Explaining Output-Based Allocations (OBAs)

Last week the federal government unveiled a proposal for the carbon levy that it plans to apply in provinces that don’t implement their own carbon price. Under the federal instrument, most types of emissions would pay the full value of the carbon tax. But large emitters that face global competition would only pay part of the price under so-called ‘output-based pricing.’ These large emitters would receive something called Output-Based Allocations (OBAs). So what are OBAs? And why do they make sense? In this blog, I provide an explainer.

First, another acronym

OBAs matter most for sectors that are Emission-Intensive and Trade-Exposed (EITE). That is, they produce relatively large amounts of GHG emissions per unit of output, and they compete in highly traded markets, and so face competitiveness pressures. Carbon pricing can put EITE firms at a competitive disadvantage. Because these firms’ emissions are so high, a carbon tax can represent a significant cost. This new cost can allow their international competitors to undercut them and take their business. This can lead to leakage—where carbon pricing doesn’t deter a polluting activity, but just causes it to pop up elsewhere. Leakage is the reason OBAs make sense.

How Output-Based Allocations work

Here’s how OBAs work. EITE firms are allocated emissions credits based on their level of output (the O in OBAs). The number of credits or “allocations” (the A in OBAs) that they get depends on a sector-specific performance standard, which sets a benchmark for tonnes of GHG emissions per unit of output. Effectively, firms get an amount of credits that corresponds to what their total emissions would have been if their emissions intensity of production had matched the standard. They then pay the carbon price only on the emissions that they don’t have enough credits to cover.

Under the proposed output-based pricing system, the worst performers end up without enough OBAs to cover their actual emissions, and they pay the full carbon price on the excess. The more that they exceed their allocation, the more they pay, whether by buying credits from other emitters or from the government at a fixed price aligned with the carbon tax. High-performing firms end up with enough credits to cover their emissions, and end up with little to no carbon liability. The few firms that can beat the standard end up with more credits than they need, which they can then sell to other producers at a profit.

Further below, we’ll talk about why this approach makes sense. But first, let’s walk through a hypothetical example.

An example

Let’s consider four oil-producing firms: A, B, C and D. To keep things simple, we’ll assume they each have one facility, and that they all produce the same amount of oil—100,000 barrels per day.

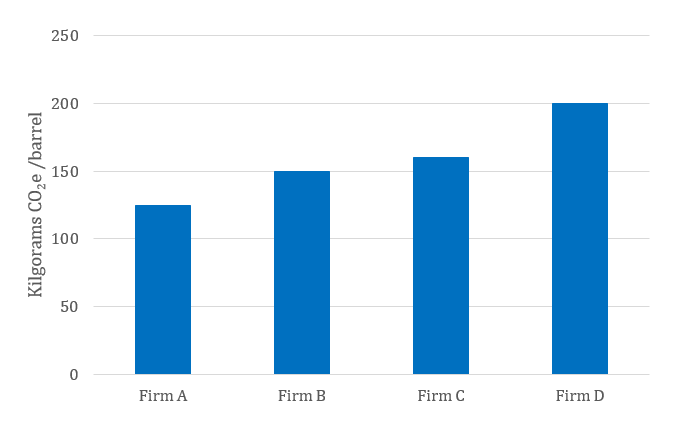

Where our four firms differ is their emissions. Each has a different emissions intensity of production, as seen in Figure 1.

Figure 1: Firms’ emissions intensity of production

Allocating credits

Let’s say the performance standard for OBAs is based on ‘top-quartile’ performance. In our example, this means that Firm A’s emissions intensity of production sets the standard. Each firm receives emissions credits on the basis of what its total emissions would have been if it were as efficient as Firm A. In other words, they get credits equal to their output multiplied by the emissions-intensity standard.

