Carbon pricing works in Sweden

Governments around the world are embracing carbon pricing as a central component of their strategies to reduce GHG emissions. Ecofiscal’s latest report highlights why and how carbon pricing works, with case studies from British Columbia, California and the UK. Today, we’ll build on those three and dust off a case study on Sweden, which has the world’s highest carbon tax.

First out of the gate

Sweden introduced the one of the world’s first carbon taxes as part of a larger environmental reform in 1991. They started small – about €33 per tonne ($52 CDN) – and worked their way up to €120 per tonne ($188 CDN), which is the highest rate in the world.

It’s important to note that the introduction of Sweden’s carbon tax was part of a larger policy package to reduce emissions. They also use energy taxes (on electricity, for example), efficiency standards, congestion pricing, and have invested heavily in renewable energy and public transit. So how do we untangle the impact of carbon pricing on Sweden’s emissions? Several economic studies have taken that on, and the results show carbon pricing was a major contributor to emissions reductions.

Sweden’s carbon tax reduced GHG emissions

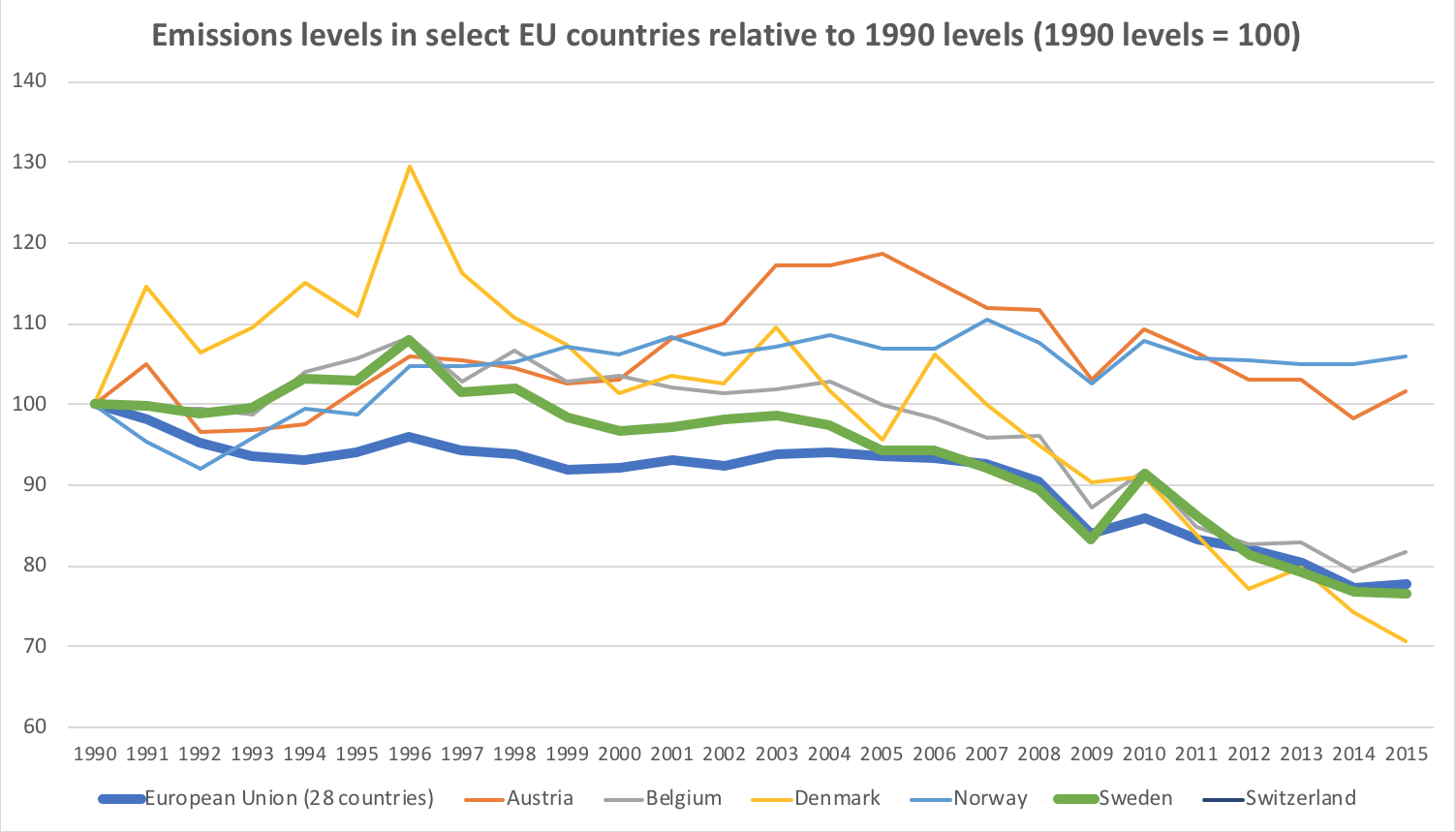

The impacts of Sweden’s carbon tax have grown over time. By 1995, emissions were 15% lower than they would have been without the carbon tax. By 2000, emissions were as much as 25% lower than they would have been without the carbon tax.

We should note that Sweden’s emissions actually rose for the first half of the 1990s. But that doesn’t mean the carbon tax wasn’t working. This is a really important distinction. We need to measure where emissions would be without the tax, not just if they’re lower overall. Even when emissions were rising, Sweden’s carbon tax was changing behaviour.

The good news is that Sweden’s emissions did begin to fall overall after 1996. And aside from a few hiccups, it’s been a fairly steady decline.

