Cost Control: The cost-effectiveness of a Clean Fuel Standard

by Dale Beugin and Nic Rivers

The most significant greenhouse gas policy you’ve probably never heard of—the federal Clean Fuel Standard (CFS)—is being developed this winter and throughout 2018. The federal government is looking for substantial emissions reductions from the policy. But a key question is how much will those emissions reductions cost? Could other policies achieve the same outcomes more cost-effectively? New analysis from Nic Rivers and Randy Wigle sheds some light.

Wait, what’s a Clean Fuel Standard, again?

Although details are not yet available, the basics of the CFS are likely to follow the template laid out by British Columbia and California in their Low Carbon Fuel Standards. It will require that fuel suppliers reduce the greenhouse gas intensity of the fuels they sell by a given amount and by a given deadline. For example, the regulation could require that fuel suppliers cut the overall greenhouse gas intensity of their fuel mix by 10% by 2030.

The policy will likely include a tradable credit system, such that the target will be achieved in aggregate, rather than by individual fuel suppliers. That flexibility for individual firms will keep overall costs down. Fuel suppliers can meet the target by substituting renewable fuels, such as ethanol and biodiesel, for fossil-based fuels. But the policy might (depending on design details) also allow encourage investments in electric vehicles or hydrogen by creating credits for those actions, similar to British Columbia’s Low Carbon Fuel Standard.

Finally, the federal CFS will differ from the BC and California low carbon fuel standards in coverage. It will cover not just transportation fuels, but also fuels used by industry and in buildings. (Nevertheless, the analysis here focuses on the transportation sector, alone).

Benefits of a Clean Fuel Standard

What’s to like about a potential Clean Fuel Standard?

First, it will change the fuel mix, and as a result, likely reduce emissions. Fuel suppliers will be subject to clear regulatory requirements to use different fuels. Environment and Climate Change Canada expect the policy to deliver at least 30 Mt of GHG emissions reductions by 2030. That’s a significant chunk of the gap to our 2030 target.

Second, it might be politically palatable. Some analysts, including SFU’s Mark Jaccard, argue that that consumers favour this type of regulatory approach over a price-based approach to reducing emissions because the costs of the policy are implicit rather than explicit.

Costs of a Clean Fuel Standard

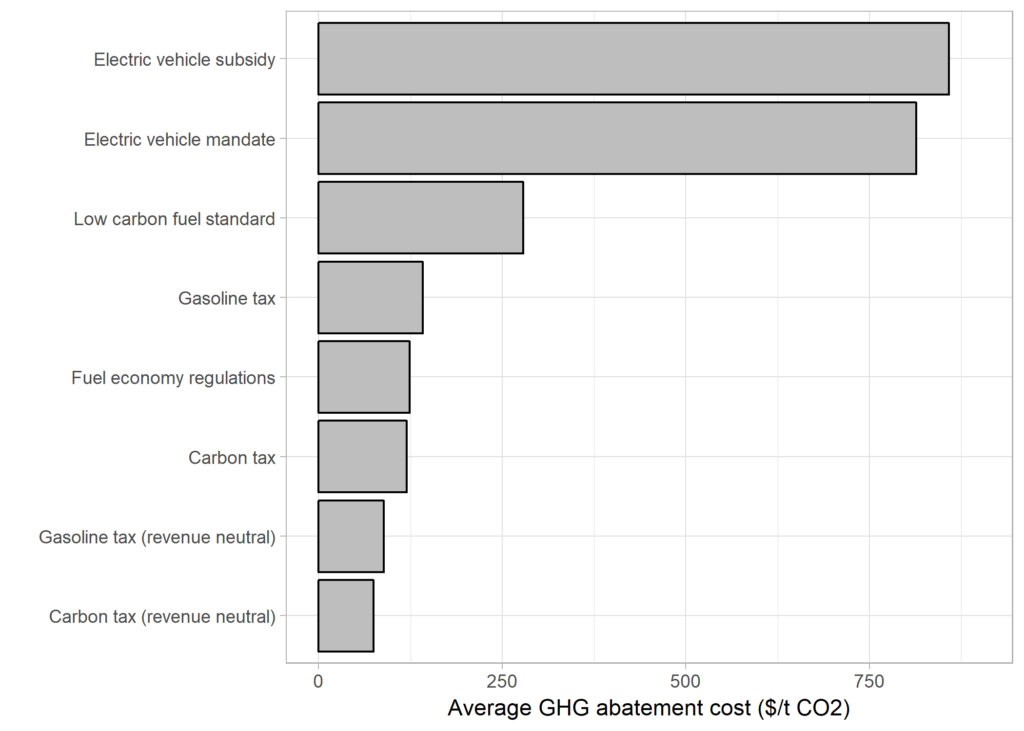

Still, even hidden costs should be considered carefully. This policy is likely to be considerably more expensive than a carbon price-based approach. Economic modelling from the Rivers and Wigle working paper estimates that achieving a 10% reduction in emissions using a low carbon fuel standard alone would cost around four times as much as achieving the same reduction using a carbon tax.

