Unpacking the WCI: Balancing stability and flexibility

In the previous instalment of our summer blog series Unpacking the Western Climate Initiative (WCI), we took a look at the legal uncertainty facing the California cap-and-trade system, one of two key drivers of the recent undersubscribed allowance auctions. In this blog we’ll look at the second driver—permit oversupply—and why the smart design of the WCI system means it’s not as much of a problem as it may seem.

An oversupply of permits

Numerous commentators believe that the California market has been oversupplied with permits. In offering explanations, some point to the effect that the system’s interaction with other GHG policies has had, or the impact of resource shuffling (basically, selling off high-emitting electricity generation to other states; stay tuned for future blogs on both these topics). Others cite the free allocation of some permits as a driving factor (though free allocation doesn’t affect the total number of permits).

Some have also argued that the system’s emission cap may have been set too loosely, either due to emission forecasts that didn’t play out as expected, or an intentional choice to “ensure prices don’t sky-rocket unexpectedly and impose heavy costs on industry”. Others, such as Mary Nichols, chair of the California Air Resources Board, suggest that the oversupply is in fact a symptom of success—that reductions are occurring beyond the program’s annual targets and that therefore the program is working.

The right answer is probably some combination of these. But regardless of how we got here, the WCI market clearly has plenty of allowances. Further, as recent undersubscribed auctions suggest, this oversupply problem has combined with the legal uncertainty around California’s system to create a supply shock in the WCI market. The key question now is: how will the system respond?

An important test for the WCI system

The European Union’s Emission Trading System (EU ETS) went through a similar test in the wake of the 2008 financial crisis, when an economic slowdown (and a few other factors) decreased the demand for allowances. It didn’t go well. A rigid schedule for the release of new permits and limited means to decrease overall supply led to a glut of permits and a crash in prices, something the system is still trying to recover from today. And ongoing low prices in the EU ETS ever since have suppressed incentives both to limit current emissions and to invest in the technologies that would limit future emissions. However, in many ways, the WCI has learned from the mistakes of the EU ETS (which was an early pioneer), and there are reasons to expect that it will fare better.

Stabilizing mechanisms

The WCI has valuable stabilizing mechanisms that the EU ETS didn’t, which limit the extent to which prices will drop in response to a supply shock. Perhaps the most important is the price floor. Under the WCI, there is a minimum price that permits must sell at in auctions. In the EU ETS, bidders could pick up permits at rock bottom prices during a supply shock, but in the WCI, if no one is willing to pay at least as much as the floor price then the permits don’t sell. This helps ensure that an oversupply problem doesn’t get even worse. Wisely, any unsold permits are held in reserve until there has been two consecutive auctions that settle above the floor price, which means the permits will stay off the market until things get back to normal. And even then, they’re only available for sale at a full $60 above the floor price.

On top of this, the California Air Resources Board (CARB) has the authority to tighten permit supplies in order to avoid a glut. This is a very powerful instrument that was missing in the EU ETS, and one that CARB authorities have suggested they’d be willing to use if oversupply were to remain a problem over the long-term. Finally, just last week CARB announced that emitters will be able to use current permits to cover post-2020 emissions. This will increase the demand for existing permits and help to lift trading prices.

Flexibility mechanisms

The WCI also has measures in place to give firms more flexibility in how they comply with policy. Most of these flexibility measures are hallmarks of good design. However, when the market is oversupplied, they can actually undercut stability. For example, permit banking allows market participants to save permits for later use, giving emitters flexibility on the timing of when they can best reduce their emissions. It’s also been shown to help reduce costs and to improve stability (in the short term) by smoothing price fluctuations. Similarly, multi-year compliance periods are used in the WCI (we’re currently in the 2015-2017 period). This means that firms can hang on to excess permits for several years (permits for the current period can in fact be used as late as post-2020, as we noted above). In addition, firms are also allowed to use offsets for up to 8% of their compliance. These mechanisms are useful ways to enhance compliance flexibility. However, in a situation of oversupply, they can also lead to loo-large permit banks and too-low secondary market prices, driving chronic weak demand at auctions.

Striking the right balance

Stability and flexibility—while both worthy design goals for a cap-and-trade system—are to some extent at odds. When WCI policy-makers designed their system, they had to try to find an effective balance between the two. But the only way to know if they struck the right balance is for the system to face a stress test, and the current supply shock is just such a test. If their stability mechanisms are strong enough, then auctions should pick up at some point as supply becomes constrained and demand for permits starts to return. But if they overdid it on flexibility, then weak demand could persist for some time.

The litmus test

The key indicator to watch will be prices on the secondary market. If the flexibility mechanisms have been too generous, then prices will be slow to rise, since firms will be able to rely on banked supplies to meet their needs. But if the stabilizing mechanisms kick in effectively, then prices will start to rise as firms use their excess permits and banked supplies start to fall. The key litmus test will be how long it takes prices on the secondary market to rise above the auction price floor.

