What share of carbon pricing revenues are needed to do no harm?

In our previous blog, we explored how carbon pricing is expected to affect households with different income-levels in different provinces. Here, we discuss how different revenue recycling options affect fairness for low-income households, and what share of provincial carbon pricing revenues would be needed to avoid unfairly burdening them.

Revenue recycling options for making carbon pricing fair to low-income households

We define fairness in terms of carbon costs as a share of household budgets. In this context, a policy is unfair if it costs lower-income households a larger share of their income than richer households. Various options for recycling revenues have different implications for fairness. We’ll look at a few of them here.

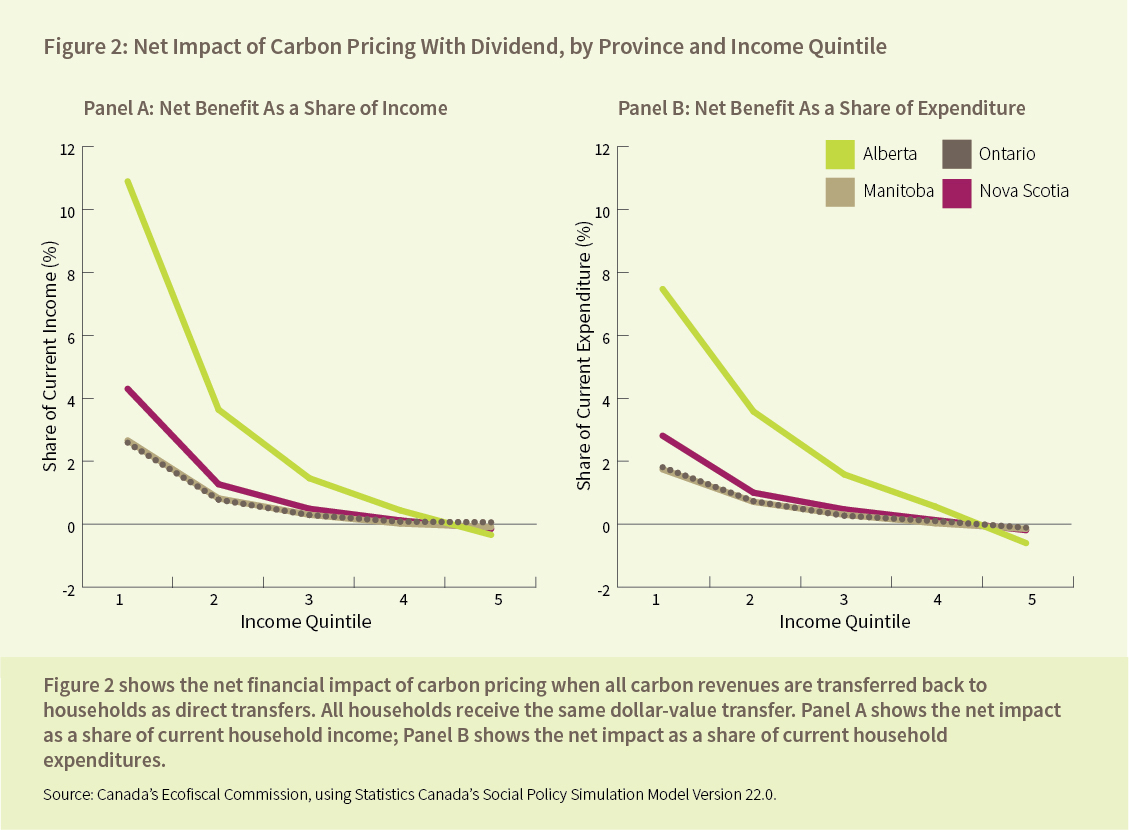

One option is to return all the revenue to households in the form of a dividend. Under this approach poor households would receive more in the form of the dividend than they pay in the carbon price. This means that fairness impacts from the carbon price would be more than offset by revenue recycling, and policy would be progressive overall, as shown in Figure 2 (from Choose Wisely).

