What “demand is inelastic” actually means

“A carbon tax does nothing for the environment.” “Road tolls won’t affect driving habits.” “Prices don’t matter when we’re using water for everyday life.” We hear these arguments frequently when discussing ecofiscal policies. Critics might even drop a little economics jargon. But that doesn’t mean these arguments are grounded in good economics. In this blog, we’ll explain why we shouldn’t fear the phrase “demand is inelastic.”

What’s elasticity of demand?

Elasticity of demand measures how sensitive we—as consumers—are to changes in price. How much more or less of something will we want if the price goes down or up?

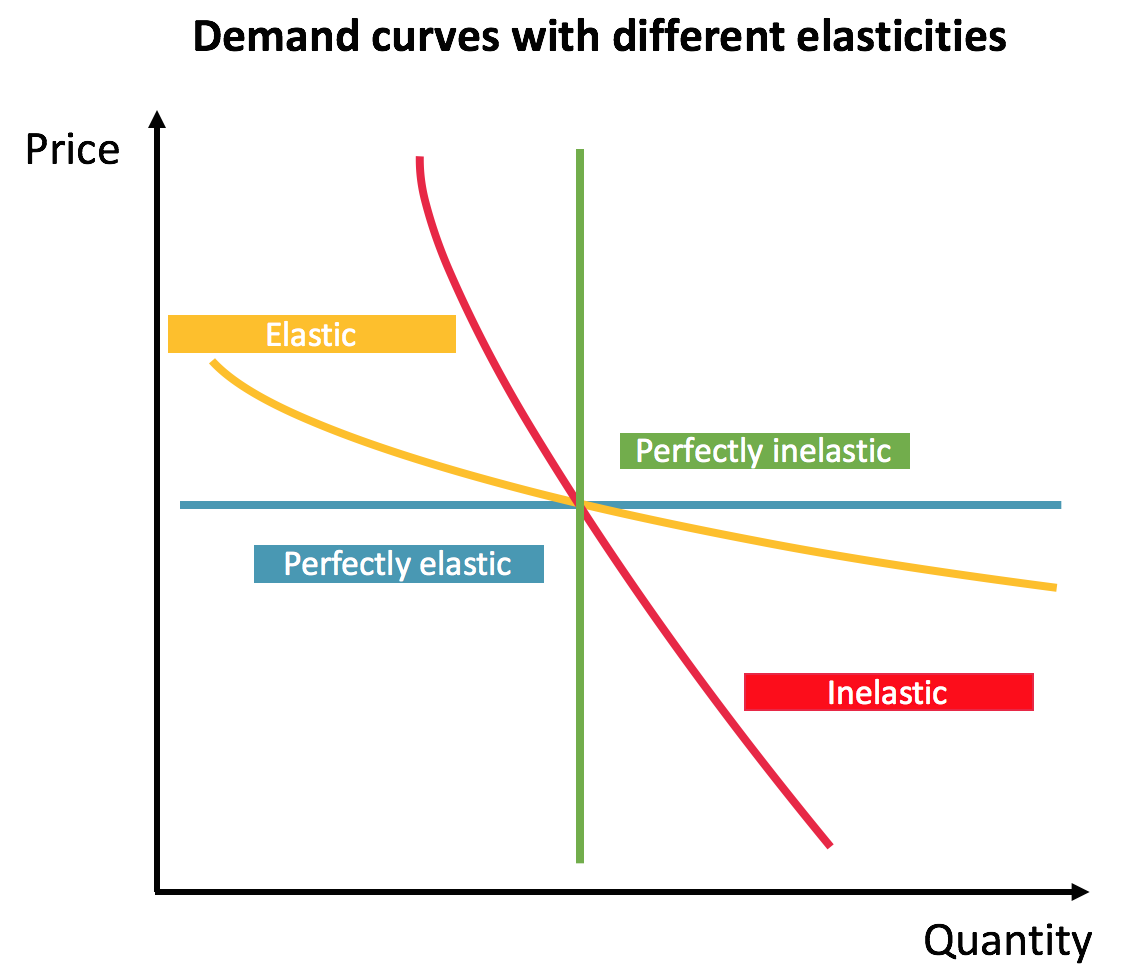

Economists think about this relationship using the shape of demand curves. As we know from the Economist’s Handbook of Proverbs, demand curves slope downward. This downward slope visually represents the fact that consumers demand more at lower prices and less at higher prices (to calculate how much more, there’s a formula).

