Is Green (Tech) the new Black(berry)? Environmental Goods and Canada’s Competitiveness

by Richard Lipsey and Céline Bak

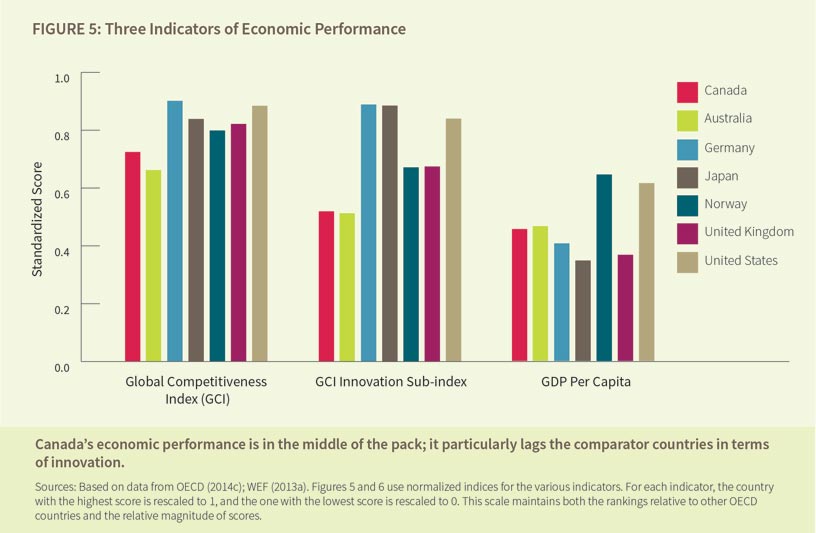

What will it take to remain competitive in a rapidly changing global economy? There are likely many answers to that question, but one is certain: innovation. It is a key factor of success in the world’s most competitive economies. This is a challenge for Canada. We currently fall near the bottom of the stack of competing countries. Top-ranking nations such as Germany and the US far outpace us.

One of the places where we seem to be particularly vulnerable is in the innovation of “environmental goods”—an important and growing part of our national economy, according to the Government of Canada. It’s a broad category, including goods for air pollution control, cleaner and more efficient technologies and products, renewable energy equipment, management of solid and hazardous waste, goods for clean up or remediation of soil and water, and products for waste water management and potable water treatment.

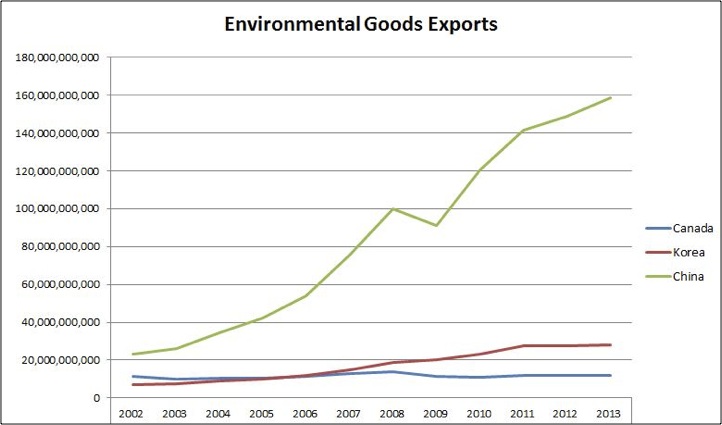

According to a recent study by Analytica Advisors, China is leading the pack in this field, particularly in respect to clean energy. The country’s exports of renewable energy technology grew to nearly $120 billion last year, up from under $20 billion in 2003. South Korea is also becoming a major innovator in this field, with export sales of environmental goods growing at an annual rate of 13%. By comparison, Canada’s exports of environmental goods have shown no growth over the last decade. This poor export performance reflects Canada’s virtual absence in this global industry; of the 65 publicly traded companies on the Cleantech Index, only one hails from Canada. With over 800 companies operating in Canada in the Environmental Goods sector, investing $1.1 billion in R&D and employing 41,000 people there is no shortage of innovative solutions and entrepreneurial impetus. What is lacking is scale.