Source: Eurostat, 2018a

Source: Eurostat, 2018a

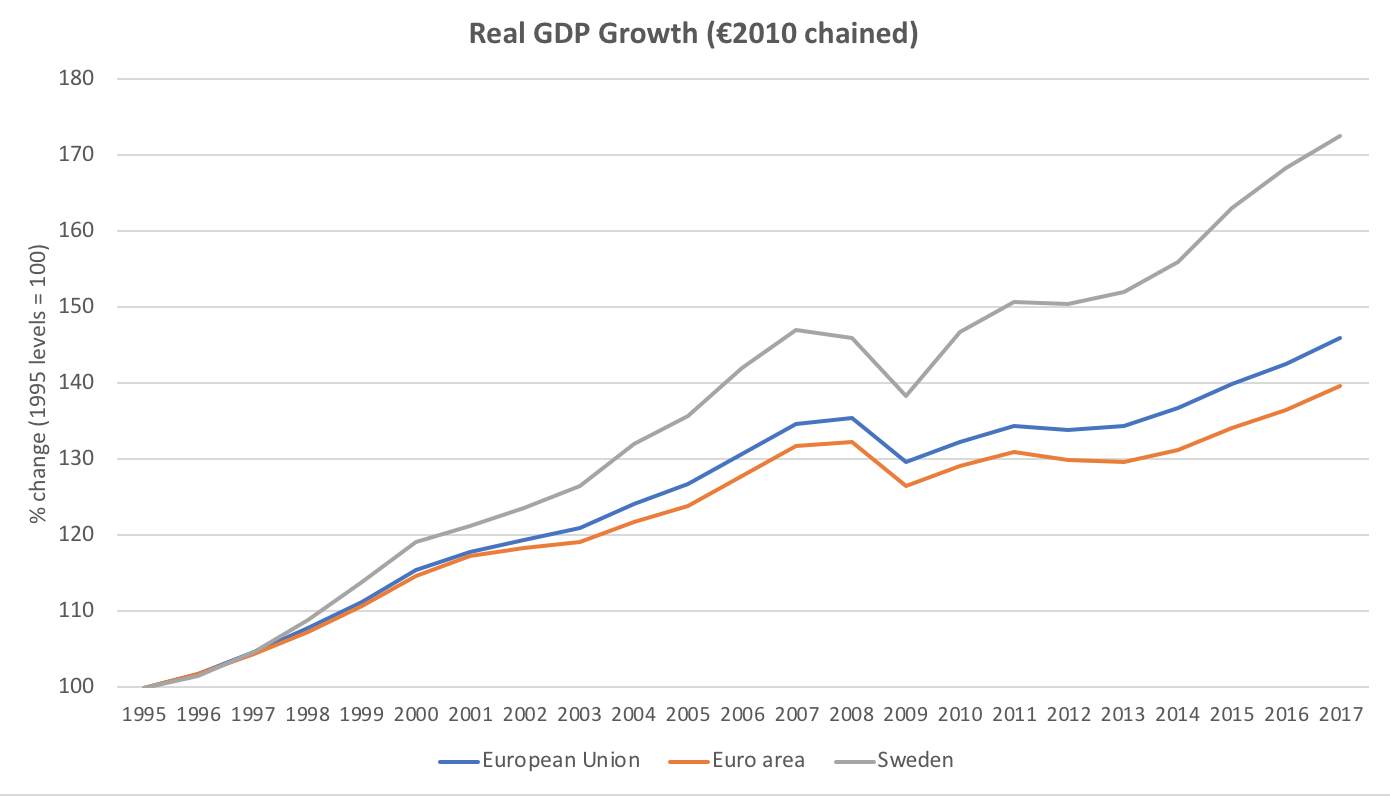

In terms of emissions reductions, Sweden has performed well relative to other comparable countries, and it hasn’t come at the expense of economic growth.

Sweden reduced emissions while growing its economy

While Sweden’s emissions curve has bent downward, their economy has performed well. The numbers and the evidence show that the carbon tax hasn’t been a barrier to a strong economy. In fact, Sweden’s GDP growth has outpaced the European average by a significant margin.

Source: Eurostat, 2018b

Source: Eurostat, 2018b

It’s not perfect, but it’s working

Despite this success, Sweden’s carbon tax comes with some exceptions and caveats, namely that it doesn’t apply equally to polluters across different sectors. Manufacturing, agriculture and forestry, for instance, pay a lower rate. And industries that are covered by the European Union’s cap-and-trade system are exempt. As of 2018, both households and businesses finally pay the same rate: €120 per tonne ($188 CDN).

Despite these irregularities, Sweden’s carbon tax is working, and changes in emissions are particularly noticeable in specific parts of the economy. Energy intensity has dropped off dramatically. Biofuels (instead of fossil fuels) now provide 60% of heat to buildings, a figure which doubled during the first 10 years of the carbon tax.