Two main factors drive higher costs.

First, a Clean Fuel Standard sends slightly mixed signals. By requiring more lower-carbon fuels, it essentially forces fuel suppliers to “cross-subsidize” lower carbon fuels from revenue from higher-carbon fuels. In other words, the policy increases the costs of higher-carbon fuels (e.g., gasoline) and lowers the costs of lower-carbon fuels (e.g., ethanol). But those lower-carbon fuels aren’t typically zero-carbon. As a result, the policy effectively subsidizes a portion of fuel use—exactly what we want to avoid in order to cut emissions.

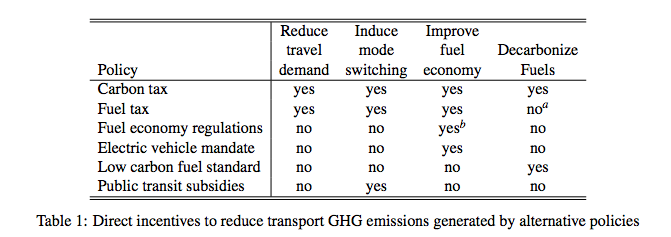

Second, the policy doesn’t create the same incentives across of a full range of emissions-reducing activities. For example, it doesn’t provide much incentive for consumers to improve the fuel efficiency of their vehicle (or buy an electric vehicle), or to reduce travel demand.

More than the sum of its parts?

Implementing a Clean Fuel Standard as part of a package of policy instruments might change how the costs stack up. Indeed the federal government is considering exactly that approach. It has implemented regulations governing the greenhouse gas intensity of new vehicles, is implementing a carbon price (along with provinces), and plans to develop a strategy for increasing the roll out of electric vehicles.

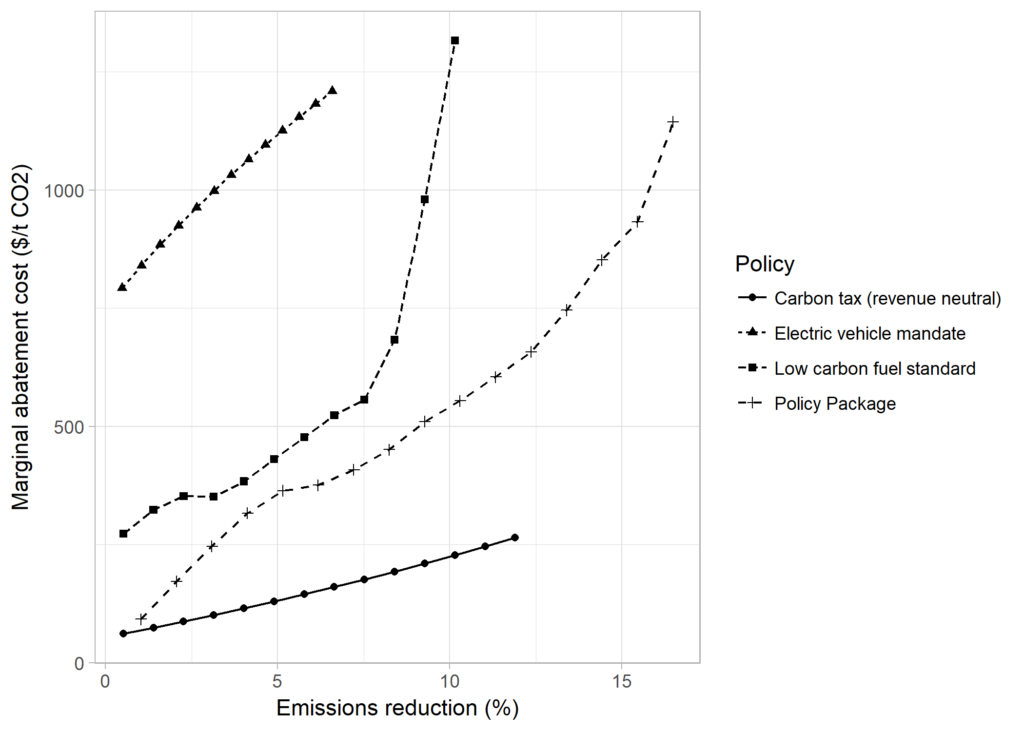

Together, these other policies help to plug some of the emissions abatement gaps left by the Clean Fuel Standard, and—if carefully chosen— should help to reduce emissions at a relatively lower cost. Again, the new analysis provides some insight. Figure 3 below shows the incremental costs (vertical axis) of achieving different levels of emissions reductions (horizontal axis). As the figure illustrates, relying on a well-designed package of policies can achieve emissions reductions at much lower cost than a single regulation alone. Yet a package of policies — even one designed to keep costs as low as possible— is still more expensive than an equivalent carbon price, alone.

