Arguments for and against “supply-side” climate policies

Our April blog about supply-side climate policies generated some online discussion. Some comments focused on the bigger, global picture. Others focused on the nuts and bolts. In particular, we got questions about our “leakage” assertion—namely, that if Canada cut back its production of fossil fuels there would just be an offsetting increase elsewhere that more or less neutralized the effect. In this blog, I take a second, deeper look at supply-side climate policies. TLDR: This is a much more complicated issue than it first appears. The costs and benefits of unilateral supply-side policies are ambiguous at best. The picture improves significantly if they could be globally coordinated.

What are we talking about here?

“Supply-side” policies focus on reducing the supply of fossil fuels. They include moratoriums, output caps, and other constraints on producing fossil fuels. (In contrast, “demand-side” policies such as carbon pricing or emissions regulations, focus on reducing the use of fossil fuels.) We’ve been debating these kinds of “keep it in the ground” policies for a long time. A recent paper on this topic generated some interesting discussion, and the idea is being discussed in places such as California, Norway and New Zealand. The supply-side action we hear about most in Canada is blocking pipelines. But some have also called for more direct interventions, such as a moratorium on new oil sands production capacity.

Avoiding the “Green Paradox”

One of the arguments in favour of supply-side policies is that they can help avoid the “Green Paradox”. The green paradox captures the idea that policies intended to reduce the demand for fossil fuels can backfire. If the producers of fossil fuels see that stringent policies are coming, they might respond by extracting their resources even faster to sell them while they can. This would cause prices to fall and consumption to rise, which could undermine (or even overwhelm) the effect of demand-side measures. There is empirical evidence that the green paradox is a real phenomenon. For example, one study found that the 1990 U.S. legislation that set up its cap-and-trade system for sulfur emissions induced an increase in emissions up to the system’s 1995 launch.

Using demand-side and supply-side policies together can help avoid the green paradox. Lots has been written about the green paradox and I won’t cover it here. It’s nevertheless a legitimate economic argument in support of supply-side policies.

Avoiding lock-in and stranded assets

When future climate policy is politically uncertain (as it currently is in Canada), firms can end up making more GHG-intensive investments than they would if they were certain that stringent policy was coming.

The problem is that once these investments are made, they’re sunk costs. Firms’ decisions on whether or not to continue to use the infrastructure they’ve invested in will not depend on whether they can recover their sunk costs, but on whether revenues cover operating costs. The same steadily-rising carbon price that might have deterred a firm from building a given type of infrastructure in the first place might not be high enough to deter them from using it once investment costs are sunk. In this way, climate policy uncertainty can “lock-in” certain sources of GHG emissions. Lock-in forces other parts of the economy to make even deeper cuts and raises the overall cost of GHG mitigation.

The alternative outcome is that revenues eventually become insufficient to cover operating costs and the infrastructure becomes a “stranded asset” (this could be the case, for example, if global GHG-reduction policies prove to affect oil markets more than investors are currently anticipating). Although stranded assets don’t have the same implications for GHG-mitigation costs that lock-in does, the wasted investment capital has an opportunity cost. Countries are starting to take this risk seriously. New Zealand recently banned new permits for offshore oil and gas. Avoiding the creation of stranded assets was one of the core rationales for the policy.

Policy-makers can reduce uncertainty-driven lock-in and the risk of stranded assets by clearly and credibly signalling that strong demand-side policies are coming. However, where this is not politically possible (or not credible), other policies such as supply-side policies may have a role to play.

A big challenge: leakage

“Leakage” is a critical, underlying dimension of the supply-side policy debate. Leakage refers to the situation where climate policy in one jurisdiction causes emissions-intensive economic activity to fall there, only for it (and the emissions that come with it) to occur somewhere with less-stringent policy. Leakage means that some portion of our emissions aren’t actually reduced, they’re just shifted.

Leakage undercuts both of the benefits outlined above. Restricting supply could help Canada avoid the green paradox problem, where we race to get our resources developed before they become uneconomic. But if foreign producers simply ramped up their own production in response, global production (and GHG emissions) would not change by much. Similarly, infrastructure we don’t build as a result of supply-side policies could just end up being built in a jurisdiction with less-stringent climate policies instead, without ultimately addressing lock-in.

(Demand-side policies can leak too. If our reduced demand drives the global cost of energy down, that can lead to rising consumption abroad that offsets our reduced consumption.)

Clearly, leakage matters. We measure the cost of climate policies in terms of their “cost-per-tonne” of GHGs reduced. Where leakage is an issue, it raises the economic costs of supply-side climate policies by shrinking the GHG reductions in the denominator of the costs-to-benefits ratio.

So how much leakage should we expect? The answer—unsurprisingly—is a little complicated.

Estimating leakage

Leakage in fossil fuel production will not necessarily be one-for-one. The GHG mitigation we lose to leakage will depend on what portion of our lost production is replaced by foreign production and how emissions-intensive that production is. (We have enough ground to cover with the first question. On the second, I’ll simply note that while Canada’s production tends to be more emissions-intensive on average than other countries’, this could narrow over time, especially with policies like output-based carbon pricing applying to Canadian producers but few others.)

