Unpacking the WCI: Storm on the horizon?

by Simon Altman

In the first blog of our series Unpacking the Western Climate Initiative (WCI), we looked at the implications of Ontario and Quebec’s decision to link with California. In today’s blog we explore an ongoing lawsuit in California that could pose an existential threat to its cap-and-trade system, and what it might mean for Ontario and Quebec.

California’s system headed into stormy waters

California’s cap-and-trade system has been under attack since 2012, when the California Chamber of Commerce filed a lawsuit challenging it. They argue that California’s permit auction is really a tax, and that therefore the cap-and-trade program is unconstitutional because it was not enacted by a two-thirds majority, as required by California law. A lower-court decision is expected by the end of this year, and legal experts say it will likely move to the California Supreme Court afterwards. The decision will also have important implications for the legal environment for any post-2020 extension of the program.

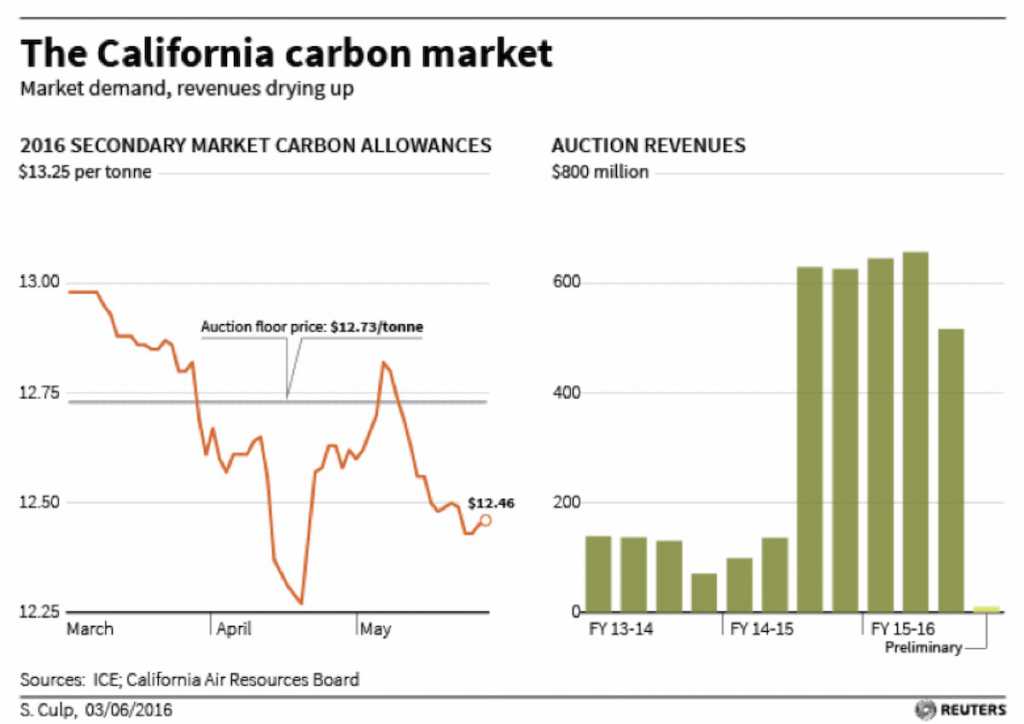

Recently, the court has asked the lawyers on either side some critical questions, one of which is how a ruling against the program might be implemented by the state. These questions suggest the existential threat to California’s cap-and-trade program is real. And the recent crash in auction revenues could suggest that the market agrees.

If California sinks, what happens to Ontario and Quebec?

If the courts rule against California’s cap-and-trade program, Ontario and Quebec (the remaining two members of the WCI) would face significantly higher costs. With California being such a large part of the market, its withdrawal would greatly reduce liquidity. And because it has more low-cost mitigation opportunities, the cost of emissions reductions under the WCI would soar if it were to leave. Indeed, EnviroEconomics and Sustainable Prosperity have projected that permit prices for Ontario and Quebec would respectively be 872% and 127%-233% higher without a link to the WCI (their linking to each other would reduce these costs, but only slightly). And they would also have to shoulder a larger administrative cost if California were to leave.

Perhaps the one silver lining of a California withdrawal is that it would cause more low-carbon investment capital to remain in Ontario and Quebec (see our last blog for more on this). However, the benefits of this are unlikely to exceed the costs.

The good news in all this is that legal experts believe the odds of California’s system collapsing are small. The bad news is that the lawsuit could be a problem whether it brings California’s system down or not.

No matter what happens, expect rough seas ahead

The uncertainty that the lawsuit is creating could spell trouble for California, Ontario and Quebec’s systems. As Sean Carney, President of Finite Carbon, puts it: “It’s not a question of whether this lawsuit prevails or not, it’s what impact it has while they’re trying to figure it out.”

Economists have noted that uncertainty is one of two main factors that have driven the weak demand seen at recent permit auctions (the second being that California over-supplied the market; more on this in our next blog). In the May 2016 auction, a mere 11% of permits available for auction in California and Quebec were purchased, netting only $10 million in revenues, pocket change compared to the $500 million earned in February’s auction. These types of revenue crashes are problematic for a number of California and Quebec programs that are counting on the revenue.

However, it’s not just revenues that are being affected. As seen in the graph below, the price of carbon allowances on the secondary market has fallen below the auction price floor. While there are mechanisms in place to drive prices back above the floor, Dan Walters, Political Reporter at the Sacramento Bee, thinks there are still speculators with allowances to dump. As long as these speculators hold allowances and are pessimistic about the program’s future, prices will remain low. This means that firms in California and Quebec will choose to buy cheap permits on the secondary market instead of buying at auction or investing in the GHG reductions that a higher price would incentivize, leading to lost time and missed opportunities.

But arguably the biggest danger—and what has become the chief concern among the scheme’s participants according to Mike Szabo, Co-founder of Carbon Pulse—is that it could deter other states from joining the WCI system. Every additional participant results in a more cost-efficient program, and all WCI members want to see the tent broadened. But the uncertainty that the lawsuit is creating may cause potential WCI members to either defer or cancel their plans to join. A new potential member opting-out would be costly to all WCI participants.

Hope that the fog lifts soon

California’s program will probably survive this lawsuit. But as outlined above, it may be costly for California, Ontario, and Quebec regardless since it can be expected to keep prices stay low and cause potential members to reconsider joining. Fortunately, the courts understand the cost of delays, which is why they have already expedited the trial. Still, experts expect it to last a while longer.

Let’s hope that California’s courts come to a decision sooner rather than later, because the more time passes, the more uncertainty will take its toll.

Comments are closed.