Fixing a hole: The role of gap-fillers in a climate policy package

In our latest report, Supporting Carbon Pricing, we delve into complementary climate policies – that is, non-pricing policies that do things carbon pricing cannot. There are three different types of policies that can genuinely complement carbon pricing: gap-fillers, signal-boosters, and benefit-expanders. Today, in the first of a series of three blogs, we look at gap-fillers.

What’s a gap-filler?

When it comes to reducing emissions, we can trust carbon pricing to do the heavy lifting. But despite its versatility, it can’t do everything. Some emissions are difficult or measure and price. For example, emissions from land use change, forestry or agriculture come from many diffuse sources. They cannot be easily measured, and can vary depending on management practices and local conditions. Emissions in the waste sector and certain types of industrial emissions can also be difficult to measure.

Because of these gaps, relying on pricing alone might leave cost-effective mitigation opportunities on the table. Gap-fillers target these opportunities. By covering emissions not covered by the carbon price, gap-filling policies can broaden coverage and lower the overall costs of a climate policy package.

But we need to tread carefully. Not all gap-fillers will complement carbon pricing. To be a genuine complement, non-pricing policies should drive additional mitigation, and should do so at low cost.

Mind the gap

In our report, we look at an example of a gap-filler in closer detail: Regulating methane emissions in the oil and gas sector. Between 2020 and 2023, the federal government will phase in regulations designed to cut methane emissions from the sector by 40 to 45% below 2012 levels by 2025. Methane emissions—for example, leaks from wells and distribution systems—come from numerous, often remote sources, meaning they can be difficult to measure. Other times, we can only infer their presence due to lost volumes along the supply chain. We cannot easily apply carbon pricing to all of these emissions. So there’s a gap.