Here’s a chart showing four separate demand curves representing different elasticities of demand.

Here’s an example. Say you and your friends are in the market for turkey sandwiches. How do changes in turkey sandwich prices affect how many sandwiches you want?

- If demand for turkey sandwiches is perfectly inelastic, then consumers will demand the exact same number of turkey sandwiches no matter the price. People want their turkey sandwiches and no other sandwich will do.

- On the other extreme, if demand is perfectly elastic, the opposite is true. Any rise in the price of turkey sandwiches will completely eliminate the demand for turkey sandwiches. You’ll all go for ham or chicken instead.

- Reality for most people and products is somewhere in the middle. If demand for turkey sandwiches is relatively elastic, an increase in price will drive some changes. Turkey is delicious, but there are lots of other things you can stick between bread. Similarly, you don’t have to use bread. Bagels or buns or pitas do the trick as well.

- If demand is relatively inelastic (so the demand curve is steeper), consumers are relatively less sensitive to price changes. But this doesn’t mean people are totally unresponsive. Most might be okay with a small increase in the price of a turkey sandwich, but some may switch to ham or chicken with a larger price increase.

Elasticity, ecofiscal, and you

The Ecofiscal Commission has recommended using pricing to solve several problems, even though demand is relatively inelastic over shorter timespans: to reduce traffic congestion, to help conserve water, to reduce greenhouse gas emissions, and to economize municipal waste collection. Most people see these as everyday essentials that—unlike turkey sandwiches—have relatively few substitutes. It’s easy to see why some don’t think pricing is a very effective way to address these problems.

Even though demand for road space, municipal water, carbon-based energy, or municipal waste services are relatively inelastic, we still respond some amount when their prices change. None of them are perfectly inelastic. Changes in prices will change behaviour.

Think about water. Water is essential for drinking and bathing, for example, and so our demand for it may be quite inelastic (although many of us could easily take shorter showers!). But watering our lawns and washing our cars is clearly less essential, and so our demand for those uses could respond a lot to changes in price. Here’s the upshot: the overall market demand for even something as basic as water responds to price changes.

But enough turkey talk. Let’s turn back to the question of energy and GHG emissions.

Case study: demand for energy

Elasticity isn’t just a theoretical concept: we can estimate it for any good or service. In particular, we have plenty of data available showing how demand for energy—and in particular, specific fuels—might be sensitive to changes in price.

One way that we expect households and businesses to respond to a carbon price is by using less energy — and also by using different kinds of energy. We can heat our homes and offices with natural gas, diesel, or electricity. We can commute in a car, or with public transit, or on foot. We can prepare food on a gas stove, in an electric oven, or eat some foods raw.

Carbon pricing changes the prices of these various substitutes, but by different amounts. The price of carbon-intensive things will rise more than less carbon-intensive things. These price changes will lead households and businesses to change their behaviour—some by a little and others by a lot. Some will substitute or conserve (e.g. take the bus or buy a more fuel-efficient car) and some people won’t. Some will switch to an electric furnace, others will turn down the heat. Others may not respond at all. The overall response may not be huge at first, but there will be a response. The same logic holds for congestion pricing, water pricing, or waste pricing.

