Gimme Cover! When it comes to Carbon Policy, Broader Coverage is Better

by Vincent Thivierge and Dale Beugin

Every so often, the research team here at Ecofiscal will venture out into the blogosphere. Sometimes, we’ll share additional analysis that didn’t quite make it to a report. Sometimes, we’ll elaborate on more technical ideas or data that the main reports consider only briefly. And sometimes, we’ll just take the opportunity to be unabashedly #wonkish. So be warned: here be graphs.

Thanks for coming down into the weeds with us as we dig into the nitty gritty of carbon pricing policy. Last week we took a deep dive into stringency. This week we’re talking coverage—another fundamental design choice.

While stringency is about the environmental effectiveness of a policy (higher stringency = more carbon emissions reductions), coverage is really about cost-effectiveness (broader coverage = less expensive emissions reductions).

In a nutshell, coverage is the share of total greenhouse gas (GHG) emissions that are subject to a policy. By casting a bigger net over emissions that face pricing incentives, broader policy enables the lowest-cost reductions to be caught—and that means a lower cost for emissions reductions over all.

True to form, let’s take a look using a simple model. Click here to listen to us walk through the model, or read through the details below. There’s no math here: this time, we’re using a graphic to show how policy interacts with different provinces’ emissions. We’ll come back to the policy part of the story in a minute; let’s start with just the emissions.

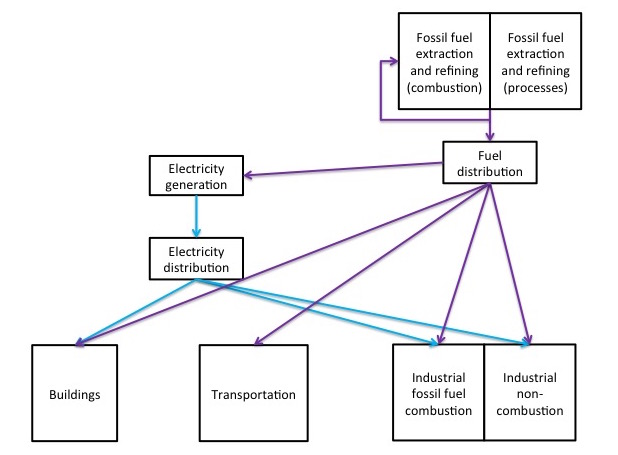

The figure shows a (highly!) simplified representation of the economy’s energy and GHG emissions system. The purple arrows represent the flow of fossil fuels in the economy, from extraction to consumption. GHG emissions embedded in the fuels are released on consumption. The blue arrows represent the flow of electricity, from generation to consumption. GHG emissions are released at generation, depending how the electricity is generated. Boxes represent economic sectors that contribute to greenhouse gas emissions, either through producing, distributing or consuming energy, or through non-combustion process emissions. Each of these boxes has the potential to be covered by a carbon pricing policy.

But how does carbon pricing policy interact with these emissions? How are emissions “covered” by policy? To illustrate, let’s work through the three provincial carbon pricing policies considered in the report.

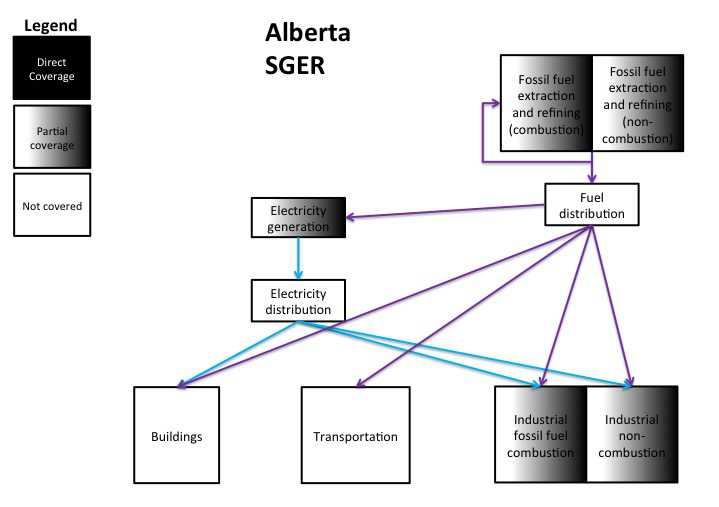

We’ll consider Alberta first, because its coverage is more straightforward. The Alberta SGER is applied “downstream” because large emitters are regulated based on the GHGs they physically produce. To represent this coverage, regulated emitters are shaded in the figure. Electricity generators and industrial emitters (both manufacturing industries and resource extraction) are covered by the policy. Yet there’s an extra nuance here: only facilities emitting more than 100,000 tonnes of GHG emissions annually are covered. To illustrate this partial coverage, the emitters are partially shaded in the figure.