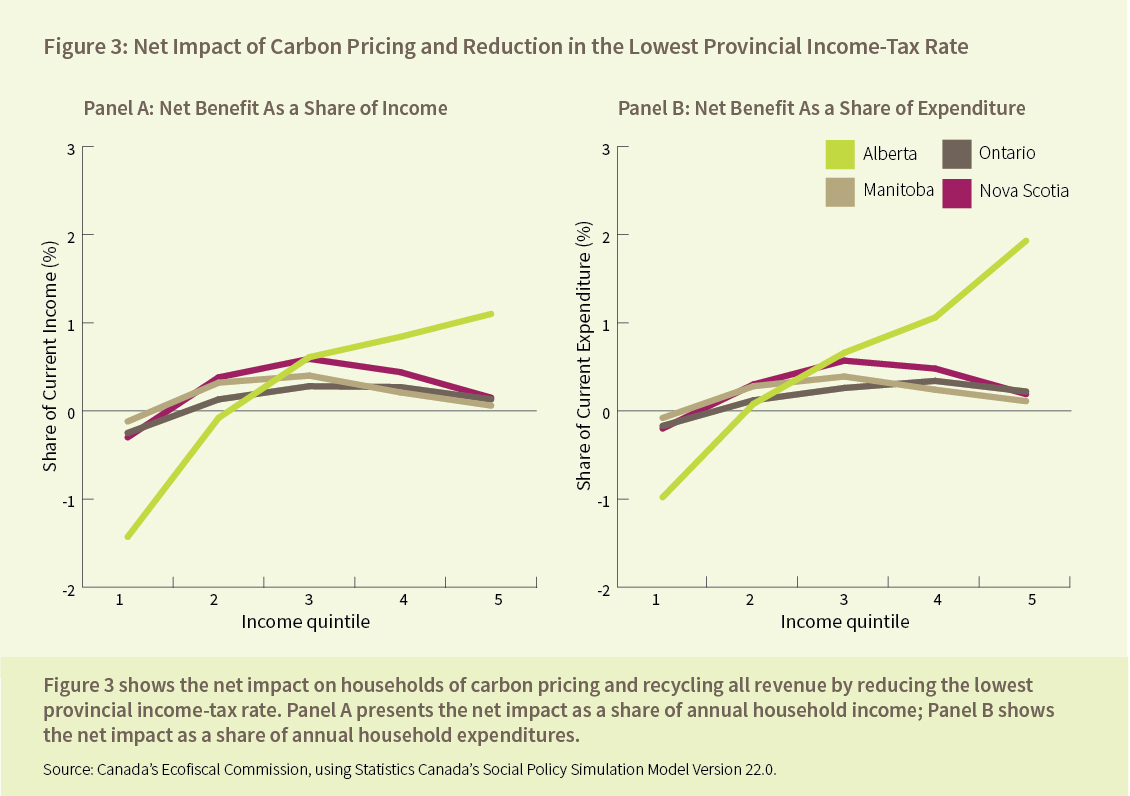

Another option is to use revenues to reduce other taxes like corporate or personal income taxes. While this approach may seem like a fair option, it doesn’t always help those at the bottom of the income distribution. These households are often recipients of government transfers, and tend to pay very little in taxes. So using revenues for tax reductions might not be an effective way to ensure lower income households aren’t disadvantaged by carbon pricing.

Figure 3 illustrates this point by considering the fairness implications of using all revenue to reduce the lowest personal income tax bracket in four provinces. As expected, low-income households in all provinces benefit less from the tax cuts because they tend to earn less taxable income. In contrast, it is middle income households in all provinces but Alberta that see the highest benefits. The reason why households with higher income in Alberta see the most benefits is because of Alberta’s (until recently) single income tax rate.

The low-income rebate option

Of course, practical policy design can mix-and-match between different approaches to revenue recycling. A more targeted option to address fairness is to use only some of the total revenue to provide a transfer to low-income households, to directly offset the unfair burden that carbon pricing places on them. This is the approach the Government of Canada takes with the GST/HST, where it uses a low-income credit to compensate low-income households for the impact of the tax (value-added taxes like the GST/HST tend to be regressive). Critically, a transfer does not undermine incentives to reduce emissions: the size of the rebate is scaled by income levels, not carbon emissions.

This approach is already used in British Columbia. The rebate depends on family size and income, and is combined with GST/HST credit payments. A study of the impacts of BC’s carbon pricing policy on households finds that BC’s rebate has had the desired effect of protecting poorer households. In fact, it more than compensates them for the cost of the tax, making the policy progressive overall.