On the other hand, industries that received partial exemptions from the carbon tax didn’t fall as much. Emissions from industrial processes, for example, rose by 8% between 1990 and 2010. Sweden had to tweak their carbon tax in the early years to get it right, but over time, people and businesses adjusted their behaviours, and emissions began to fall overall.

Looking ahead to carbon-neutrality

So what does all of this mean? Well, to start, Sweden is set to hit its 2020 emissions target. Even more impressively, they’ve pledged to go carbon-neutral by 2045.

There are some lessons as well. Sweden’s carbon tax would have been more cost-effective as a single, economy-wide rate, rather than a sector-by-sector approach combined other tax instruments. The early years of Sweden’s carbon tax were a learning process, and their policies required tweaks and adjustments. By 1995, their system took the form we know today, and has functioned well ever since.

Like the case studies in our report, Sweden’s system isn’t perfect; but it’s working, and other jurisdictions have had the benefit of learning from Sweden’s experience. Well-designed carbon pricing should be the centre plank in any serious plan to fight climate change. Sweden is just one of dozens examples that demonstrate why. To learn more about how and why carbon pricing works, check out our report.

11 comments

Please refer to the Swedish Government’s info site on the carbon tax for more info about the Swedish carbon tax http://www.government.se/carbontax

Thanks Susanne, that’s an excellent resource that gives greater context to Sweden’s experience. The hyperlinks in the blog also offer some further reading for anyone who is interested.