Flexibility is key for low cost abatement

The logic is clear: policies that create similar incentives across all possible ways to reduce GHG emissions—whether improving the carbon intensities of fuel, switching to electric vehicles, using alternative modes of transit, or simply driving less—cost less than policies that focus on a single mode of emissions reductions. Carbon pricing automatically creates these incentives. A package of flexible regulations—including a Clean Fuel Standard— can do better than non-pricing policies alone, but only if both individual policies are well-designed and the package as a whole is coherent.

6 comments

Noting an error here: “Second, the policy doesn’t create the same incentives across of a full range of emissions-reducing activities. For example, it doesn’t provide much incentive for consumers to […] buy an electric vehicle…

LCFS policies actually do reward electric mobility if they are designed well – in CA, an EV owner receives (as a requirement) a rebate from their utility for the value of credits sold into the LCFS by the utility. OR has the same approach, and ECCC will be assessing how to build this functionality into the Clean Fuel Standard. Modelling done for the Canadian CFS shows that a rebate could be worth $500/yr to an EV owner (ON was assumed as the location).

The core premise of this piece is also misses the acknowledged shortcoming of carbon pricing to get past the market failures in fuels’ distribution. In short, carbon pricing doesn’t work to address the 95% of fossil-based motive energy (liquid fuels).

– in ON/QC cap & trade, refiners’ wholesale racks ‘levelize’ the pricing for prices of fuels – notwithstanding that the fuels have different carbon intensities, and that allowance were required on only some of the fuels.

– in BC’s carbon tax, very low carbon biofuels are taxed at the same rate as gasoline and diesel

In the latter case, the province acknowledges that this treatment is contrary to its carbon reduction objectives but that the administration of its fuels tax structure doesn’t work for the carbon tax. Arguably this is a policy failure more than it is a market failure.

These are two examples of the ineffectiveness of carbon pricing on fuels.

Thanks for the comments, Ian. Yes, some fair points here about design of carbon pricing. We blogged about some of them here. https://ecofiscal.ca/2016/10/05/disincentives-design-carbon-pricing-biofuels-canada/ My first choice is to fix a policy failure by adjusting design, though, rather than layering other policies on top.

With respect to your bretheren of economists, energy is not dependent on anything or anyone. To the contrary, life on this planet is dependent on energy. A fuel (energy) standard must be based on the amount of energy being provided, not by cost impact and not by human policy preference.

Fossil fuels are carbon based, hence the source of carbon dioxide and methane GHGs. Joules and 4.2 calories are equal units of energy, just as 1000 gigajoules equals 1 petajoules. Dollars, euros, pesos are monetary units; unlike energy units, monetary units are not consistent simply because they do not obey the laws of energy. Carbon taxation, or carbon pricing, subjected to inconsistency is equal to inviting disaster. A gigajoule of natural gas generates 56.1 kg of CO2 and a gigajoule of diesel generates 74.1 kg of CO2; 1 GJ diesel is at least twice the costly of 1 GJ of natural gas.

Food companies now label their products identifying the amount of energy and corresponding nutrition being provided. People understand food labels. A two liter container of ice cream has 160 calories of energy, a 200 gram box of wheat crackers contains 90 calories, and a two liter bottle of water contains 0 calories; yet all can be acquired for the same quantity of monetary units. People understand energy labels; they know that food loss wastes generate CO2 and CH4 emissions.

GHGs recovered and recycled for reuse which do not attract carbon tax credits are a policy FAILURE.

Policy makers need to abide the laws of energy; CH4 is 30 times more dangerous than CO2.

A major fault flowing through all of the Rivers/ Beguin/ Bataille/ Sawyer analysis is they simply assume that the most efficient way to incent energy suppliers to phase out fossil fuel content in the energy supply chain is to tax energy at the point of end use. This assumption is hard-wired into the modelling and not supportable by real evidence. Every real-life precedent actually proves that taxing a the point of end use is a most inefficient way to get changes in upstream energy product and service pollution precursor content.

These unrealistoc analyses ignore, among other things, 30+ years of research that shows that developed nation energy users reveal a very high internal discount rate–20% to 40%–in their energy purchase decisions. So point-of-end use energy price increases have to be disproportionately large before most consumers make the capital investments required to shift to low-GHG and more efficient options. This is why most EU nations’more significant tax increases over the last 15 years have been on vehicle purchases and annual vehicle registrations, not retail fuel sales–where the taxes reflects combination of vehicle fuel efficiency, weight and kms of use. At this time, Norway collects 2.5 times more revenues from taxes on vehicle sales and registrations than they collect at the gas pumps. Denmark, Finland, France and Sweden are not there yet, but on their way. The models designed by Rivers et al. can’t even replicate the reality that behaviour changes way faster at lower tax costs if the tax is applied upstream on what is or feels more like a capital expenditure, and not on retail energy sales.

