Driving towards cleaner transportation: low-carbon fuel standards

Canada is moving full-steam ahead on carbon pricing. But what other policies might best complement carbon pricing? We’re in the midst of exploring this question, but our most recent report on biofuel policies found that flexible performance standards, including low carbon fuel standards (LCFS) might be a better complement than existing biofuel policies.

First things first: time to transition away from expensive biofuel policies

The latest report by the Ecofiscal Commission, Course Correction, takes a close look at biofuel policies, and whether they effectively and cost-effectively reduce transportation emissions (see here for a quick recap of the report). The report considers the two biggest forms of support: (1) production subsidies, which provide direct cash payments to Canadian biofuel producers, expiring in 2017-18; and, (2) renewable fuel mandates, which guarantee certain amounts of biofuels are blended with gasoline and diesel, and have been implemented indefinitely.

Given their high costs and questionable benefits, the report ultimately recommends that production subsidies be terminated, as planned, and renewable fuel mandates be phased out. In their stead, we argue that carbon pricing can offer emissions reductions at a much smaller economic cost and should therefore be the main plank of climate policy.

But carbon pricing alone may not be enough to reduce emissions from the transportation sector. A lack of affordable alternatives to gasoline and diesel could mean the transportation sector will be slow to respond to carbon pricing. This may particularly be true in the short-term, as it will take time to design, implement, and ramp-up the federal-provincial carbon pricing framework. Market barriers might also be inhibiting the adoption of low-carbon fuels in the transportation sector—requiring more than just a carbon price to overcome.

Given these challenges, Course Correction suggests that provincial and federal governments consider replacing renewable fuel mandates with flexible performance standards, such as low-carbon fuel standards. (Introducing zero-emission vehicle regulations is another type of flexible performance standard, and will be explored in a future blog.) In addition, government support for R&D should be aimed across the spectrum of emerging transportation technologies. These measures could smooth the transition from targeted biofuel policies, and could address other market problems in the transportation sector. It could also drive early progress while pan-Canadian carbon pricing ramps up.

What is an LCFS, and how does it differ from existing fuel mandates?

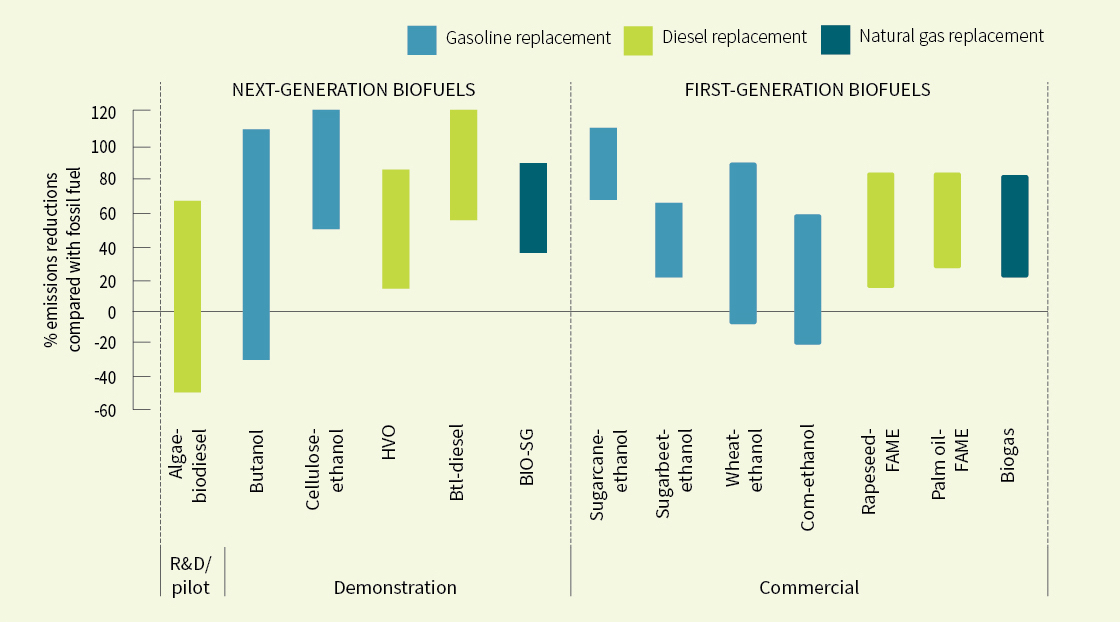

Let’s first start with renewable fuel mandates, which operate in five provinces and also at the federal level. In each case, they require fuel distributors to blend specific amounts of ethanol and biofuel with gasoline and diesel (ranging between 2–4% for biodiesel, and 5–8.5% for ethanol). Generally, biofuels have lower carbon intensities than fossil fuels (see Figure 1), which means that displacing more gasoline and diesel with ethanol and biodiesel results in fewer emissions. Yet it is important to note that there are practical limits to how much biofuel can be blended with petroleum fuels. Most gasoline-powered vehicles, for example, can use ethanol blends of up to 10%, or 15% for newer vehicles.