We’ll consider Alberta first, because its coverage is more straightforward. The Alberta SGER is applied “downstream” because large emitters are regulated based on the GHGs they physically produce. To represent this coverage, regulated emitters are shaded in the figure. Electricity generators and industrial emitters (both manufacturing industries and resource extraction) are covered by the policy. Yet there’s an extra nuance here: only facilities emitting more than 100,000 tonnes of GHG emissions annually are covered. To illustrate this partial coverage, the emitters are partially shaded in the figure.

Two aspects of Alberta’s coverage stand out: the prevalence of partial coverage and the importance of non-covered sectors.

The 100 or so covered “large emitters” end up accounting for about half of the provinces total emissions. Halving the threshold would end up increasing coverage by less than 10% while increasing disproportionately the amount of new emitters added to the regulation. For non-combustion emissions, process emissions are excluded whereas venting and fugitive emissions are included for large emitters.

But what about the other half of Alberta’s emissions? Offset markets and other policies cover other emissions to a more limited extent. But that still leaves non-covered emissions—whether emissions from the combustion of fossil fuels from buildings or the transport sector— which have no incentive to reduce emissions. Leaving potential emissions reductions from these sources on the table increases the cost of achieving a given level of reductions and limits the cost-effectiveness of policy.

Given the diminishing returns to lowering the threshold for currently covered sectors, Alberta can increase its coverage more easily by covering new emissions. In fact, carbon pricing in BC and Quebec provide some insight on how this objective could be achieved.

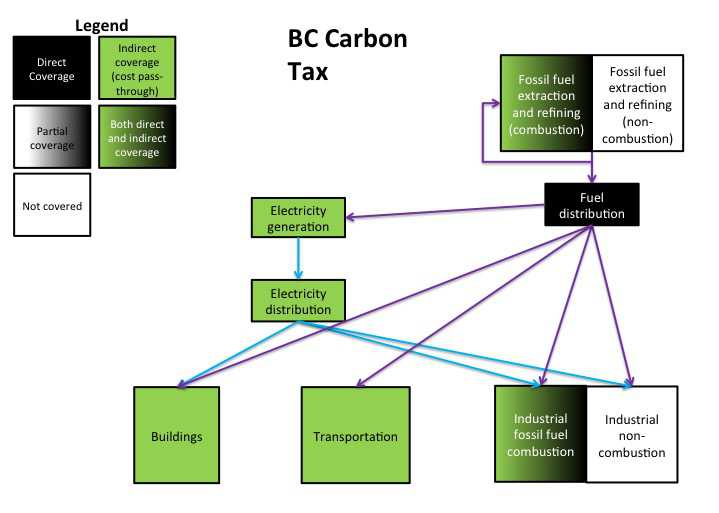

BC’s carbon tax is an “upstream” system. Its carbon tax is applied and collected at the fossil fuel wholesale level, similar to motor fuel taxes (shown in the figure in black as direct coverage). This approach minimizes administrative costs, as the government deals with a small number of large suppliers. But crucially, an upstream approach allows policy to cover a large number of small emitters—think buildings and vehicles—indirectly. Fuel distributors pass on carbon costs through the supply chain to final consumers (as shown in green in the figure). The black shade on two of the boxes represents BC’s direct coverage for the flaring of methane gas.

BC’s carbon tax is an “upstream” system. Its carbon tax is applied and collected at the fossil fuel wholesale level, similar to motor fuel taxes (shown in the figure in black as direct coverage). This approach minimizes administrative costs, as the government deals with a small number of large suppliers. But crucially, an upstream approach allows policy to cover a large number of small emitters—think buildings and vehicles—indirectly. Fuel distributors pass on carbon costs through the supply chain to final consumers (as shown in green in the figure). The black shade on two of the boxes represents BC’s direct coverage for the flaring of methane gas.

Two lessons for BC are worth noting

First, upstream regulation leads to fairly broad coverage. Given the importance of transportation, buildings, and small industrial emitters, regulating fuel distributors based on carbon content of fuel covers about 70% of BC’s emissions (the direct coverage of flaring adds less than 2% to this number).

So what’s left? The remaining 30% of BC emissions are from non-combustion sources. Half of these are from landfills, forestry and agricultural sources. The other half includes industrial process emissions, venting and fugitive emissions. If they remain excluded, low-cost reduction opportunities can be missed. Finally, however, it is important to note these coverage gaps could be even more important in light of proposed LNG development in the province. The first phase of proposed projects could double current fugitive emission sources in the province.

