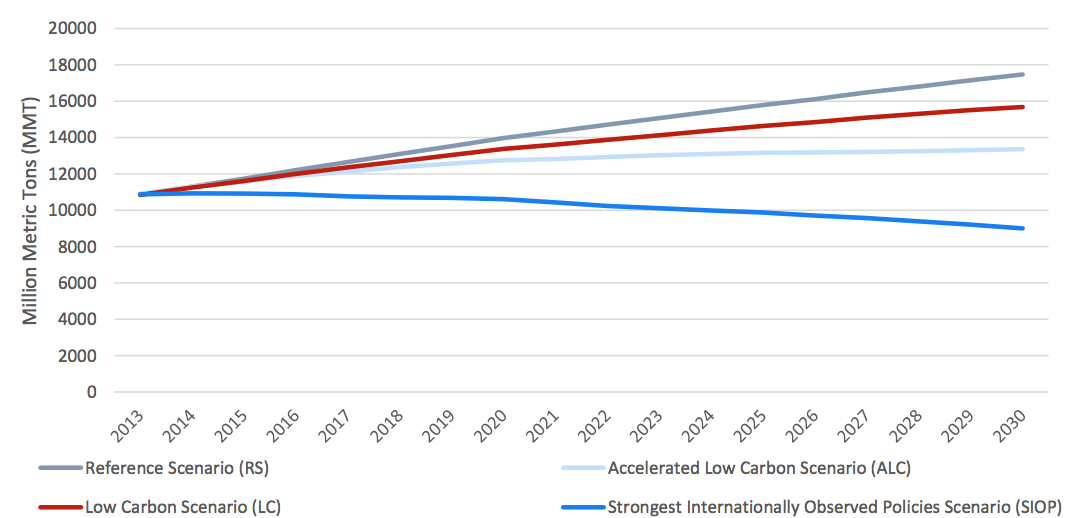

This brings us to the question of price. Pilot-phase permits sold for anywhere from 1 to 123 yuan ($24 CDN). A national price will take some time to calibrate, but a study from China’s Centre for Climate Change Strategy and International Cooperation found an average price rising to $50 by 2030 would drive over 90 percent of national emissions reductions in the “Accelerated Low Carbon” (ALC) scenario below. (ALC is the minimum policy stringency necessary to peak China’s emissions by 2030; we discuss what the international community can do to help get China on the SIOP track in Part 3.)

Figure: Total emissions projections in China under various policy scenarios

Source: NCSC, 2016

The value of market-based tools is evident to Chinese policymakers. If it scales according to plan, carbon pricing could prove pivotal in decarbonizing China’s energy and heavy industrial sectors.

Regulatory and non-pricing policies

China has hundreds of other climate policies on the books. Here are a few major pieces (for comprehensive reading, see here).

Transportation is an interesting case because the personal car is a fairly new feature of modern life in China. There were 6 million registered motor vehicles nationwide in 1990, and 310 million in 2017. It’s also one of the least fuel-efficient fleets in the world. New internal combustion vehicles must meet market-based efficiency standards (5.0 L/100 km by 2020). There are longer-term plans in the works, too.

China’s electric vehicle (EV) policies are both a climate play and an economic play. China wants five million EVs on its roads by 2020 and is primed to secure 50% of what will be a US$912 billion global industry by 2026. Manufacturers and importers face steadily rising quotas for EVs (10% of total new vehicles by 2019, 12% by 2020), backed by significant private investment and procurement programs. Consumers and businesses have access to subsidies and tax exemptions for purchasing EVs, and charging infrastructure deployment is a national undertaking. (China is also hedging with new investments in hydrogen cars.)

Low-carbon cities are another big component. China has deployed thousands of pilot programs for passenger transport, retrofitting, net-zero buildings, urban ecology, and development of environmental indicators. They’re not all successes, but China remains intent on using its cities as laboratories.

China also has a proactive, robust green finance strategy. Recent reforms in banking, insurance, and capital markets have led to a proliferation of green financial instruments and established China as an international leader. There’s a long way to go. China issued US$37 billion worth of green bonds in 2017, but one estimate suggests it needs to mobilize closer to $300 billion to fulfil its environmental commitments.

A lesson in driving down technological costs

With its massive economy and one-party system of government, Chinese leaders have shown a willingness to sacrifice efficiency to achieve specific economic outcomes. Some recent top-down interventions were motivated by public health. In other cases China has sought first-mover status, vacuuming up market share of technologies when it sees global market potential.

Because of its size, China’s industrial policies have positive spillovers for the world. For example, the cost of large-scale solar power has declined by 72% since 2010 thanks to growing competition and advances in manufacturing from early adopters. The world largely has Germany and now China to thank for targeted policies that have sent the costs of renewable power tumbling.

On renewable power, China is way out in front. It accounted for 45% of global renewable energy investment in 2017, including $86.5 billion for solar and $36 billion for wind. Global solar capacity reached about 400 gigawatts in 2017; China installed 53 gigawatts of solar capacity in 2017 alone, and sits on about 30% of existing global capacity.

China will do for EV batteries what it has done for renewables, and appears to have its sights on carbon capture and storage next.

A positive trend

The Chinese know they have a serious emissions problem, and they are moving on it. (This is just a small slice of China’s domestic actions.)

Are these policies good enough? Not even close, but the trend is undoubtedly positive. Beyond the new carbon market, China’s domestic climate policy package recognizes—and intends to seize—the economic opportunities that decarbonization and low-carbon growth offers. Speed is still an issue, but the Chinese are moving forward on climate policy. Who will they have to drag behind them?

In the meantime, China’s emissions are still rising, and it does a lot of carbon-intensive investment abroad. The entire world has a stake in accelerating the decarbonization of the world’s largest polluter. How can industrialized nations push China to clean up its act faster? We turn to that question in the series finale.

Comments are closed.