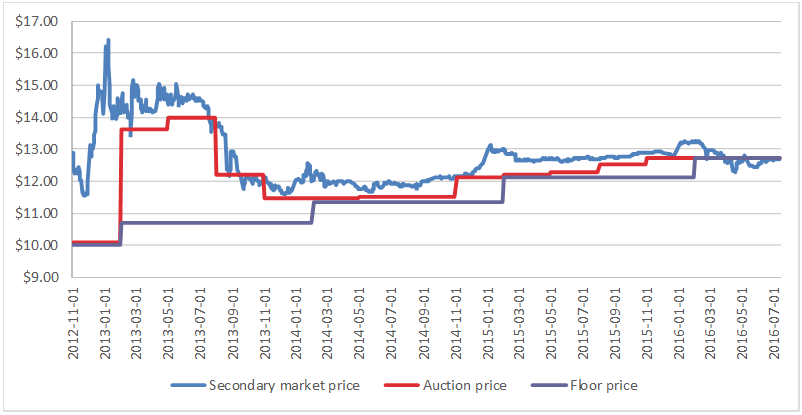

Currently, permits are available on the secondary market at a price below the price floor, so there is little incentive for emitters to buy at auction. Historically, as seen in the figure below, the secondary market traded above the auction price floor, which created incentive for firms to buy at auction. Auctions were almost always fully subscribed during this period. Once secondary market prices rise above this line again, firms will have incentive to buy at auction, and we can expect that the return of auction demand (and revenues) will not be far behind.

Figure 1: Historical prices in the WCI market (USD)

Notably, after hitting a low following May’s unsuccessful auction, secondary prices have since been steadily rising. But it might not be this year that we see a strong return of demand. 96 million allowances will go up for sale in August. Demand for these is likely to be low, and the same might be true in November’s auction. But the February and April auctions next year will be important ones to watch.

In the meantime, the sky isn’t falling

As we wait to see when auction demand will return, there are two things that are important to keep in mind:

First, while the limited demand we’ve seen in this year’s auctions might be problematic for government revenues, revenue generation isn’t the primary goal of a carbon pricing system – it’s to limit GHG emissions. Unlike a carbon tax which locks in a price, a cap-and-trade system (by setting a hard cap on emissions) locks in a quantity that annually declines. This means that despite recent market turmoil, the quantity targets of the WCI system are not being affected.

First, while the limited demand we’ve seen in this year’s auctions might be problematic for government revenues, revenue generation isn’t the primary goal of a carbon pricing system – it’s to limit GHG emissions. Unlike a carbon tax which locks in a price, a cap-and-trade system (by setting a hard cap on emissions) locks in a quantity that annually declines. This means that despite recent market turmoil, the quantity targets of the WCI system are not being affected.- Second, while it’s true that secondary market prices have fallen below the auction price floor, they haven’t fallen that far below it—they’re currently trading at less than 5 cents below the floor price. Low secondary market prices aren’t ideal because of their effect on auctions, but permit prices haven’t crashed in the same way that auction revenues have. This means that firms’ incentives for abatement are only being marginally affected.

All in all, the WCI system has been well-designed, so this problem of permit oversupply will likely pass. We spoke to Dallas Burtraw from Resources for the Future, and he agreed, noting: “The WCI model, including the price floor, provides buoyancy for the trading program during storms of uncertainty. It’s designed to be stable and effective over the long run.”

In the meantime, the best thing to do is just keep calm and carry on.

2 comments

I find what you are saying to be quite reasonable, but I wonder about the wisdom of a partnership that allows one partner to get most of the low-carbon investment, and therefore jobs.

Also, since California’s permits are cheaper, are their emissions going down?

Thank you for writing about this.

Hi Laurel.

On your second point, California’s emissions do seem to be going down (https://www.arb.ca.gov/cc/inventory/pubs/reports/2000_2014/ghg_inventory_trends_00-14_20160617.pdf), and they are aiming at even deeper reductions by 2030 (https://www.nytimes.com/2016/08/26/us/californias-emissions-goal-is-a-milestone-on-climate-efforts.html). Their falling emissions and at the same time low price for permits is explained to a large extent by their choice to have other climate policies do a good deal of the heavy lifting. See here for another blog from us on that topic: https://ecofiscal.ca/2016/08/03/unpacking-the-wci-backhanded-complements/. We’ll have more to say on ‘complementary’ climate policies in the coming months.

On your first point regarding the wisdom of the partnership, there’s a lot to consider. There would be long-term benefits to Ontario/Quebec going it alone to the extent that doing so decarbonizes their economies. This would lower their long-term carbon liability, and the investment that it would take to get them there would for sure generate (green) jobs. But in the short-term, the costs of this would be high due to the fact that mitigation costs in Ontario/Quebec are so much higher than in California. These high costs would themselves likely lead to (non-green) job losses. There are difficult trade-offs here. The partnership between California, Quebec and Ontario (once it joins) offers benefits, but as you point out, it also has its costs. For more on linking and why Ontario and Quebec might think that the pros outweigh the cons, see here for an earlier blog in our series on the WCI: https://ecofiscal.ca/2016/06/29/unpacking-wci-thinking-linking/

All the best,

Jason

Comments are closed.