How You Do that Voodoo: Modelling carbon policy

Every so often, the research team here at Ecofiscal will venture out into the blogosphere. Sometimes, we’ll share additional analysis that didn’t quite make it to a report. Sometimes, we’ll elaborate on more technical ideas or data that the main reports consider only briefly. And sometimes, we’ll just take the opportunity to be unabashedly #wonkish. So be warned: here be graphs.

If you spend enough time with economic modellers, sooner or later you’ll hear that “all models are wrong… but some are useful.” The point is that—by definition—models are simplified versions of the real world. They are bound by assumptions. And we have to keep these simplifications in mind when interpreting results. The point of modelling, in the end, is to generate insights about the interactions between policy and the economy, not to see the future in our numerical crystal ball.

In The Way Forward, the Ecofiscal Commission uses modelling to explore the economic benefits of carbon pricing relative to regulatory approaches. And indeed, our modelling is both wrong and useful in several ways.

Strengths and weaknesses

Different models have strengths and weaknesses — it’s all about how you use them.

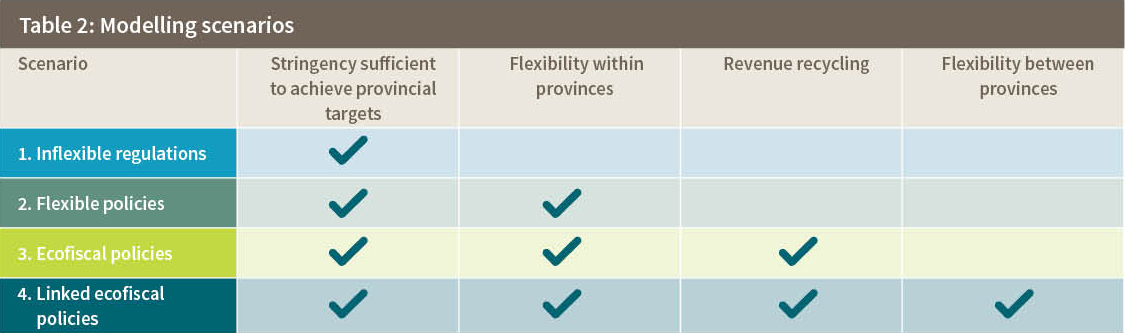

In this case, we use a computable general equilibrium (CGE) model (yes, I know… a mouthful). CGE models aren’t great at predicting the future. But they are pretty good at comparing impacts between different policy options. And that’s why we chose the modelling scenarios as per the table below.

Each scenario changes exactly one thing from the previous, allowing us to isolate the implications of this change. The scenarios are useful because they allow us to break down the different economic benefits of carbon pricing relative to regulations.

We also do something a little unconventional. We deliberately didn’t include a scenario in which no new policy is implemented at all. We made this choice for both policy and methodological reasons. First, we firmly believe that business as usual just isn’t a viable option moving forward. The world is moving. The question for Canada is not whether to implement policy, but how to do so.

Second, one of the drawbacks of this model is that it simply can’t capture the costs of inaction. In other words, it doesn’t consider the rising costs of climate change impacts, or market access risks or missed opportunities in international clean tech markets. The more useful approach, therefore, is to compare between different policy approaches that lower greenhouse gas emissions: in all of our scenarios, each province implements policy sufficient to achieve their own 2020 target.

