The way forward for BC

British Columbia’s carbon tax has been at the forefront of carbon pricing policy in Canada since 2008. But now that other provinces are catching up, what’s next for BC? The province’s Climate Leadership Team has been working on potential next steps in BC’s climate policy. In the run-up to the Paris meetings, they are close to releasing their recommendations. One design issue to keep an eye on: How policy design addresses competitiveness concerns.

Defining competitiveness pressures

Since carbon policy across North America remains uneven, competitiveness pressures from carbon pricing is a key issue that any new policy proposal will have to consider. What is the nature of carbon competitiveness pressures for BC? Ecofiscal’s latest report sheds some light.

Carbon competitiveness is all about how different carbon prices in different jurisdictions create advantages and disadvantages for specific industries. As part of the new report, we estimate how much of the BC economy is exposed to competitiveness pressures. Effectively, this means identifying the industries that both 1) produce more GHGs (relative to their output) and 2) compete with firms from outside their province.

This approach makes it possible to identify industries that may require short-term assistance to help insulate them from the competitiveness impacts, while also creating incentives for them to improve their emissions performance. Across Canada, only about 5% of the economy is potentially vulnerable to competitiveness pressures. In BC, it’s more like 2%.

Identifying carbon competitiveness pressures in BC

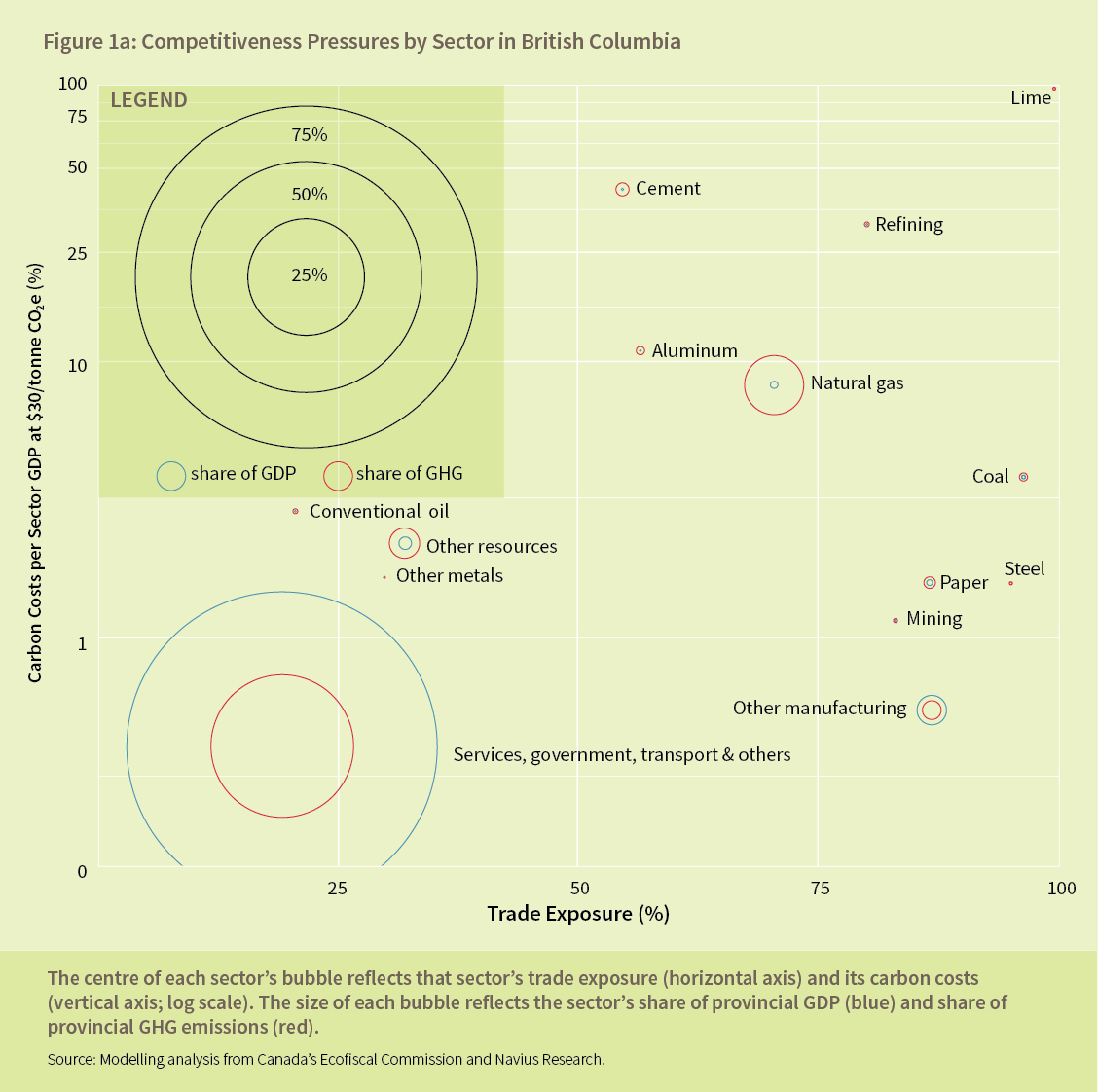

The graph below is taken from the report and illustrates how specific sectors in BC are more or less exposed to pressures created by carbon pricing. Each sector is plotted showing its carbon costs on the vertical axis and its trade exposure on the horizontal axis. The farther a sector is positioned toward the upper right-hand corner of the figure, the more vulnerable it is to these two competitiveness pressures. The size of the bubble representing each sector shows its contribution to provincial GHG emissions (red) and GDP (blue). A larger bubble indicates a larger share.

What’s different about BC’s carbon competitiveness?

A few key issues stand out for BC.

- The cement sector appears to be one of the most exposed to competitiveness pressures, with particularly emissions-intensive production. This is consistent with BC’s decision to provide transitional support to this sector. Still, note that much of the GHG emissions produced in cement manufacturing come from “process emissions”— those produced during the chemical processes involved in cement production—rather than from the combustion of fossil fuels. Such process emissions are not currently covered by the province’s carbon tax.

- Refining is the other particularly emissions-intensive sector in B.C., though it is quite small, contributing less than 0.1% of provincial GDP and less than 1% of provincial GHG emissions.

- The natural gas sector is also exposed to competitiveness pressures, and makes up about 2% of provincial GDP. Yet the sector is only one-fifth as emissions intensive as the cement sector on average (though not shown in the figure, emissions intensity varies substantially across different natural gas projects, from conventional fields to shale and tight gas plays).

- Finally, liquid natural gas (LNG) facilities are not included in the analysis, as no projects are currently completed. Should the sector grow, however, it would likely be quite exposed to competitiveness pressures. Interactions with B.C.’s evolving tax treatment of LNG facilities would also play an important role in determining the sector’s overall competitiveness.

The way forward for BC

Competitiveness pressures shouldn’t be a reason not to move forward with more aggressive carbon pricing policy. Instead, identifying these pressures can help policy-makers design policies to address competitiveness concerns while also moving forward with comprehensive, stringent carbon pricing. As our report suggests, the way to do is, to provide targeted, temporary, and transparent support to vulnerable sectors, while still including them under the carbon pricing policy.

Comments are closed.