Can subsidies for electric vehicles “boost the signal” from carbon pricing?

Québec car buyers might have more than one reason to consider an electric vehicle (EV). For one, Québec’s cap-and-trade system increases the cost of gasoline. But the province also provides a cash rebate for going electric. Does that combination makes for good policy? Does Québec — or for that matter, any other province — need both carbon pricing and EV subsidies? In other words, can EV subsidies complement carbon pricing? Building on last week’s blog on gap-fillers, today I will use our case study on EV subsidies in Québec to explore another kind complementary policy: signal boosters.

OK, what’s a “signal booster”?

When it comes to reducing GHG emissions, carbon pricing should do the lion’s share of the work in order to minimize costs. But sometimes, carbon pricing can’t do it all. Our most recent report considers the role of other, complementary policies.

One of the ways that a policy can complement carbon pricing is by boosting the price signal from the carbon price. By overcoming other problems in the market, a signal-boosting complementary policy can make the carbon price work better.

In economics jargon, we’re really talking about market failures. A carbon price corrects an important market failure: with no carbon price in place, adding GHGs to the atmosphere—and adding to costly global climate change—would cost nothing. But the market also has other problems that can justify other policies (See Table 3, here, for more examples).

Can EV policy be justified as a signal booster?

In the case of electric vehicles — and decarbonizing the transportation sector more generally —a few specific market problems may justify additional policy measures.

For example, society may benefit from scaling up electric vehicles and enabling networks of charging stations. For example, individuals or firms don’t have incentive to build networks. Yet when that network gets built, car-buyers are much less inclined to worry about getting stranded in their limited-range EV. That kind of problem — i.e., the lack of network infrastructure— can be a market failure. Policy support for that network might create net benefits for society… depending on the costs of doing so.

On the other hand, a smaller or slower response to carbon price signals does not necessarily justify the creation of additional policies. Slower uptake of electric vehicles could also represent real underlying costs and preferences. Maybe consumers are legitimately sceptical of new, emerging technologies. Those preferences aren’t a policy problem… they just reflect potential non-financial costs.

Of course, addressing a market failure isn’t enough to justify policy. To be genuinely complementary, a policy must do so cost-effectively.

How have EV subsidies performed in Quebec?

Under Québec’s Drive Electric (Roulez électrique) program, drivers who purchase or lease fully electric, plug-in hybrid, hybrid, or low-speed electric vehicles (PEVs) qualify for rebates from the government of up to $8,000. The program began in 2012 and will run until 2020, or until available funds are exhausted. Quebec is one of three Canadian provinces that offer significant PEV subsidies: Ontario and British Columbia offer per-vehicle subsidies of $14,000 and $5,000, respectively.

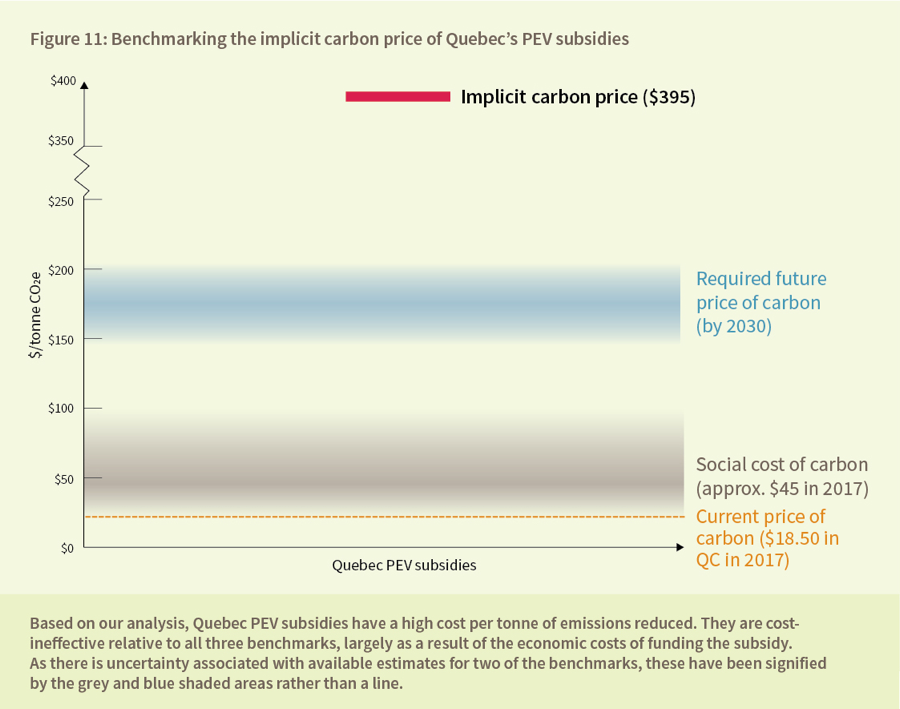

Our analysis took a closer look at the performance of the Québec policy. Overall, we found that the policy is reducing GHG emissions, but at a cost of almost $400 per tonne of GHG emission reduced. Those are expensive emissions reductions — more expensive than current carbon pricing policies. More expensive than estimates of the social cost of carbon. And more expensive even than where the carbon price has to go to in the future to achieve deeper reductions.

That high cost per tonne is partly due to the fact that tax revenue — in this case, Québec’s cap-and-trade system — generates the subsidy money. Raising money through taxes has costs. Another way to think about it is that revenue has an opportunity cost: it could have been used to cut other taxes or fund other programs.

But the high costs also result from free-ridership: some recipients of the subsidy would have bought an EV even in the absence of the subsidy. In these cases, the policy has costs without corresponding emissions-reductions benefits.

In other words, we can probably do better. Smart GHG policy reduces GHG emissions and makes economic sense too.

Now what?

Does that mean there’s no place for complementary policy here? Not necessarily. As Clare Demerse at Clean Energy Canada notes, in a thoughtful critique of our analysis, we shouldn’t ignore potentially important benefits from increased EV penetration.

Perhaps the solution is better complementary policy.

One way to do that is to more narrowly target market problems. If the key policy problem for EVs is infrastructure, for example, supporting public EV charging stations provides a solution. Just as it makes sense for governments to fund infrastructure like electricity grids and public transit, so too might it make sense for them to fund EV networks.

Another way might be to improve the design of the policy. Québec’s other personal vehicle policy is a flexible regulation that requires automakers to sell a minimum share of zero or low-emission vehicles, while giving them flexibility in how they achieve that quota. As Mark Jaccard writes, that kind of policy might be a lower-cost way to drive change in transportation. And it’s technology neutral: manufacturers can comply by selling EVs, biofuel fuelled cars, or something else.

At the end of the day, governments still need to weigh the costs and benefits of complementary policies. As we’ve seen here, a policy might have worthy goals but be too costly. And in that case, we’re better off phasing out policies that cost too much, and relying on carbon pricing instead.

Comments are closed.