Imperfect, but illustrative

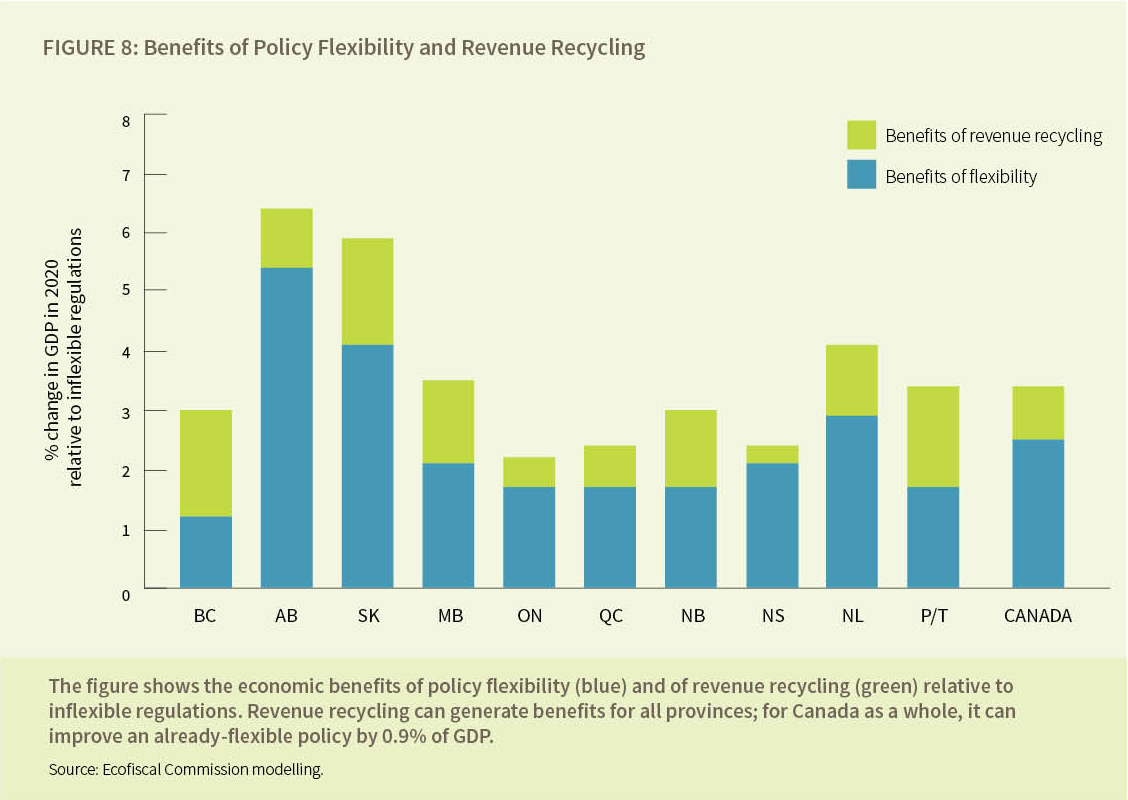

The first three scenarios illustrate the core benefits of ecofiscal policies. The difference between the first two scenarios shows the benefits of flexibility, and the difference between the second two shows the benefits of recycling revenue from carbon pricing policies back into the economy, as per the figure below.

Just like the model itself, the scenarios aren’t perfect reflections of policy—but they are useful.

To represent inflexible regulations, our scenario assumes that each sector would have to contribute the same share of provincial emissions reductions, irrespective of how expensive those emissions reductions might be. From an economic standpoint (or just a practical one) this is the worst possible policy you can imagine. No government is likely to implement such blunt regulations.

Yet at the same time, the scenario highlights the real challenges with sector-by-sector regulations. If not the same level of reductions, exactly how should government divvy up reductions between sectors? The problem is that government simply doesn’t know enough about the costs of emissions reductions in different sectors to do so efficiently. And relying on industry knowledge opens the door to endless negotiation and lobbying. Allowing the market forces to drive the lowest cost reductions is an absolutely sensible alternative. Even the smartest, most flexible regulations will have trouble being as flexible (and efficient) as a carbon pricing policy.

The biggest limitation to the modelling in terms of revenue recycling is that it only considers one approach, in this case, reductions in personal income taxes. In reality, a range of other recycling approaches—reductions in corporate income taxes, investment in critical infrastructure, investments in low-carbon technology, reducing government debt, or even direct dividends back to citizens—are all viable policy options. Stay tuned on this front: future Ecofiscal work will look at these options in detail.

