Carbon pricing would help position Nova Scotia to thrive in a low-carbon world

So far Nova Scotia hasn’t played a prominent role in Canadian climate change discussions. With a population of less than one million, and relatively modest industrial activity, provincial emissions represent roughly 3% of the Canadian total. Indeed, few outside the ocean-front province are aware that Nova Scotia is one of the only provinces expected to meet its greenhouse gas reduction goals by 2020.

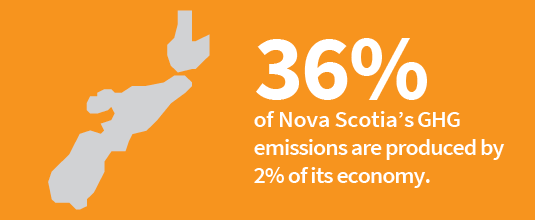

Yet the case for carbon pricing in NS is strong. Coal is still king for electricity generation, and Nova Scotians have the fourth highest per capita emissions in the country. Moreover, with Alberta committing to introducing a carbon tax, over 85% of Canadians will now be living in a province with a price on carbon. Implementing carbon pricing will not only help drive further reductions, but it will help position the NS economy to thrive and compete in a low-carbon world. But how would a carbon price in Nova Scotia affect business and provincial competitiveness?

Last week the Ecofiscal Commission released its report on carbon pricing and competitiveness, looking at how different carbon prices in different provinces create advantages and disadvantages for specific industries. Part of the report was devoted to estimating how much of the Nova Scotian economy is exposed to competitiveness pressures.

The graph below is taken from the report and illustrates how specific sectors in Nova Scotia are more or less exposed to pressures created by carbon pricing. Each sector is plotted showing its carbon costs on the vertical axis and its trade exposure on the horizontal axis. The farther a sector is positioned toward the upper right-hand corner of the figure, the more vulnerable it is to these two competitiveness pressures. The size of the bubble representing each sector shows its contribution to provincial GHG emissions (red) and GDP (blue). A larger bubble indicates a larger share.

Nova Scotia Carbon Competitiveness Highlights from the report include:

- Nova Scotia’s small size has interesting implications for its exposure to competitiveness pressures. A large share of the goods it produces—coal, gold, cement, natural gas, pulp and paper, and other resources—are exported in competitive markets, leading to a very high measure of trade exposure.

- At the same time, vulnerable “sectors” are often single facilities. For example, Nova Scotia has a single cement facility and two pulp and paper plants. These are the individual emitters in the province likely to be most exposed to competitiveness pressures.

- About 10% of the provincial economy is based on other manufacturing that has low emissions intensity and carbon costs, although considerable trade exposure.

- Future developments in the province—such as additional natural gas projects and LNG plants—would likely also be both emissions intensive and trade exposed.

Although the Nova Scotia is on track to meet its 2020 targets, it is still a heavy emitter in per capita terms and relies on emissions-intensive electricity generation. The province also has a number of small emission-intensive industries (in some cases single facilities) that would be exposed to competitiveness pressures with a carbon price. Understanding this exposure is critical for designing a carbon pricing system that can help provide targeted short-term assistance to help insulate exposed industries from competitiveness impacts, yet also drive continuous emissions reductions.

Comments are closed.