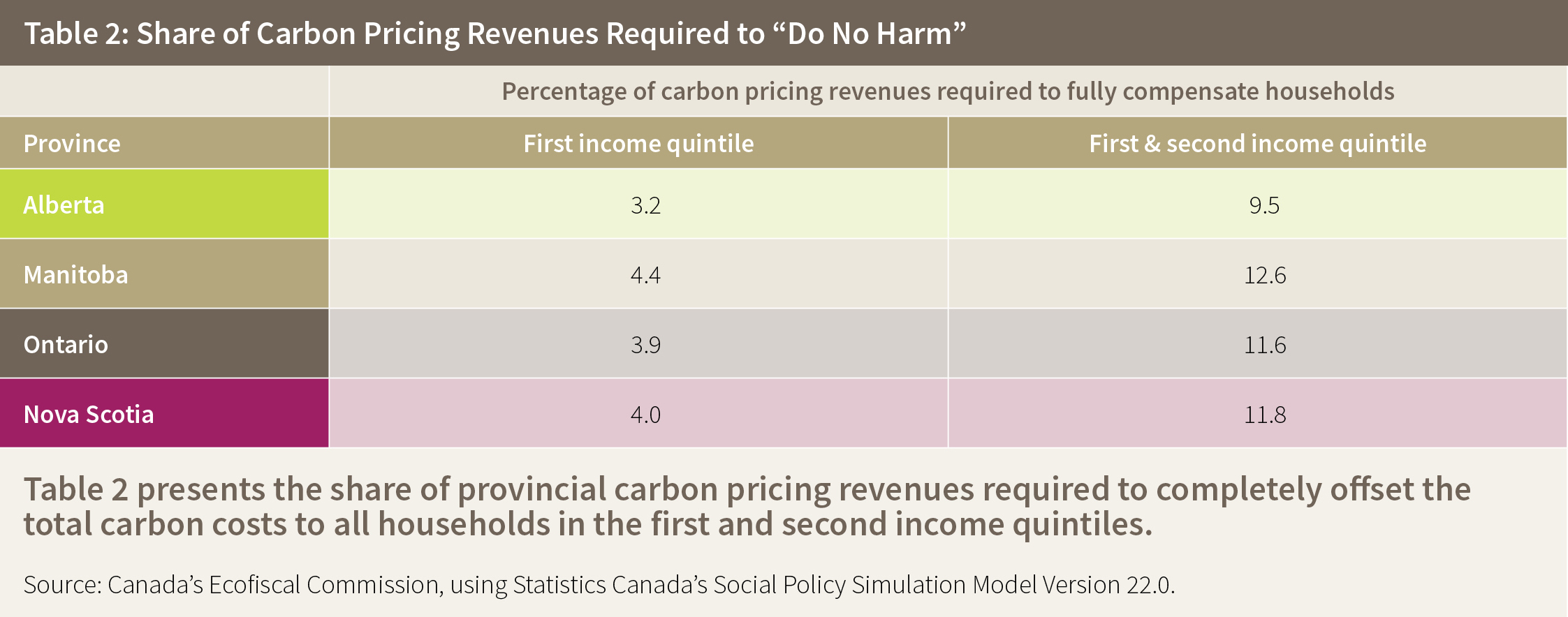

The share of carbon pricing revenues needed to protect low-income households

How much carbon revenue is needed to fund rebates for low-income households? Table 2 shows the different share of carbon pricing revenues needed to fully compensate lower-income households in our four provinces. We look at what share of revenues would be required to fully compensate the first income quintile (i.e. the bottom fifth of the income distribution), as well as both the first and the second quintile (the bottom two fifths). It will be up to individual provinces to decide exactly what share of poorer households they would like to shield from the impacts of the carbon price.

As seen in the table, offsetting the full cost of policy to the first income quintile requires less than 5% of total carbon pricing revenue in all four provinces. And the revenue required to offset the cost to the first two income quintiles is less than 13% of provincial carbon revenue. It should be noted that the revenues needed to compensate households are probably overestimated in our analysis, since we don’t account for shifts in their consumption patterns that will occur in response to the carbon price.

Households in Alberta, with its emissions-intensive resource and electricity sectors, and Nova Scotia, with its reliance on coal, will face a larger burden from carbon pricing than households in other provinces. However, their economies’ emissions intensity also means that, on a per capita basis, their carbon pricing revenues will be higher than other provinces’. As a result, the share of total carbon pricing revenues required to protect their vulnerable households doesn’t end up being that different from less emissions-intensive provinces like Ontario and Manitoba.

Smart revenue recycling can ensure carbon pricing is fair

The clear implication of our analysis is that governments can fully eliminate unfair impacts on poorer households and still retain most of the associated revenues for other policy objectives. What they then choose to do with their remaining carbon pricing revenues is up to them.

Comments are closed.