Household Fairness of Carbon Pricing

The Ecofiscal Commission recently released a research paper on provincial carbon pricing and household fairness to complement our broader report, Choose Wisely, which looks at how provinces could use carbon revenue. The research team’s next three blogs will lean on both reports to explore different dimensions of household fairness of carbon pricing.

To start, this first blog looks at the “incidence” of carbon pricing alone (i.e., before revenue recycling). How does a carbon price affect a household’s budget? How does it affect lower-income households relative to higher-income ones? The answers to these questions help define how revenue recycling can ensure a carbon pricing policy is fair.

Carbon pricing rebates in Alberta

Last Thursday, for example, Alberta released its 2016 Budget, and with it, details about how the government is planning to recycle its carbon tax revenue once its policy is implemented in 2017. When the tax will reach $30/tonne in 2018, 10% of the revenue will be directed towards “household rebates”. Lower and middle income Albertans will receive cash payments from $300-$540 a year in 2018 depending on their household structure. Importantly, these payments don’t undermine incentives to reduce emissions. They do, however, change the total costs for families.

Why is the government providing such offsets to lower- and middle-income households? And why 10%? These are precisely the questions that our recent research paper on provincial carbon pricing and household fairness aims to answer. It unpacks the incidence of carbon pricing to assess the extent to which a carbon price—on its own, without considering revenue recycling—could be unfair for lower-income households.

Where do carbon costs go?

