Do OBAs make sense for the electricity sector?

Governments in Canada are using Output-Based Allocations (OBAs) to address leakage in emissions-intensive and trade-exposed (EITE) sectors. As I discuss here, there are strong arguments for using OBAs in EITE sectors. But governments are also looking at using them in the electricity sector, which is typically not considered EITE. In this blog I discuss whether or not that makes sense. The answer? Maybe.

A primer on leakage and OBAs

For EITE sectors like cement and oil and gas, putting a price on carbon can make them less competitive than their international peers. The result can be “leakage.” Leakage is when increased production in jurisdictions without carbon pricing — and the emissions that come with it — displaces domestic production and emissions. Leakage undermines the effectiveness of carbon pricing. Emissions aren’t reduced, they’re just shifted. So we lose economic activity for no net environmental benefit.

OBAs are a way to address leakage. Let’s quickly discuss what OBAs do (for a walk-through of how they do it, see here).

Under OBAs, firms basically pay the full carbon price only on emissions that exceed a given benchmark, paying nothing on the rest. This means they pay a lot at the margin, and very little on average.

This type of set-up helps avoid leakage while maintaining an incentive to reduce emissions. If a firm produces a tonne of GHG emissions above its benchmark, it pays the full carbon price on it. This creates an incentive for firms to find efficiencies and reduce emissions where they can. But on average, they pay much less than the full price, which allows them to remain internationally competitive. This provides a way of pricing carbon and reducing emissions in sectors where it would otherwise just lead to leakage. OBAs act as a useful stop-gap while the rest of the world catches up on carbon pricing (again, for more detail, see here).

EITE sectors – who’s in and who’s out

The key thing for OBAs is that they are only needed for sectors that are genuinely EITE — that is, emissions-intensive and trade-exposed.

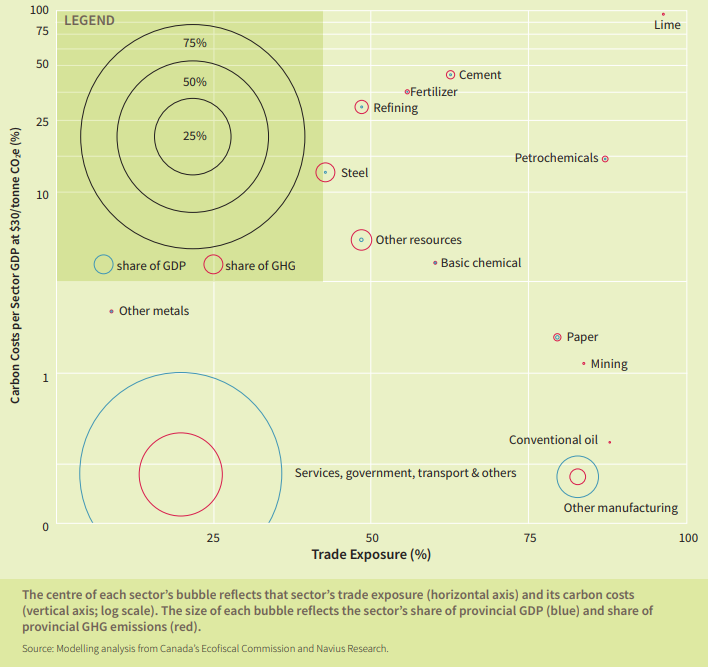

So which sectors are EITE? The Ecofiscal Commission has done some analysis on this for four different Canadian provinces. The figure below shows the results for Ontario. Emissions intensity (EI) is on the left axis and trade-exposure (TE) on the right, so the closer a sector gets to the top-right corner, the more EITE it is.

Clearly, not all sectors are EITE. This is why it’s really important to get the sectoral targeting of EITE right. A lot of sectors will say they need OBAs, but not all of them actually do.

Going electric

Our analysis didn’t consider the electricity sector directly (we included electricity emissions as “indirect costs” for sectors consuming electricity), so we’ll take a look at that here.

In places that use lots of coal- and gas-fired electricity (instead of hydro, nuclear or renewables), electricity will definitely be emissions-intensive. However, in Canada, it is not trade-exposed. Sure, there are grid interties with the U.S., but the trade volumes are actually pretty low. Nationally, we produce around 98% of what we consume, and export around 10% of what we produce.

Using available data from StatsCan and NEB, we can calculate the electricity sector’s trade-intensity the same way we do in the figure above. (This is also what the California Air Resources Board uses).

Trade-intensity = [Exports + Imports] / [Imports + Generation]

Between 2012 and 2015, electricity’s trade-exposure averages 10% — less than the services, government and transport sectors. So, electricity doesn’t appear to count as an EITE sector. Yet Alberta, which uses an OBA system in its Carbon Competitiveness Incentive Regulation (CCIR), applies OBAs in its electricity sector. (The federal government is still assessing how it will approach carbon pricing in the sector). Why?