In contrast to a renewable fuel mandate, an LCFS requires obligated parties—the fuel distributors—to reduce the average carbon intensity of their fuels over a specified period of time. The LCFS in California and British Columbia, which is the only examples of LCFS in North America, each require a 10% reduction in the average carbon intensity of fuel by 2020 (relative to 2010).

Low-carbon fuel standards have a few advantages over fuel mandates. First, they are technology agnostic and encourage the adoption of all low-carbon fuel and vehicle technologies. Fuel distributors can comply by using credits from lower-carbon fuels, such as biofuels, electricity, hydrogen fuel cells, or any other new and emerging technology. This provides fuel distributors with a bigger market for low-carbon fuels, some of which are cheaper than biofuels.

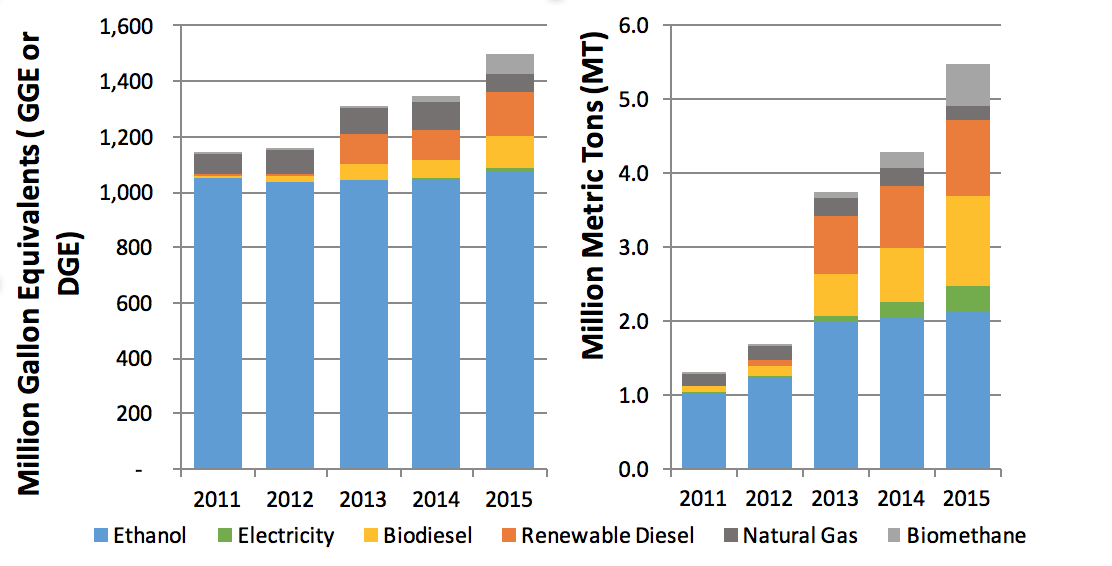

Second, LCFSs establish a market for buying and selling credits based on the life-cycle emissions analysis (LCA) of each fuel. This means the value of compliance credits is higher for fuels with lower life-cycle emissions intensities, rewarding producers that can innovate and deploy low-cost and low-carbon alternatives. So far, ethanol has been the primary compliance pathway in California, but other fuel technologies are beginning to catch up (see Figure 2). Course Correction does however highlight the inherent uncertainties associated with LCA, and the need for caution and sensitivity analysis in policy development.

As an added benefit, different LCFS systems can also be linked together so that permits can be traded between jurisdictions (as is currently planned with California, B.C., Oregon, and Washington), which can reduce the cost of compliance even further.

Considering its mechanisms for flexibility and its ability to incentivize low-carbon technologies, LCFSs may offer a more cost-effective way to reduce emissions from the transportation sector (see here, here, and here). In contrast, renewable fuel mandates offer no clear incentive to blend the low-carbon biofuels (with the exception of the fuel mandates in AB and ON, where fuel mandates include carbon intensity criteria for biofuels), and no incentive for other emerging fuels. In fact, renewable fuel mandates may create the opposite effect: because higher-emission biofuels are typically cheaper (i.e. first-generation biofuels), fuel distributors may be more likely to blend these over lower-carbon biofuels (i.e. next-generation biofuels).

Before we get too excited…

Despite its advantages over renewable fuel mandates, LCFS are inherently more complex. LCFS require policy-makers to set the stringency of the LCFS, which affects the overall cost of the policy. If the policy is too stringent, then firms might struggle to purchase enough low-carbon fuels, which would in turn make permits (i.e. emissions reductions) more expensive. On the other hand, if the policy is too lenient, there might be missed opportunities to capitalize on emerging low-carbon technologies to drive further emissions reductions. Governments can address some of these concerns by setting price ceilings and floors for permit prices and maximizing flexibility, but LCFS still requires governments to consider what types of emissions reductions might become feasible, years in advance.