Unfortunately this comparison is somewhat meaningless without understanding the differing cultures and types of economy. Sweden is also progressive in welfare, workers and benefits. This is something that is missing in other western economies.

Hi Colin,

You are correct that there are important economic and political differences between Sweden and Canada. What is universally true, however, is that prices change behaviour. When it comes to pricing carbon, Sweden has one of the longest track records, and the results speak for themselves.

To “save the world” from Climate Change catastrophe:

1. No NEW oil, gas, and coal exploration and development; no NEW infrastructure built, (i.e. pipelines, refineries, LNG ), some petro-chemical production, but reduction of plastics; use the existing infrastructure.

2.Transition to Green Energy and renewable technòlogies NOW: Solar, (rooftop/tiles, “farms,” path/road panels, films in skyscrapers); wind, (land, ocean); tidal, geothermal, cogeneration, hemp, high mix alcohol fuels from landfill/wood waste; turbines in water and sewage lines, (and methane collection), etc. Government oil and gas subsidies, go to Green energy and R&D, rebates; carbon taxes to Green energy installations.(jobs, refunds for low income.) The “Green New Deal” implemented globally!

3. War/military-industrial complex: O&G decreases, will limit M. East and other wars, ($6 trillion spent by U.S. alone!), ban $1 trillion for U.S. nuclear upgrade, reduce military bases and personnel to re-trained C.C. workers…$$ saved and greater taxes on the rich, to global Climate Change survival! C.C. will cost $11 trillion, millions of refugees with floods, heat waves/drought; wildfires, etc.; destruction of land and infrastructure, shortages of food and water! Our Choice: $$ for global war or peace?!

4. Protect tropical rainforests, (i.e. Amazon), and Old Growth forests, with carbon dividends for countries with carbon sequestering trees, paid by % of GDP by unforested countries. Also, carbon sequestering agricultural land management strategies; more organic, less factory farms and animal production.(eating less meat, especially beef.)

5. Overpopulation: Education for girls,(especially in developing countries), free birth control, incentives for “1 child families; adoptions;” religious groups discussions on child limits.

6. Recognize it is a global “crisis,” not a debate; “not talk and pollute!” BAU! (Business As Usual!)

7. Youth: Their world’s inherited problems, so a voice now! Climate Change, Environment, all party Politics course (politicians’ presentations) in the Grade 10 cirriculum; any 16 year old who passes, is eligible to vote!

Support a global movement, 350.org …to “change Climate Change!” Our choice…change NOW before it’s too late, (IPCC and Trump’s reports says 2030!)…or “fry and die?!”

[…] carbon tax is one action to cut our carbon production. It has worked in Sweden since 1991 and Sweden has grown its economy with the carbon tax in place. However, there needs to be many more […]

Education is always key to improve understanding. However, it all needs commitment from all fronts. There is need to lift the mindset of the ordinary person who would definitely think its “unfair” why is this tax being levied when they are simply making ends meet. I agree money talks, the challenge to walk that talk.

It’s not ordinary people causing the most pollution. The military and industry/businesses are causing the majority of the damage, but somehow it’s individuals who are expected to do the most. Not to say that the public isn’t helping, but it needs to be done by everyone that contributes to pollution.

Hi Kristy,

The question of responsibility is a difficult one. Large businesses do produce a lot of pollution. On the other hand, they’re creating that pollution to make products that we want and use. Carbon pricing creates an incentive for households and businesses alike to reduce their emissions. If you create pollution, you pay the carbon price, no matter how big or small you are. We can also do creative things with the revenues to ensure that the policy doesn’t unfairly burden individuals.

Fridays for future and GRETA THUNBERG support carbon pricing as an effective way to change from fossil fuels to renewables.

We want a sustainable economy, energy and life and will never stop using science to reach our goals teaching politicians and adults.

[…] drop in emissions. Significant reductions have coincided with carbon levies in the United Kingdom, Sweden and Australia. The European Union has been covered by a cap-and-trade system since 2005 and its […]

Comments are closed.