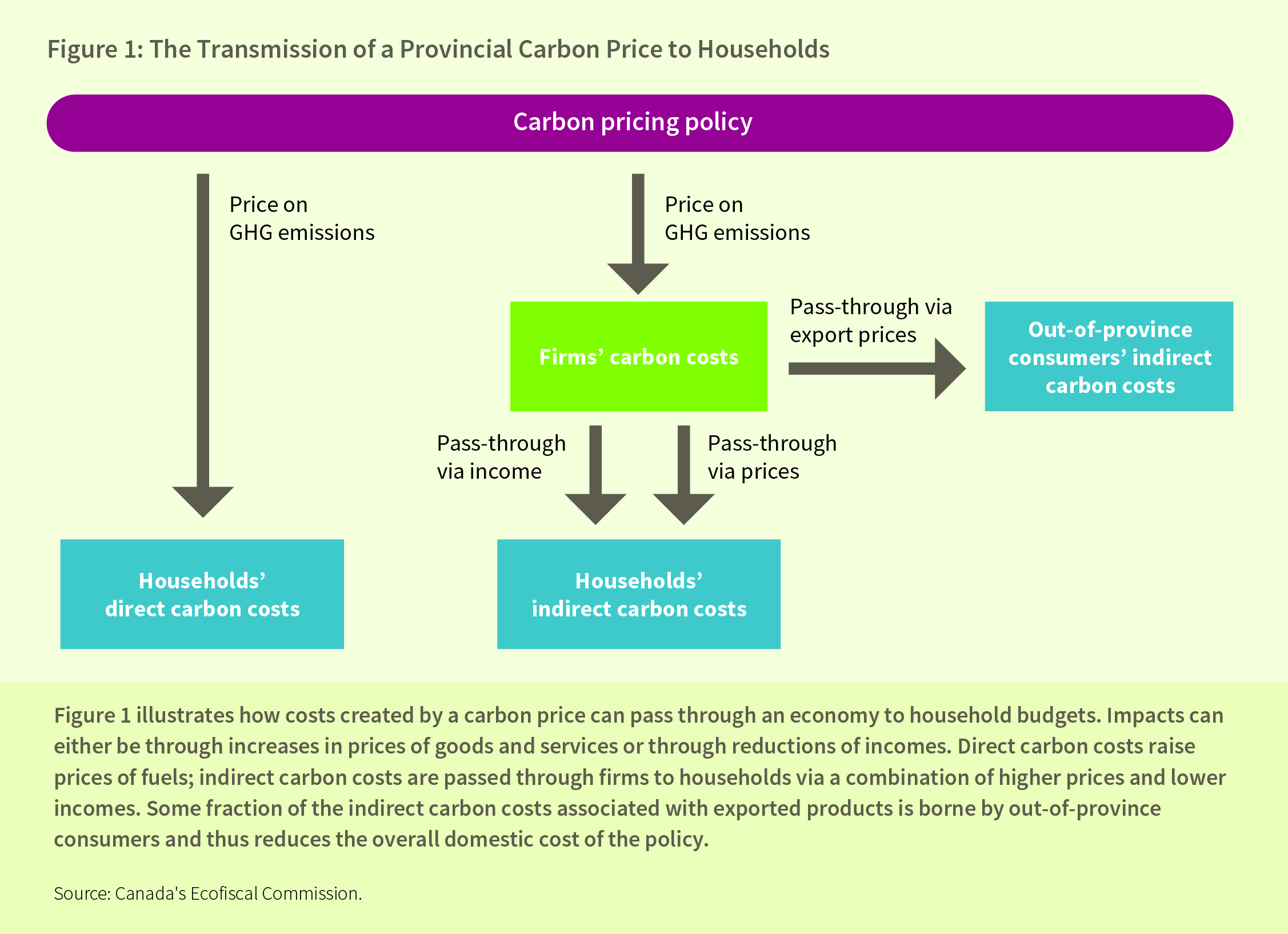

Figure 1 illustrates how costs created by a carbon price can pass through an economy to household budgets. Impacts from policy can come either through increases in prices of goods and services that households consume or through reductions of incomes households receive.

First, a carbon price directly raises the prices of fuels consumed by households. We refer to these as the direct carbon costs of the policy, and they are based on the GHG emissions that households produce through the combustion of fuels for transportation and home heating, such as gasoline, diesel, and natural gas.

Households also consume many goods and services that do not directly emit GHGs, but have emissions associated with their production processes. Electricity, housing, food, and clothing all fall into this category. In other words, GHG emissions occur upstream in the supply chain of these products, and the indirect carbon costs incurred from pricing these emissions must be borne by someone—either in the form of higher prices or lower incomes.

Some fraction of the indirect carbon costs associated with exported products is borne by out-of-province consumers and thus reduces the overall domestic cost of the policy.

Different channels have different effects on fairness

Before we go on, what do we mean by fairness? Fairness in our report is defined in terms of carbon costs in proportion to household budgets. A policy is regressive if low-income households face greater carbon costs as a share of their income than do higher-income households.

Whether a carbon costs increases prices or reduces income, each channel has an important role in determining the fairness of a carbon pricing policy. Because households of different levels of income have both distinct patterns of expenditures and sources of income, they are affected differently by a carbon price.

Since a carbon price will increase the price of energy-based products more than other products, and since lower-income households spend relatively more of their budget on these products, the price impacts of a carbon pricing policy, when taken alone, tend to be regressive.

On the flip side, because some portion of carbon costs will lead to lower employment and investment income, which are relatively more important income sources for higher-income households, decreases in income tend to make carbon pricing progressive.

What is the overall fairness of carbon pricing?