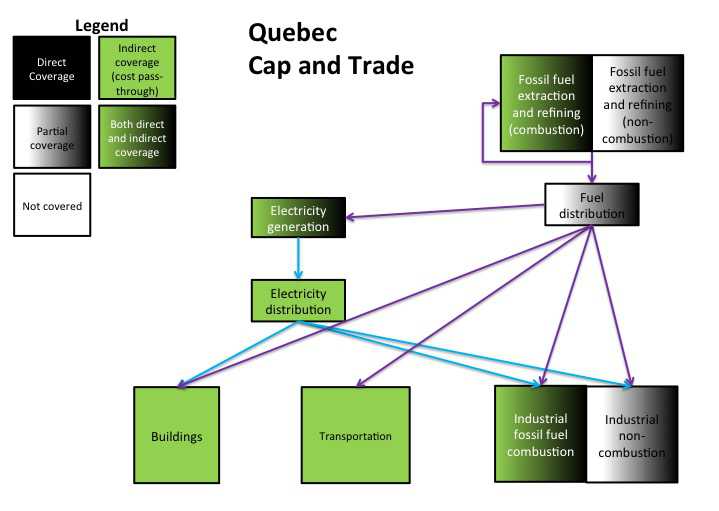

Quebec’s cap-and-trade system takes a different approach, with the most comprehensive coverage of the three policies, overall. But it’s also the most complicated coverage story of the three systems.

Quebec’s cap-and-trade system includes both “upstream” and “downstream” components. Upstream, the fossil fuel distributors are required to buy permits for the embedded GHG emissions on their products. Similar to the BC carbon tax, this cost is then passed on to retailers who in turn pass to final consumers (as shown in green). In the figure, fuel distributors are represented by a shaded box as opposed to a full back box because only facilities emitting annually more than 25,000 tonnes of GHG emissions are directly covered (Quebec does not provide data on the proportion of fuel distributors or related emissions below this threshold but it is likely very small).

Quebec’s cap-and-trade system includes both “upstream” and “downstream” components. Upstream, the fossil fuel distributors are required to buy permits for the embedded GHG emissions on their products. Similar to the BC carbon tax, this cost is then passed on to retailers who in turn pass to final consumers (as shown in green). In the figure, fuel distributors are represented by a shaded box as opposed to a full back box because only facilities emitting annually more than 25,000 tonnes of GHG emissions are directly covered (Quebec does not provide data on the proportion of fuel distributors or related emissions below this threshold but it is likely very small).

Downstream, industrial and electricity generators are directly subject to the cap-and-trade system. Once again, only facilities emitting annually more than 25,000 tonnes of GHG emissions are directly covered. This includes both combustion and non-combustion emissions sources, as represented by the boxes shaded with black. Currently, downstream covered facilities purchase at most 20% of their combustion emission permits while all non-combustion emissions are freely allocated.

The combination of the upstream and downstream components of Quebec carbon pricing policy brings its coverage to about 85% of its provincial emissions.

Yet the interplay between Quebec’s upstream and downstream components is interesting.

Most importantly, some downstream facilities are covered by both: they are large emitters subject to the cap, but also consumers of fuel, with carbon costs passed on by fuel distributors. To avoid double counting in the Quebec system, upstream fuel distributors do not pass the cost of carbon through to downstream covered facilities. This approach is somewhat administratively more complex than BC’s way of covering all industrial combustion emissions. It also leads to subtle inconsistencies between large and small industrial emitters. Given the large free allocation of combustion emission to above threshold industries, small facilities pay a larger proportion of their combustion emissions. However, their process emissions are not covered as they are for above threshold facilities.

What we should take away from this coverage of carbon pricing policies

First, let us reiterate the message from the report: broader coverage generally leads to more cost-effective policy. When more emissions reductions face the price, more low-cost reductions can be realized.

Second, to achieve broader coverage, upstream coverage seems to be an essential (and practical) part of the story. It’s relatively easy to include fuel distributors under a pricing policy, and doing extends coverage to a large share of emissions, as illustrated by the BC and Quebec systems. This seems to be a key piece of the story that’s missing in the Alberta policy.

Third, some tension exists between broader coverage and complexity. Quebec achieves the broadest coverage (about 85%) by including both upstream and downstream components. Avoiding possible overlaps between the two components is manageable, but does add some additional complexity. And extending coverage even further — for example, but lowering the threshold for large emitter—could further add administrative costs. Overall, then, policy should be as broad as is practically possible.

Finally, we should remember that complementary policies could also play a role in broadening coverage if emissions cannot practically be covered by a carbon price. Regulations, for example, could apply to fugitive emissions in upstream oil and gas. Offset markets could drive emissions reductions in agriculture.

1 comment

[…] know that effective carbon policies are broad—covering as large a share of the economy as possible. That means not excluding industries, even […]

Comments are closed.