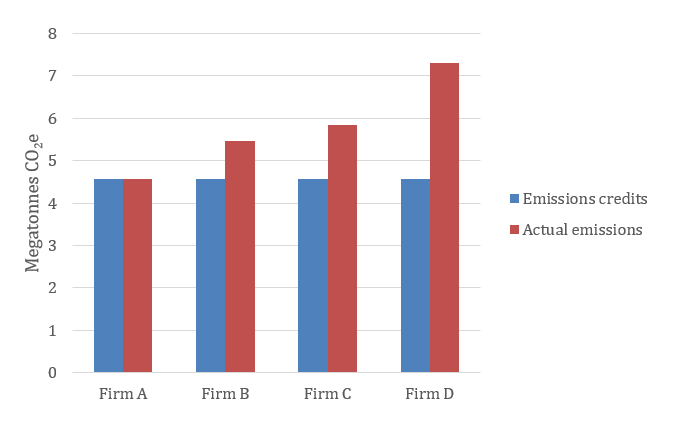

Next, firms pay the carbon price on the emissions that they don’t have credits for. Figure 2 shows the difference between the firms’ OBAs and their actual emissions for the year. Firm A ends up with an amount of credits equal to its emissions, and so it doesn’t have to pay anything. Firms B and C are more emissions-intensive. They don’t have enough credits to cover their emissions, and so end up with a modest carbon liability. Firm D has the highest emissions, and therefore ends up with the highest carbon liability.

Figure 2: Firms’ output-based allocations versus their actual emissions

Who pays what

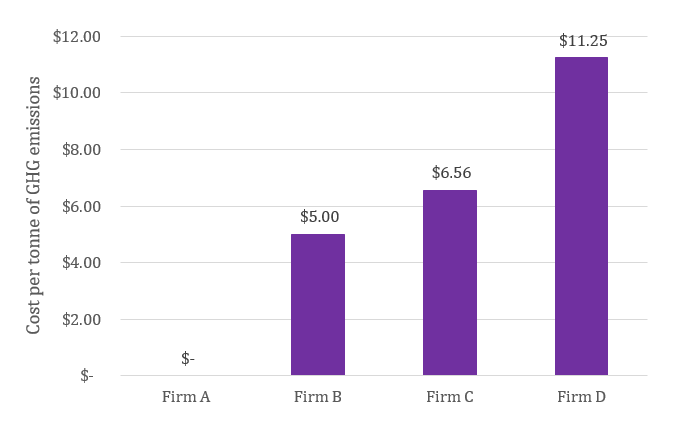

Let’s assume the price of carbon is $30 per tonne. That means that the firms actual costs reflect their remaining emissions (i.e., the emissions that they don’t have credits for) multiplied by $30. The bigger the gap, the bigger the cost for the firm.

Figure 3 shows each of the four firms’ average cost per tonne of GHG emissions. As seen in the figure, Firm A—the top performer—has no carbon costs; while Firm D—the worst emissions performer—pays over a third of the full value of the carbon price.

Figure 3: Firms’ average cost per tonne of GHG emissions

In our example, Firm A gets rewarded for its efficiency by paying no price on carbon. (If we had more firms in our example, the top-performer might beat the top-quartile performance standard, and end up with a net benefit, by selling its surplus permits to other producers.) Firms B, C and D, on the other hand, are penalized for their relatively high emissions intensity. The more they emit per unit of output, the more they pay overall.

Why OBAs make sense

OBAs lower costs for firms. But why would we want to do this? Let’s boil down the key benefits of OBAs:

-

OBAs address concerns around leakage and competitiveness.

An output-based carbon pricing system means that firms have incentive to reduce emissions by improving their emissions performance, but not by reducing production. In our example above, paying the full carbon tax might have made firms uncompetitive compared to their international peers. If this pushed them out of business, these competitors could be expected to take their place in the market. This would mean economic costs for Canada, and little benefit in the form of falling global GHG emissions. OBAs help avoid this outcome. Reducing production would reduce the number of credits available to a firm. This means there’s no incentive for firms to cut their emissions by cutting production, potentially displacing their emissions to other jurisdictions.

