Smart Carbon Policy for Alberta: reducing emissions AND addressing competitiveness

Alberta is about to release details of its new climate action strategy. Given the nature of Alberta’s economy, getting these details right is critical. In particular, the question of carbon competitiveness matters for Alberta more than any other province. But here’s the thing: policy can be designed to reduce emissions in Alberta and address competitiveness pressures from carbon pricing. Ecofiscal’s latest report shows how.

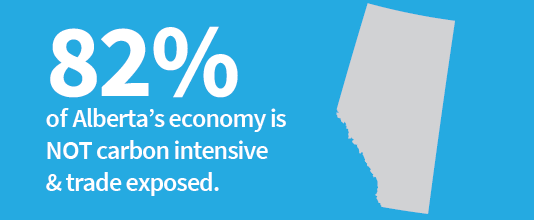

Carbon competitiveness is all about how different carbon prices in different jurisdictions create advantages and disadvantages for specific industries. As part of the new report, we estimate how much of the Albertan economy is exposed to competitiveness pressures. Effectively, this means identifying the industries that emit a lot of GHGs (relative to their output) and the extent to which firms in a particular sector compete with firms from outside their province. This makes it possible to identify industries that may require short-term assistance to help insulate them from the competitiveness impacts, while also creating incentives for them to improve their emissions performance.

The graph below is taken from the report and illustrates how specific sectors in Alberta are more or less exposed to pressures created by carbon pricing. Each sector is plotted showing its carbon costs on the vertical axis and its trade exposure on the horizontal axis. The farther a sector is positioned toward the upper right-hand corner of the figure, the more vulnerable it is to these two competitiveness pressures. The size of the bubble representing each sector shows its contribution to provincial GHG emissions (red) and GDP (blue). A larger bubble indicates a larger share.

Carbon pricing and competitiveness pressure highlights include:

- A much larger share of Alberta’s economy is exposed to competitiveness pressures, given the importance of resource extraction sectors. The oil and natural gas sectors collectively make up around 20% of provincial GDP.

- Indirect GHG emissions matter much more for provinces that rely on coal-fired electricity generation, such as Alberta and Saskatchewan. With a much more emissions-intensive electricity supply, a broad-based carbon price would lead to higher electricity costs. On the other hand, switching to gas-powered generation likely represents relatively low cost abatement; over time, indirect emissions are likely to decline in response to effective carbon pricing policies.

- Even though the oil and gas sectors are exposed to competitiveness pressures, they are not the most vulnerable sectors in Alberta. Fertilizer, chemical manufacturing, and petrochemical manufacturing are all considerably more emissions intensive and trade exposed—although they are much smaller as a share of the economy and thus may present less of a challenge for policy design.

- NOTE: interactions with other fiscal policies are a critical factor not considered here. In particular, royalties paid by oil sands companies are currently based on the difference between revenues and the sum of current and capital expenditures. As a result, these royalty payments would decrease as carbon prices rise, thereby offsetting some of the impact on competitiveness (Bošković & Leach, 2014).

Competitiveness pressures matter for Alberta. But so does reducing GHG emissions. The new strategy will have direct impacts for Albertans, but the broader effects could resonate nationally. A shift in policy in Alberta—the homestead for most of Canada’s oil and gas industry—could help reset the dialogue on moving forward with a strategy that makes sense for all Canadian provinces.

Comments are closed.