However, Canada’s competitiveness in this area is tricky to measure precisely, primarily because, as evidenced by a recent Bank of Canada Report, we do not actively track exports under the category of “environmental goods.” Perhaps the old saying is true: what doesn’t get measured, doesn’t get managed. In any case, there are strong indications that Environmental Goods will play an increasingly important role in the global economy, evidenced not only by China’s massive investment but also by current negotiations by members of the WTO (including Canada) to reduce or eliminate tariffs on these goods and services.

However, Canada’s competitiveness in this area is tricky to measure precisely, primarily because, as evidenced by a recent Bank of Canada Report, we do not actively track exports under the category of “environmental goods.” Perhaps the old saying is true: what doesn’t get measured, doesn’t get managed. In any case, there are strong indications that Environmental Goods will play an increasingly important role in the global economy, evidenced not only by China’s massive investment but also by current negotiations by members of the WTO (including Canada) to reduce or eliminate tariffs on these goods and services.

All of this makes good sense in the context of an emerging 21st century economy trending toward a greater emphasis on efficiency and sustainability, particularly as the impacts of climate change on nations and economies becomes clearer. As Shawn McCarthy notes in his article regarding Analytica’s analysis: “Chinese policy makers believe the country will incur huge costs if the world doesn’t respond to the climate threat, and that it can gain commercial advantage if the world does act.”

So where does that leave Canada? Ostensibly, with the opportunity to flex our own innovation muscles in the realm of Environmental Goods to ensure we do not get left behind. Certainly we have the capacity. What will it take for us to catch up and, more importantly, get ahead of the curve as the international market for Environmental Goods expands and evolves?

One key is to examine our fiscal systems across the country. Right now, these structures discourage the innovation of Environmental Goods, because pollution and environmental degradation are free. Ecofiscal policies help address this problem by harnessing the power of the market to make environmental solutions, and the innovation of Environmental Goods, more economically rewarding.

Once upon a time economists used to think that innovation was a random process undergone by possessed guys in sheds. Now we know better. Innovation grows out of a response to economic incentives. We now have the opportunity to recalibrate our fiscal systems to provide incentives for the kind of innovation that may prove most valuable in a competitive global economy, while discouraging the kind of environmental damage that the world’s largest economies are actively trying to prevent.

Environmental Goods may not sound sexy. They probably won’t drive line-ups at big box stores this Christmas. But chances are, they will have a profound impact on the competitive landscape of the next decade. Will Canada be ready? Getting the right policies in place now would be a very wise start.

About the Authors

Richard Lipsey is a Professor Emeritus at Simon Fraser University in the Department of Economics, as well as a Commissioner of Canada’s Ecofiscal Commission.

Richard Lipsey is a Professor Emeritus at Simon Fraser University in the Department of Economics, as well as a Commissioner of Canada’s Ecofiscal Commission.

Céline Bak is the President of Analytica Advisors.

2 comments

I very much agree with Analytica Advisors on this issue… Project financing is and remains a major obstacle for Canada’s clean technology industry. Canadian Innovators are no less innovative than their global counterparts – perhaps even more so. What keeps them from attaining global success beyond just the innovation is the ability to deploy their technologies at scale internationally. To get beyond the demonstration to full commercial global deployment. There are tools in the tool box (SDTC, EDC, Capital markets…) but they may not be sufficient if we want to have an impact globally. Its complex but therein lies the opportunity to be innovative… competing at scale is the game.

Not really fair to look at China’s exports as predictive of innovation in green tech. That export was led preponderously by cheap PV solar at well below cost of production. The PV field internationally the last few years has been a field largely of corpses. The state in China dtermined they would not lose a price war with the US and didn’t. Now 9 of top 10 PV manufacturers are Chinese. There are no real winners in that field.

What Canada has that China does need is our nuclear. The CANDU design works well as a portion of the vast fleet they are now undertaking. But where is this countries support now for the most significant GHG emissions reduction technology Canada has ever produced?

Comments are closed.