-

OBAs don’t undermine the carbon price

Here’s a really important part: even though OBAs lower costs to firms, they maintain incentives from the carbon price to produce goods and services that have lower emissions. OBAs are valuable. In fact, their value is exactly the carbon price (in our example, $30 per tonne). Because the allocations are tradable, covered firms have incentive to take any action that reduces emissions—for example, upgrading to more efficient processes or equipment, electrification, etc.—that costs less than $30 per tonne. Doing so would allow them to sell a surplus permit on the market (or avoid buying one). This flexibility means that the incentive carbon pricing provides to improve the emissions-intensity of production is left intact.

-

OBAs maintain incentives for low-carbon innovation

This same flexibility also means that OBAs preserve the incentive for firms to develop innovative technologies and processes that reduce emissions. Top-performing firms are able to sell their excess credits—at a steadily increasing price that’s defined by the price of carbon—giving them a competitive advantage. The possibility of this competitive advantage encourages other firms to reach this performance level themselves—and critically—to exceed it. This creates a built-in incentive for ongoing innovation and improvement.

Careful though

As the Ecofiscal Commission discusses in Provincial Carbon Pricing and Competitiveness Pressures, this type of support works best when it follows the three T’s— targeted, temporary and transparent. OBAs should be targeted, so that only sectors that are genuinely EITE benefit. They should be temporary, so that firms receive support only while other jurisdictions catch up on pricing carbon. And they should be transparent, with clarity provided on how EITE is defined, and how performance standards are set.

There are good reasons to favour targeted, temporary, and transparent OBAs as a way to price carbon in EITE sectors. Still, as with any public policy choice, OBAs do have trade-offs, especially in the longer-term. In this blog, I’ve focused on the pros of OBAs. In a future blog, I’ll discuss some of the cons. Stay tuned.

- To learn more about Providing transitional support to industry, read revenue recycling position paper #6, by Mark Purdon, Davide Houle and Blake Shaffer.

- To learn more about the role of OBAs in federal and provincial climate policy, read our blog.

- OBAs work a little differently in the electricity sector, read our blog to learn more.

6 comments

The cost of managing this program are too expensive. We would rather see direct fines levied monthly.

Rhart

Nobody likes a program with high admin costs. But a less complex, one-size-fits-all approach would have really high economic costs. OBAs help balance the need to create strong GHG reduction incentives with the need to have a flexible approach that deals with leakage.

THe problem with OBAs is that these large emitters are not paying $30/tonne on their total emissions. Small emitters, and individuals, however, DO. This means that the general burden of the carbon tax falls on individual tax payers and small businesses in a greater proportion to their overall income. It may help the competitiveness of the large emitters in a world where other jurisdictions do not yet price CO2, but hurts the competitiveness of small businesses in a world that is becoming borderless even for small business. It also makes it more attractive for individuals to flee carbon tax jurisdictions.

Hi Morgan. I think the right question to ask about those small businesses is whether they are both emissions-intensive and trade-exposed. Our research has shown that competitiveness pressures tend to be quite small for sectors not covered by the output-based pricing system. I agree with you that lowering the total cost of the carbon tax for some firms but not others is not ideal policy. But we need to ask what would happen if we didn’t. Output-based pricing is a second-best policy that governments implement while they wait for other countries to catch up on climate policy.

Is there opportunity for an offset market under this scenario? In other words, can allocations be generated by promoting carbon sinks in addition to directly innovating?

Indeed there is. Firms could buy offsets from outside the system as an alternative way of complying, potentially at lower cost. There is no provision for this in the current federal system, but it is something that could be added in the future.

The key thing is that the GHG reductions that the offset represents be “additional;” that is, something that would not have happened otherwise. Establishing additionality can be tricky for things like land use, but it’s possible.

Comments are closed.