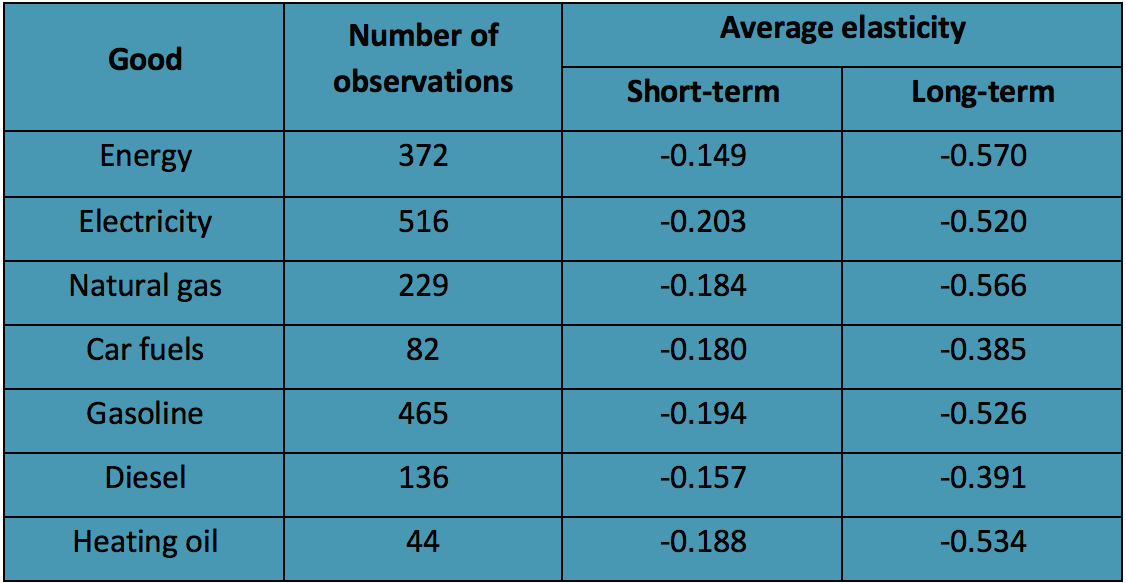

Dozens of studies have tried to calculate the elasticities of different types of energy. The table below shows the results from a meta-analysis from 2016. For example, in the short term, the evidence suggests that the demand elasticity for natural gas is -0.18, meaning that a 10% increase in the price of natural gas will lead to a 1.8% decrease in natural gas consumption. For all of the energy sources shown in the table, demand falls when price rises, even over short periods of time. But the table shows something else as well.

Source: Labandeira et al., 2016

Source: Labandeira et al., 2016

Buying time

That something else is that demand becomes more elastic over the long term—two to three times as elastic. Why? In the long term, people have more options available to them. This greater flexibility allows them to respond more to higher prices. As the study’s authors put it, demand probably becomes more elastic due to “significant investments and behavioural changes.”

This is exactly the type of shift that ecofiscal policies can help with. Long term, we will see more investment, more behavioural change, and more options to move away from environmentally damaging activities. We’re playing the long game here.

Defining our terms

In any good debate, we need to define our terms. Elasticity of demand is wonky, but it’s a critical component of ecofiscal policies. It’s important to understand when it is being used appropriately or (especially) inappropriately.

In the debate over ecofiscal policies, inelastic is sometimes confused with perfectly inelastic. The phrase “demand is inelastic” is not the argument that some opponents think it is, and it is certainly not evidence that ecofiscal policies don’t work as we recommend. Two fundamental truths of economics are still with us: prices do change behaviour and demand curves do slope down.

4 comments

“It’s just a tax grab.” If that’s the feeling you get at first, it’s because in the short run you don’t see much you can do to abate. In the long run, next time you upgrade your vehicle, or move or change jobs, or next time you replace your furnace or hot-water heater, or renovate or change a broken window, you can do a step-wise abatement by choosing more energy-stingy alternatives. The higher the carbon price, the more net-savings you’ll get from an abatement, making more/new things possible. Also google: MACC marginal abatement cost curve

Hi Doug,

Thanks for adding your thoughts. For anyone curious about MAC curves, we get into them in our 2016 report.

This is good and I believe reasonable data. Also the point about short run vs long run. What would be interesting if you also showed the PED for other goods and services, for some comparison. Energy generally is much more inelastic than other things. In the short run PEDs of less than .2 clearly indicate you need high price increases for affect demand. The carbon taxes currently being used are so low they cant any real effect, yet, especially on motor fuels (might change with better EVs).

Hello Steven,

Demand for energy is relatively inelastic in the short run, but as we mention in the piece, there are some changes in behaviour–even at the low prices we have today. Your point is well taken, and shows exactly why carbon prices must gradually rise over time.

Comments are closed.