On the first question, let’s first assume that oil is produced under “perfectly competitive” conditions globally. Economics 101 would tell us that if we reduced the global supply of oil by cutting back Canadian production, the price for oil would rise. This would cause demand (and thereby, consumption) to fall. Over time, this higher price would create incentives for new production. This new oil would be higher-cost than Canada’s. Therefore, assuming there were no other changes to demand, the global oil price would be higher and overall consumption lower than it was before Canada’s reduction.

The reality isn’t so simple. While oil is a highly-traded global commodity, the global oil market doesn’t work according to perfect competition assumptions. A massive cartel in the centre of that market (OPEC) adjusts its collective output through a quota system. It can be argued that OPEC would respond to Canada’s pullback by increasing its own production by the same amount in order to keep global supply (and by extension, price) at the level it had determined maximizes its profits.

But that’s just the tip of the iceberg. While refined petroleum products like gasoline are easily interchangeable, crude oil types aren’t. Heavy Canadian crudes require specially-equipped refineries. A Canadian supply reduction might change the trading price of heavy Venezuelan crudes, but it might have little effect on the price for OPEC’s crudes or U.S. shale oil. The result could just be a shift to lighter crudes (i.e., once refineries eventually re-tool) rather than less total output, and little to no effect on the price of refined products such as gasoline.

So, when it comes to leakage, what can we expect? Considering these nuances and having looked at the literature, it’s probably fair to say that GHG mitigation from supply-side policies would be mostly lost to leakage. But the precise magnitudes are unclear.

Leakage’s implications for costs

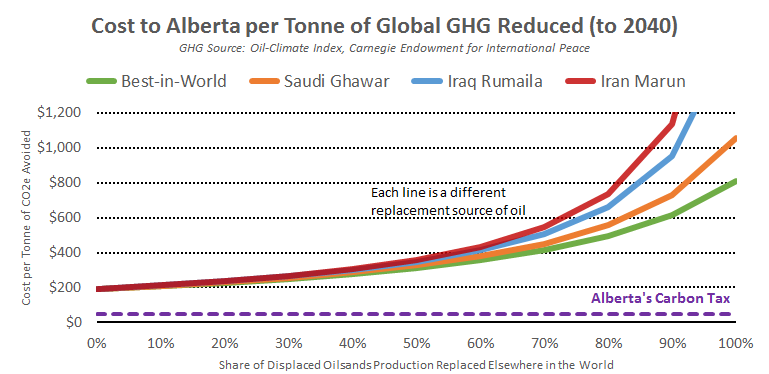

What does all this mean for the cost of supply-side policies? Trevor Tombe has estimated the cost-per-tonne of blocking pipelines for different levels of assumed leakage. As we see below, it’s a costly proposition even at low levels of leakage. And at the higher levels we can more reasonably expect, it becomes even more costly.

The costs measured on this figure’s vertical axis are an estimate of the total income lost by Alberta’s labour and capital per tonne of reduced emissions of greenhouse gases (GHGs) (measured in units of carbon dioxide equivalent (CO2e)). The leakage measured on the horizontal axis is the percentage of Alberta’s reduced output that is made up by increased output from other producers.

The costs measured on this figure’s vertical axis are an estimate of the total income lost by Alberta’s labour and capital per tonne of reduced emissions of greenhouse gases (GHGs) (measured in units of carbon dioxide equivalent (CO2e)). The leakage measured on the horizontal axis is the percentage of Alberta’s reduced output that is made up by increased output from other producers.

Source: Tombe, 2016

But blocking pipelines is not the same thing as a moratorium on new capacity. Blocking pipelines reduces both the amount of new production capacity that gets built and the profitability of existing production. Each of these contributes roughly half of the total costs seen in the figure above, so supply-side policies that avoided the latter would cost significantly less.

However, it’s difficult to say how much these policies would cost on a per-tonne basis. While we can estimate economic costs (as Trevor Tombe does above), leakage makes it difficult to estimate net GHG mitigation. Further, potential benefits such as avoiding the green paradox and avoiding GHG lock-in or stranded assets are difficult to quantify.

Global supply-side policies make more sense

The calculus for supply-side policies changes significantly if supply-side policies could be globally coordinated. If we restricted our supply at the same time that others restricted (or at least didn’t grow) theirs, the leakage problem would be off the table, and the economic arguments would become much stronger.

Some globally-coordinated supply-side policies are already underway. For example, the G20 has a commitment to phase out inefficient fossil-fuel subsidies. (Not propping up the sector is, admittedly, step one.) There’s also much work underway on how we could use the Paris agreement and UNFCCC mechanisms to restrict fossil fuel supply at the global level. This work is still in its early stages, but it might ultimately offer a powerful way of cutting global GHG emissions. (At the same time though, the challenges of getting agreement on constraining fossil fuel production shouldn’t be underestimated.)

Collective action problems like climate change require working together. As a result, there’s a much stronger case for globally-coordinated supply-side policies than for unilateral domestic ones.

Comments are closed.