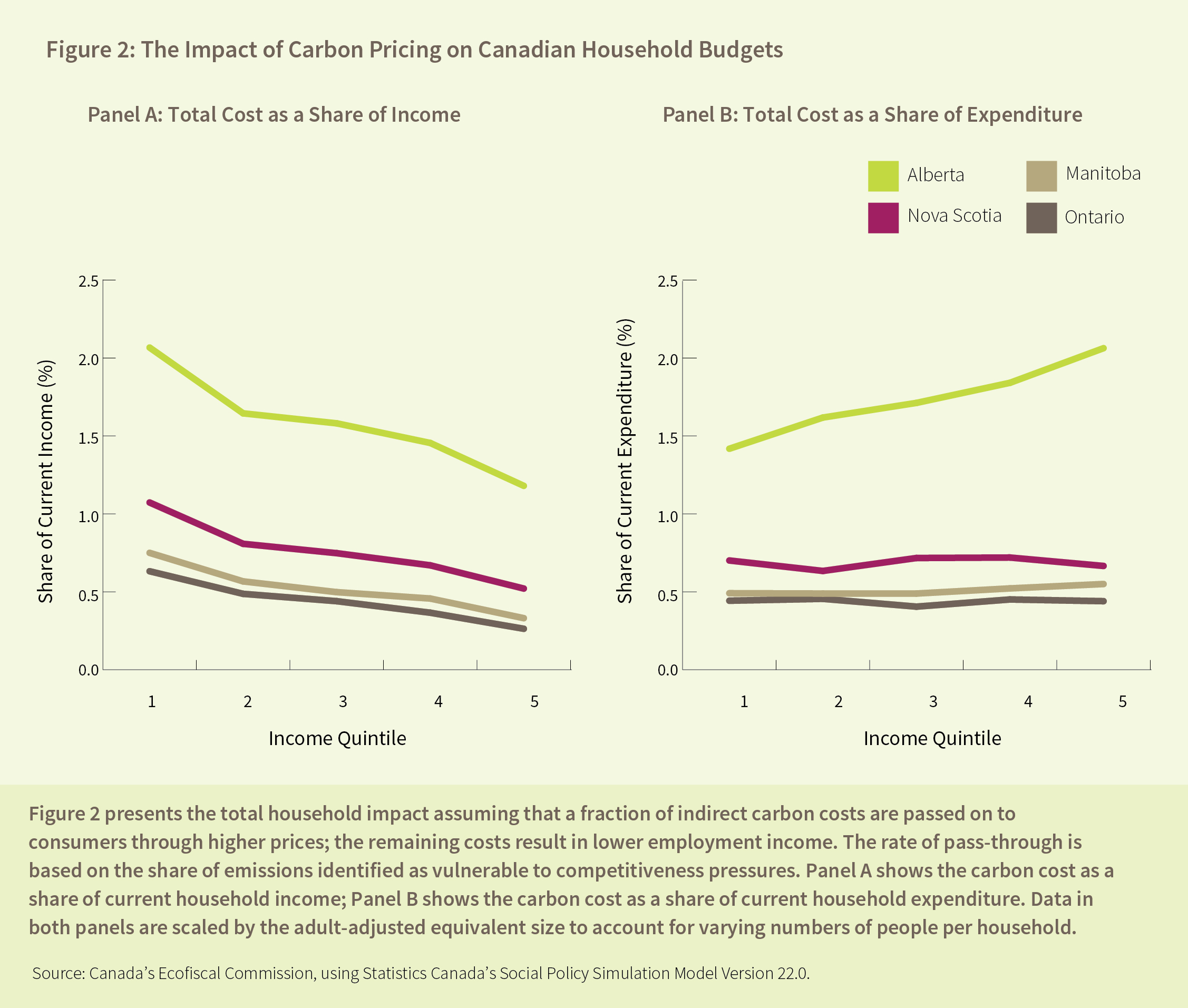

To assess the fairness of carbon pricing in Canada, we use economic models to estimate the impacts of a $30 carbon price on households. To illustrate the implications of different provincial energy mixes and economic structures, we consider households in Alberta, Manitoba, Ontario and Nova Scotia. For our modelling scenario, we assume that all direct costs of the carbon price (i.e., on fuels) are passed through to consumers in the form of higher prices. However, we assume that only a fraction of the indirect carbon costs are passed on in the form of higher prices; the remainder leads to reductions in household income (for more information on the modelling and assumption, see section 3 in the report).

Figure 2 presents the estimated household impacts before any revenue recycling. It shows the total household carbon cost by income quintile for each of the four provinces, and includes both the direct and indirect costs.

Three important findings emerge from Figure 2:

- Household impacts are relatively small. The carbon cost is always less than 2.1% of household income or expenditure, and for most provinces and income quintiles, it is less than 1%.

- The extent of regressivity is sensitive to measurement. When household costs are considered as a share of current income, carbon pricing appears to be regressive for all four provinces—but only slightly. Yet when considering the cost as a share of current expenditure, carbon pricing is mildly progressive in Alberta and almost exactly proportional in the three other provinces.

- Overall household costs are greater because Alberta’s economy is more carbon-intensive. This means that indirect price increases will be greater than in other less emission intensive provinces.

However, an equally important take-away from our paper is that smart recycling of revenue can and even fully address fairness concerns around carbon pricing. As a result, fairness concerns should not be an obstacle to implementing carbon pricing. The next blog will explore precisely how different revenue recycling options impact the overall fairness of carbon pricing for households, and how much revenue might be required to do so.

2 comments

Although the work above suggests the household impact seems relatively low, the impact of even a few dollars in lower income households where pennies, or should I say nickels, count is significant.

Futhermore when virtually all economists have advised that a carbon price in the $100+ range is needed to meet even Canada’s modest targets, let alone the 1.5 degree rise of the Paris agreement, the regressive nature will really hurt lower income families and also the political viability of the needed steady (perhaps $10/CO2 eq. / year) rise of carbon prices for decades.

Hi Tom, thank you for your comment and for reading the post. You are right that for the most vulnerable households, any cost could be too much, independent of the regressivity/progressivity of a policy. In our report, we refer to this as the “do no harm” scenario in which low-income household get a rebate equal to their total cost, thereby maintaining the price signal while compensating the cost. This is what BC is currently doing with its Climate rebate and very similar to what Alberta is proposing. Our blog next Wednesday will concentrate on precisely revenue recycling options to ameliorate fairness.

Comments are closed.