A path to international carbon pricing?

It’s useful to remember that carbon pricing isn’t just a Canadian phenomenon. International momentum is growing as well. In this blog, I take a look at some of the outcomes of the international climate change negotiations held in Bonn last week, and the prospects for international carbon markets.

Moving forward at Bonn

On April 22 this year, 175 countries signed the Paris Agreement at a special ceremony in New York. To take effect, the agreement needs to be ratified by at least 55 countries that produce at least 55% of the world’s GHG emissions, and the World Resources Institute believes the agreement will enter into force in 2017, or possibly even later this year. But in parallel to this ratification process there remains a lot of technical work to do on the mechanisms, guidelines, accounting, and reporting rules that will underlie the agreement. The intersessional meeting in Bonn, Germany last week focused on many of these details.

Bonn is usually a relatively low-profile affair compared to the annual Conference of the Parties (COPs), but this year’s meeting had a relatively ambitious agenda focused on transitioning the talks toward action and implementation. Discussions at Bonn focused on things like financing, technology transfer, reporting protocols, and transparency and compliance. Overall, participants and commentators at Bonn reported significant progress. However, much work remains to be done, and some tough issues have been left on the table for the meetings in Marrakesh later this year.

Carbon pricing and the Paris Agreement

Carbon pricing received significant support at the Paris COP. The World Bank and IMF officially launched the Carbon Pricing Leadership Coalition. New Zealand, supported by 17 countries, issued a declaration in support of carbon markets. And carbon pricing or markets appear in more than 90 of countries’ Nationally Determined Contributions (NDCs). But how exactly international carbon markets might be operationalized under the Paris Agreement is still unclear.

As a result, the scope of market mechanisms was a key agenda item in Bonn. Delegates exchanged views on best practices and lessons learned from other UNFCCC carbon mechanisms, discussed the state of ongoing research, and identified key information gaps that will need to be closed before Marrakesh. In summing up the progress made, the Chair of the Subsidiary Body for Scientific and Technological Advice (SBSTA) encouragingly expressed that parties seemed eager to move forward with carbon markets and were aiming to arrive at a common understanding in Marrakesh. However, business and industry NGOs, expressed disappointment on the lack of progress that was made. Clearly much remains to be done.

A global market or carbon clubs?

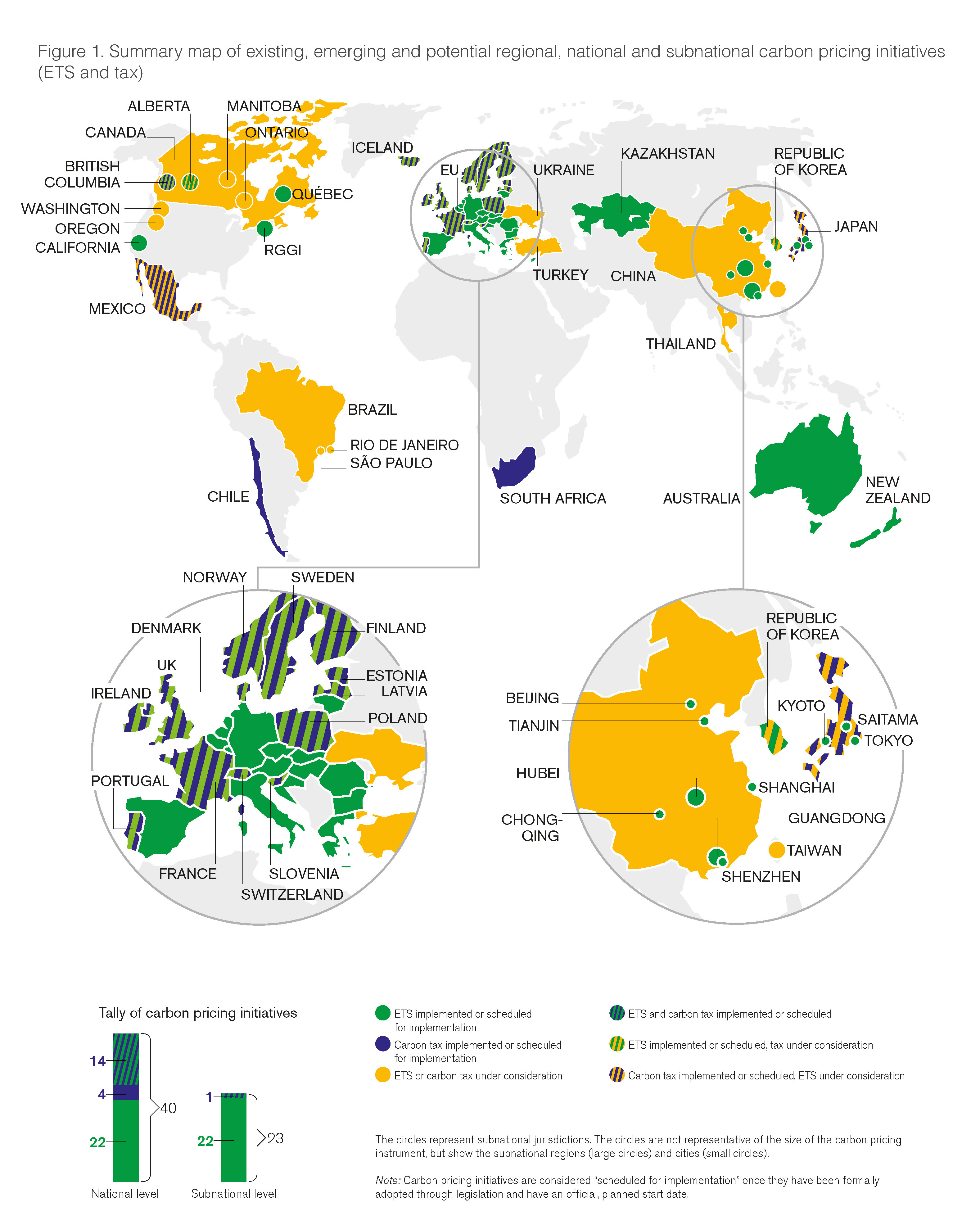

Where this is all headed is an open question. As a recent report by the World Bank shows and as seen in Figure 1 below, there has been a proliferation of carbon pricing initiatives in recent years, both unilateral and cooperative.

Source: World Bank and Ecofys. (2016). Carbon Pricing Watch 2016. Available here.

Integrating these systems would help to create more uniform global carbon prices and make countries’ mitigation efforts more cost-effective. Some observers believe that the UNFCCC could facilitate this by developing the framework for this new market, but others question the appetite for yet another new mechanism. There seems to be more hope for linking together various national and regional schemes into ‘carbon clubs’, which could work in parallel to the Paris agreement. These clubs could create common, credible standards or guidelines that would ensure the integrity of carbon emission units traded internationally, and in time be integrated with one another.

Canada has stated in its NDC that it may use international mechanisms to achieve its target, so how carbon markets take shape under the Paris Agreement will have important implications. If the Paris Agreement can create the foundation for an integrated global carbon market (and that’s a big if), the process of global carbon market integration could be accelerated, and Canada and other countries able to use these international markets to deliver real, cost-effective GHG mitigation.

No matter what happens, it will be some time before we see globally integrated carbon markets. But negotiators’ progress on this front will definitely be something to watch for at COP22 in November.

Comments are closed.