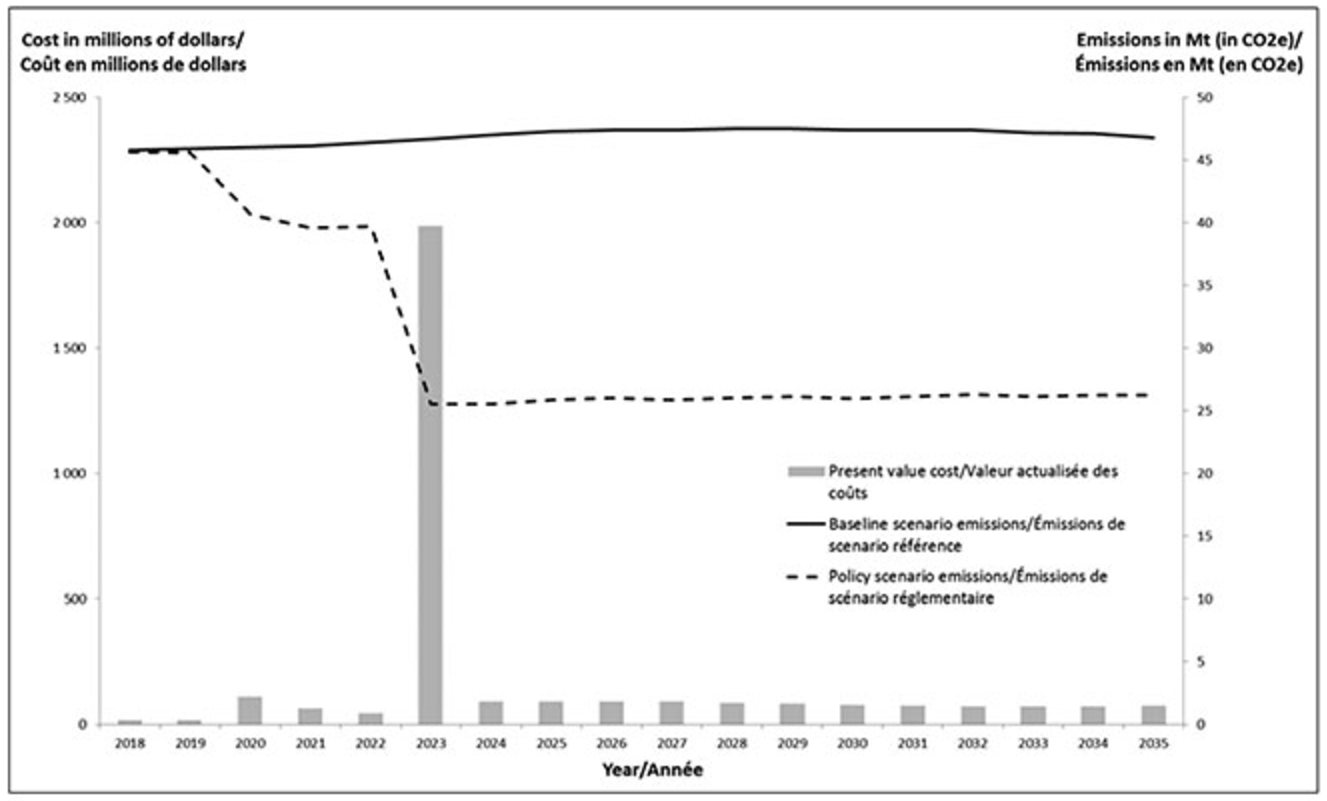

The Regulatory Impact Assessment Statement (RIAS) for the proposed regulations (which came out a few weeks ago) quantifies some of its expected impacts. It estimates that by 2025 the regulation would drive annual reductions of 21 Mt of CO2e, and a total of 282 Mt of mitigation between 2018 and 2035. We can achieve these reductions at an estimated cost of $13/tonne. Most of these costs are upfront, with the vast majority arriving in 2023 (see Figure 1).

Figure 1: Baseline scenario and policy scenario methane emissions and compliance costs by year

Get low (cost)