Alberta’s use of OBAs in the electricity sector

Before we look at the pros and cons of electricity sector OBAs, let’s understand what exactly Alberta is doing.

Alberta’s “output-based pricing” policy reduces the net carbon tax that electricity producers pay. Under the policy, producers only pay the carbon tax on their emissions that exceed a benchmark — the emissions intensity of an efficient natural gas-fired electricity plant. Electricity that is less emissions intensive than this benchmark gets credits for the difference that they can then turn around and sell. On the other hand, electricity that is more emissions intensive than the benchmark pays the carbon tax on the excess, buys credits to cover the difference, or some combination.

The result of all this is that a coal plant pays the carbon tax on about two thirds of its GHG emissions, while an efficient natural gas plant pays nothing. Renewable producers, on the other hand, get a net benefit: they generate credits under the output-based pricing system that they can sell to other electricity producers.

Alberta’s system helps maintain the price signal from carbon pricing while limiting the cost. Under the system, no producers pay the full cost of their GHG emissions. But the carbon costs that result still reflect the relative carbon intensity of different generation sources. (Importantly, this includes renewables. The fact that non-emitting renewable producers can opt-in to the system — instead of being disadvantaged by it — is a critical design feature.)

Giving electricity the OBA treatment has some advantages…

There is one big upside to applying OBAs to the electricity sector: it keeps the costs of electricity low.

Low electricity prices can be desirable for three reasons. The first is that high electricity prices are notoriously unpopular (witness the recent boiling rage over high electricity prices in Ontario). By keeping electricity prices low, governments can mitigate potential political opposition to carbon pricing.

The second reason is that many EITE sectors are large consumers of electricity. Paying the full carbon cost on their electricity inputs could undermine their competitiveness, leading to leakage. OBAs can help avoid this by keeping the price of electricity low (there are some alternatives to this scattershot-type approach, but they get complicated).

The third argument in favour of low electricity prices is that low prices support electrification, which will be key to decarbonizing Canada’s economy. When the price of electricity is low, factories, households and businesses will be more likely to transition from fossil fuels to electric alternatives (for example, getting an electric instead of a gas-fired boiler). Over the long-term (as a result of countless individual choices) this can help to facilitate a transition off fossil fuels, and help Canada reach its emissions goals. (Of course, carbon pricing also incentivizes electrification, but the transition may be slower to come about when long-term carbon prices are uncertain, as they currently are).

… But it also has drawbacks

The first disadvantage of including electricity in OBA systems is the flipside of keeping electricity costs low: it discourages conservation. The higher the price, the more steps individuals and firms will take to conserve it (for example, by getting a smart thermostat or switching to LED lighting). OBAs inhibit this effect by shielding consumers from electricity’s full carbon cost. Ideally, we should apply carbon pricing uniformly across all types of emissions. Not applying it in full to electricity distorts the price signal that carbon pricing provides.

Second, giving the sector the OBA treatment has an opportunity cost. As we discuss in our report Choose Wisely, there are lots of things provinces can do with their carbon pricing revenues, including building infrastructure, supporting further emissions reductions, or lowering other taxes. Choosing to give back a large portion of the carbon tax that electricity-producing firms pay means these funds aren’t available for other priorities.

Third, using OBAs in the sector creates a distortion that requires more policies. Alberta has a policy to phase out coal. But analysis presented in our report Supporting Carbon Pricing suggests that under full carbon pricing (i.e., with no OBAs), this phase-out would happen as the result of market forces alone, and would not require policy intervention. Similarly, the province has a program that provides rebates and incentives for the adoption of energy-saving technologies. But the incentive for their adoption would be stronger if households and businesses were paying the full carbon cost of electricity. To be fair, even with full carbon pricing there can be a strong case for energy efficiency programming. But having OBAs in the sector means these programs will have to work harder and cost more.

The takeaway

Overall, the story on OBAs in the electricity sector is a bit mixed. Some questions we can answer, while others aren’t quite so clear-cut:

- Is the electricity sector emissions-intensive and trade-exposed, and therefore suited to OBAs? No.

- Are there reasons to give it the OBA treatment anyway? Maybe.

- Does using OBAs in the electricity sector create as well as solve problems? Yes.

- Is the trade-off worth it? Unclear.

The last question is the key one. This blog has laid out the pros and cons. To determine whether using OBAs in the electricity sector makes sense, governments in Canada need to weigh the benefits of lower electricity prices against the cost of reduced conservation incentives and the opportunity cost of providing OBAs. They also need to evaluate the costs and benefits of the other policies that become necessary as policy-makers try to solve the problems that OBAs create. After that, it’s a question of priorities.

Comments are closed.