Also, the point made above is important. These modellers always assume that point-of-end use carbon taxes convert directly into retail price signals –however insignificant those signals might be to consumers who reveal 20% to 40% internal discount rates–on the products/services that the taxman intends. But any review of Canadian and other nation’s fuel price and tax data back to 1972 shows a very different story. Suppliers always adjust wholesale prices to shift tax burden across products, customer classes and between regions to maximize sales margins. There has been no correlation between change in fixed (as opposed to %-denominated) nominal tax rate and retail price, anywhere in the deveoped world since before 1980. Th imaginary correlation between change in tax rate and change in price occurs only in these unrealistic models.

In 1978, Canada, the US, the European Economic Community (EEC)? and Japan all pledged to get lead out of gasoline by 1990. Canada imposed the gasoline equivalent of a Clean Fuel Standard on fuel suppliers (not end-users). The Canadian rule said “obligated parties can comply jointly” (there was a privately operated lead credit market). Canadian gasoline suppliers got the lead out ahead of schedule–mostly by 1988 years–while real retail gasoline prices fell 12%. The European nations elected a “lead differential tax”, instead. In 1999–after 19 years of the lead tax and when the retail price premium for leaded petrol ranged from USD$0.40 to $1.10/litre (depending on the county)–leaded petrol still dominated EU retail petrol sales. In 1999, EU nations agreed to phase out the lead tax and phase in a regulation that looked much like Canada’s 1978 unleaded gasoline supply regulation. They didn’t get the lead out until 2006, 18 years after Canada. Similar stories apply to the sulphur (in diesel) and Ozone Depleting Substance phase outs.

In every successful pollution reduction precedent we got pollution precursors out of our supply chains…by ordering reductions in pollution precursors in our supply chains (surprise, surprise)! But the Rivers/Beguin/Sawyer/Bataile models can’t replicate any of this history. Their findings reflect assumptions that are hard-wired into their models that are inconsistent with reality.

It is time to move on from these bogus models. Let’s have a fulsome debate about CFS design. In effective, efficient regulations governmenrs neother set peice or prescribe solutions. They order reductions in pollution precursor content, not reductions in end use emssions. Suppliers–not end-users–are the oblogated parties and the standards treat domestoclly produced energy amd imports ecactly the same way without introducing any form of tariff.

I think there should be one standard for all energy sales portfolios, not different standards foe different fuels. A, say, 3% per year reduction in fossil C content per Gj (and MWh-equivalent) energy sales, on a sales portfolio average basis. Same reduction rate requirement no matter what mix of energy products make up the obligated parties’ portfolios. (There can be a declining C/Gj floor below which incremental cuts are not required but marketable credits can be earned.) No more than 3 alternative compliance options. Leave it to the suppliers to find different ways to shift the C content profile of their energy (and building product) sales portfolios. Every time we regulated this way in the past, the suppliers beat the schedule and retail prices went down or up only a little. And dump the modelling that can’t replicate this.

Thanks for the comment, Aldyen. Briefly:

1. To be clear, the types of models used here and in our other analyses *are* parameterized based on empirical evidence regarding how people and businesses respond to prices. They certainly do not ignore revealed preferences and high implied discount rates in consumer behaviour. Nic and Randy’s paper, which underpins analysis in this blog, goes into extensive detail about how they’ve tried to get good estimates for these “elasticities.” See: http://www.lcerpa.org/public/papers/LCERPA_2018_1.pdf

2. Besides: regulatory policies don’t automatically overcome any challenges from “inelastic” price response. Those price responses imply high costs, irrespective of which policy is used to drive those changes.

3. Your point about technological change is more fair: firms likely will find ways to reduce emissions at lower cost than the model expects. But that is true of carbon pricing *and* regulations (though only for the latter if they are flexible). See: https://ecofiscal.ca/2016/10/26/carbon-pricing-innovation/

4. There is plenty of evidence that gasoline retailers pass on excise taxes to final consumers. In fact, the evidence seems almost unequivocal: gasoline retailers pass excise taxes through to final consumers completely. For example: https://www.sciencedirect.com/science/article/pii/S0165176503003264

https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1465-7295.2008.00164.x

https://www.sciencedirect.com/science/article/pii/S0047272711000545

5. There’s room for a conversation about flexible regulations vs. carbon pricing, especially when it comes to politics, but criticizing the model here seems like a red herring.

Comments are closed.