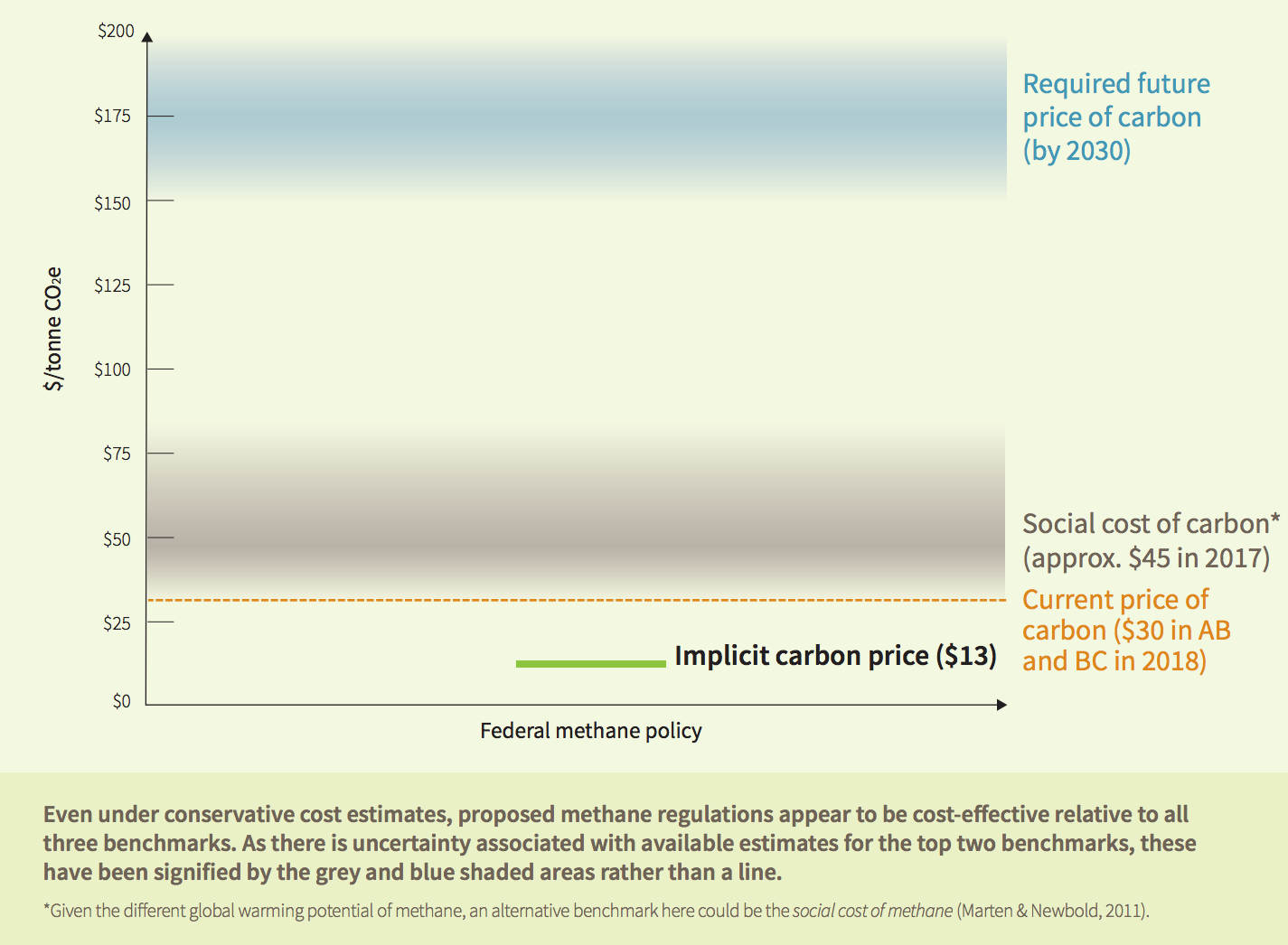

These regulations will drive significant emissions reductions. And on a per-tonne basis, those reductions are less than both explicit carbon prices and the social cost of carbon. That means they make economic sense as well (see Figure 2, and see our TL;DR blog for a rundown on benchmarking).

Figure 2: Benchmarking the implicit carbon price of federal policy on methane emissions in the oil and gas sector

As we see in Figure 2, the policy’s costs fall significantly below current carbon prices. In our report, we explain why harmonizing the stringency of regulations and carbon pricing can improve the cost-effectiveness of a policy package. In short, it offers a uniform price signal across the economy. This helps us to identify the most cost-effective mitigation opportunities.

In short, the federal methane regulations are likely a genuine complement to carbon pricing. They drive significant emissions reductions at a reasonable cost.

Iron out the kinks

Although the regulation passes our benchmarking tests, there’s room for improvement. Our results suggest that these regulations could be even more stringent and the mitigation would remain cost effective.

There are a few ways to do this. First, the requirements could be tougher. Inspections, for instance, could occur quarterly, instead of three times per year. Second, the timeline could be more ambitious. The federal government pushed back the enactment of the first regulations from 2018 to 2020 – in part due to competitiveness concerns. These are now perhaps less founded than before, and this delay reduces cumulative mitigation (see Figure 1). Third, the regulations could remove exemptions for small and medium facilities that might be leaving cost-effective mitigation on the table. Lastly, the policy lacks clear post-2023 requirements. Clarifying long-term targets would likely be useful for industry. It would make their transition more cost-effective and help to ensure that Canada reaches its 2030 targets.

As they finalize the design over the next year, policymakers should consider increasing the stringency of these regulations. If the average mitigation cost per tonne remains below the federal floor, increasing the stringency and coverage of these regulations is likely cost-effective. For a more thorough break down, and for details on our methods and assumptions, see our report.

More to come

Methane regulations in the oil and gas sector are just one example of a gap-filling policy. We go through several other examples in our new report. We’ll also be diving into gap-fillers in more depth in a future webinar. So stay tuned. And be sure to check out next week’s blog on signal-boosters.

Comments are closed.