Another tricky design hurdle is determining who is regulated under a LCFS. At present, petroleum fuel distributors are the ones having to comply in B.C. and California. Producers of low-carbon fuels, on the other hand, such as electricity utilities or biofuel producers, have the opportunity to opt-in and sell their permits to the petroleum fuel distributors. This means that fuel distributors are often reliant on the supply and demand of low-carbon fuels and vehicles in order to comply with the LCFS, even though this may be out of their control. Finding ways to avoid this constraint is still a live conversation amongst industry and government.

Finally, LCFS can have interesting interactions with carbon pricing policies. Introducing a LCFS on top of a cap-and-trade system, for example, may not drive additional emissions reductions: fewer emissions reductions will be required elsewhere in the economy, which, in turn, can drive down permit prices. Under a carbon tax, on the other hand, complementary performance standards typically lead to additional emissions reductions beyond those generated by the carbon tax.

Despite their complexity, LCFS might complement carbon pricing

Course Correction concludes that targeted biofuel policies are an expensive way to reduce GHG emissions from the transportation sector. While we argue that transportation-specific policies may still be required to complement a carbon price, renewable fuel mandates and production subsidies are a costlier way of achieving this goal.

Introducing a LCFS in Canada (provincially or federally) has the potential to achieve emissions reductions at a lesser cost than biofuel policies. LCFS are inherently more flexible than targeted biofuel policies and can provide continuous incentives for developing and deploying new, low-carbon fuel and vehicle technologies. This last point is especially important, as the transition to a low-carbon transportation sector will likely involve many different emerging technologies, not just biofuels.

For more discussion on how Canada can decarbonize its transportation sector, watch our Google Hangout ‘How best can Canada reduce its transportation emissions?

1 comment

You appear unaware that it is most likely that a Low Carbon Fuel Standard breaches WTO rules. WTO has consistently failed to uphold environmental standards that discriminate against products based on how they are made/produced. I am sorry for that fact. I believe the BC and California LCFSs are deficient in a number of ways, but relatively easy to fix if any desire to fix them emerges.

So it was a disappointment for me to learn that if/when a nation or group of nations elect to challenge a LCFS under international law, they are most likely to succeed in defeating it. However inconvenient this might be, international law precedents suggest we must take the LCFS off the table.

By the way, in every successful developed nation pollution reduction precedent, distributors (as opposed to manufacturers) have ultimately been the parties obliged to control polution precursors in their supply chain. (E.g. getting lead out of gasoline and paint sulphur out of diesel, PCBs out of electriciy distribution, ODSs out of refrogerant chemicals and refrigeration equipment, etc.) There is no pollution or sustained CO2 reduction precedent–not one–across the entire developed world and going back to 1962, in which a major pollution reduction target has been achieved in the absence of regulation that controls pollution precursor content where the obligated parties are distributors.

There is not one precedent in which a pollution tax has been successful without distributor regulations. There are many precedents in which regulating pollution precursor content at the point of distribution has been most efficient and effective in the absence of any pricing get mechanism. This is as true in California’s GHG policy context as it has been for the entire environmental regulatory history that precedes it.

It is, therefore, disingenuous to describe the pricing mechanism as the primary and most efficient control measure and distributor regulation as secondary/complementary, let alone a source of market inefficiency. History clearly shows the opposite is true.

Market participants had to suppl new fuel formulations as well as new automobile technologies to enable us to achieve the objective of getting lead out of gasoline. In Canada, we regulated lead content in gasoline sales at the point of distribution and got the lead out in 8 years, over a period in which the real pump price for gasoline fell 12%.

The US added cap & trade ON TOP of (not in stead of) a similar distributor regulation. The US got the lead out in 12 years, also while US retail prices fell. The purpose of the US cap & trade rule was trade protectionism, and it was effective. Over the lead phase out period, US refining capacity grew 25% and Canadian capaciy shrank 15%. The US cap and trade rule was added on top of the performance standard to achieve this shift of investment capital into the US from foreign suppliers of unleaded fuel, and it succeeded. Every US cap and trade rule has always been on top of, not instead of, performance standard regulotions. And every such US attempt at trade protectionism has been successful, to date.

At the same time Canada & US used performance standards to limit lead content in the products distributors sold, the European nations adopted a lead differential tax to get the lead out. The EU took 26 years (more than 3 times as long as Canada took) to get the lead out of retail petrol sales, in spite of a large, lead-tax-driven retail petrol price increase. (NOTE that distributors always adust wholesale prices to move around the impact of new taxes. So a new tax on one fuel does not translate into an equivalent retail price increase on that fuel. The target fuel typically gets a a smaller retail price increase, and the retail prices of other, greener products go up too.)

In fact, the EU did not get the lead out until 6 years after abandoning the lesd differential tax measure and adopting the same performance standard regulation that Canada had adopted more than 20 years earlier. EU refineries also lost US market share to US refineries due to the trade protectionist nature and goal of US cap and trade.

Comments are closed.