Sometimes, it’s the counterintuitive results that are the most interesting

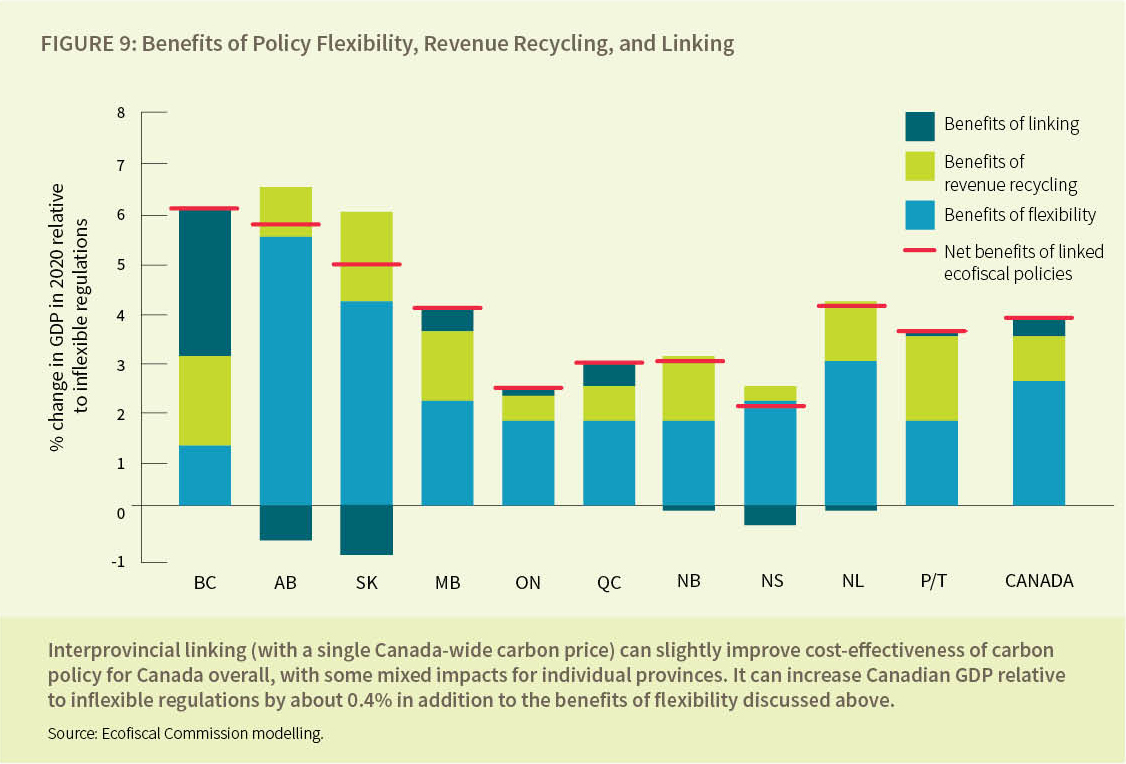

The final modelling scenario takes provincial policy a step further. Like the previous scenarios, it assumes that each province implements its own carbon pricing policy sufficient to achieve each provincial target. Unlike the previous scenarios, however, it also assumes that each of these systems are linked together.

Think of it this way: linking systems means that we’re finding the cheapest way to lower emissions not just within each province, but across the country as a whole. Provinces with cheaper emissions reductions take more action, and those with more expensive reductions do less, thanks to buying and selling permits between provinces. The implication is a common carbon price across Canada. Adding this flexibility between provinces further improves the economic performance of the policy overall.

Interestingly, these benefits are relatively small compared to the benefits of flexibility and of revenue recycling. This is largely a function of the provincial targets being at least comparable. The carbon prices required for each province to achieve their own targets alone actually aren’t that disparate, with a few exceptions. As a result, linking leads only to modest benefits nationally.

The other benefit of harmonization, not captured in the model, is potentially lower administrative costs for firms that operate across Canada. How much would this increase the overall economic benefit of linked policies? Hard to say for sure, but the core benefits of linkage the gains that come from are minimizing the costs of abatement. In many ways firms, are already used to a patchwork of policies across provinces.

But there’s something else going on here too. You’ll notice that not all provinces come out ahead. Why are provinces like Alberta, Saskatchewan, and Nova Scotia seeing losses from linkage? Shouldn’t the benefits of trade mean that flexibility improves outcomes for all provinces?

Digging into the model results suggests that several inter-related factors are at work. In a general equilibrium model, everything affects everything else. It’s not just the costs of emissions reductions that matter, but also the ripple effects of policy throughout the economy, including households, various industrial sectors, and even trade. Let’s unpack some of those factors.

GDP Impacts vs Welfare Impacts

First, remember that we’re looking at GDP impacts here, an imperfect measure of costs and benefits. Linkage means that some provinces increase their emissions reductions. Alberta and Nova Scotia for example, have relatively shallow targets and, therefore, greater availability of additional low cost reductions. But for these provinces, linkage means a higher carbon price with more reductions. And in some cases, those reductions would come from industry reducing output (i.e., producing fewer goods).

But provincial welfare (an overall measure of the prosperity of Canadians in each province, and a better measure of economic efficiency than GDP) doesn’t necessarily decrease in the same way, given that emitters are being paid to reduce their additional emissions in the linked scenario. In fact, in terms of welfare, as a key permit-sellers, Alberta and Nova Scotia are some of the biggest beneficiaries of linkage in our scenario.

Revenue Recycling Impacts

Second, the magnitude of revenue recycling is also affected by linkage. When emitters in a given province reduce fewer emissions and instead buy more permits from other provinces, the revenue available to reduce taxes in that province decreases, reducing the benefits of linkage.

Trade Impacts

Finally, linking changes the price of carbon in different provinces in different ways, with implications for interprovincial trade. It lowers the price for provinces that buy permits, and raises it for those that sell them. That means that firms in some provinces actually experienced competitive advantage in the unlinked scenario given differential carbon prices. Linkage levels the playing field leading to improvements for some, but reduced advantage for others.

Complicated? Yes. But also illustrative. Even though linkage generally makes sense economically, it often faces opposition for other reasons. For permit buyers, purchases of emissions reductions from outside of the province can be perceived as wealth transfers. For permit sellers, linking with other provinces means a higher price of carbon, and as a result, higher energy costs.

The side of the equation—net buyer or seller—on which a province lands depends very much on the level of its policy ambition. We’ve assumed that each province will implement policy to achieve it’s own 2020 target, but this is far from given.

Unpacking the modelling analysis can help us to understand these dynamics. It’s the structure of a model, after all, that is both its strength and weakness. By formalizing assumptions—even if they are imperfect ones— we can compare policies in an internally consistent, controlled way. By acknowledging the limits of a model, we can parse out meaningful policy insight, and follow surprising results toward deeper understanding. See? Modelling isn’t voodoo after all.

Comments are closed.