TLDR: Research from our First Report in a Nutshell

The Ecofiscal Commission’s first report makes the case for implementing ecofiscal policies in Canada. In case you don’t have time to read the full report, this blog distills the essentials.

Our overall conclusion is simple: Smart environmental policy makes economic sense for Canada. In short, the benefits of such policies exceed the costs. Still, there’s detail to be unpacked from that core finding. What do we mean by “smart policy?” And what is the nature of these benefits?

Smart policy for the environment and the economy = Ecofiscal Policies

Ecofiscal policies correct market signals to encourage the economic activities we want (job creation, investment, and innovation), while discouraging those we don’t (greenhouse gas emissions and pollution of our land, air, and water). They use prices to help companies and individuals make decisions that take the true value of our environmental assets into account.

These policies can help us tackle a wide-range of issues—water, waste, carbon emissions, traffic congestion—to improve prosperity for our cities, our provinces, and our nation as a whole.

Protecting our natural assets makes economic sense

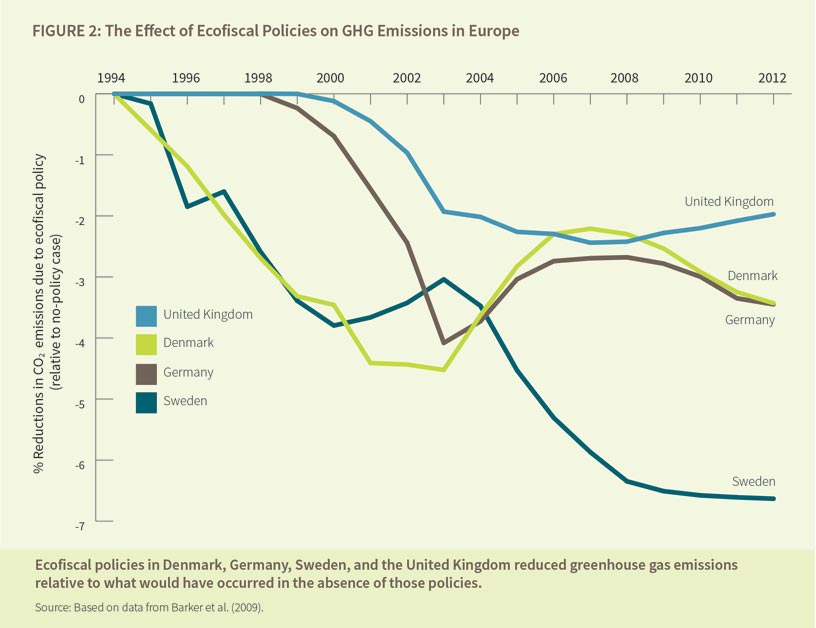

Canada’s natural assets—from healthy ecosystems to clean air, land, and water—not only have economic value, but are in fact essential to the long-term prosperity of Canadians. Cleaning up environmental damage is costly. Air pollutants in Canada, for example, could impose health costs of roughly $230 billion between 2008 and 2031. Estimated costs of climate change rise from around $5 billion annually in 2020 to between $21 and $43 billion annually by 2050. Ecofiscal policies have proven effective in addressing these threats, for example, by decreasing greenhouse gas emissions.

This is a smart way to get both environmental and economic results

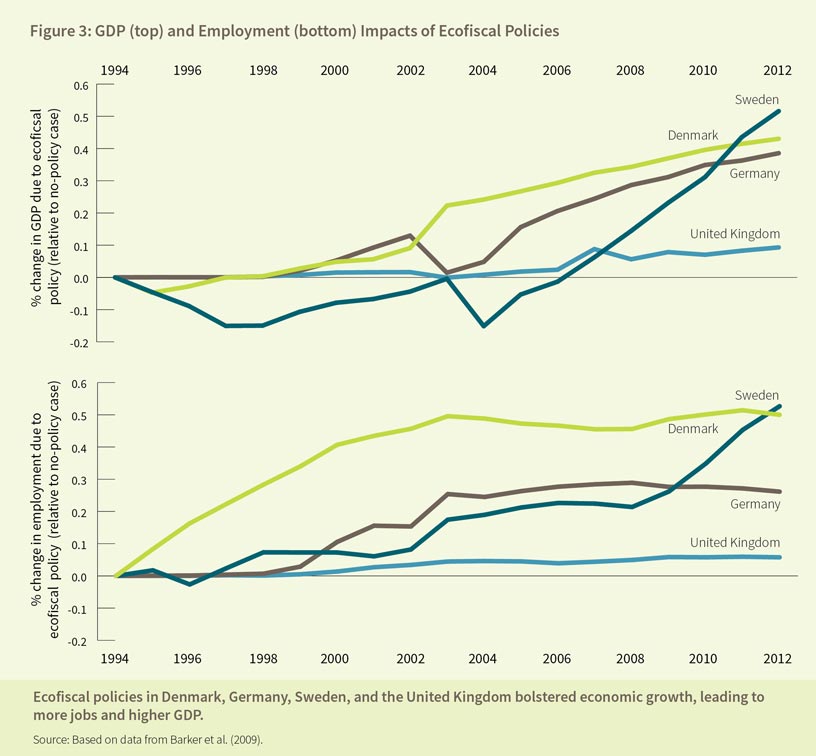

Ecofiscal policies can achieve environmental objectives more cost-effectively than other policies like regulations and subsidies by spurring innovation and allowing flexibility in how businesses and individuals reduce their pollution. But they can also create the fiscal space for reductions in growth-retarding taxes or investment in infrastructure or clean technology. The same analysis that showed that ecofiscal policies in Europe worked also showed that they led to increases in GDP and jobs,.

Canada can do better along both lines

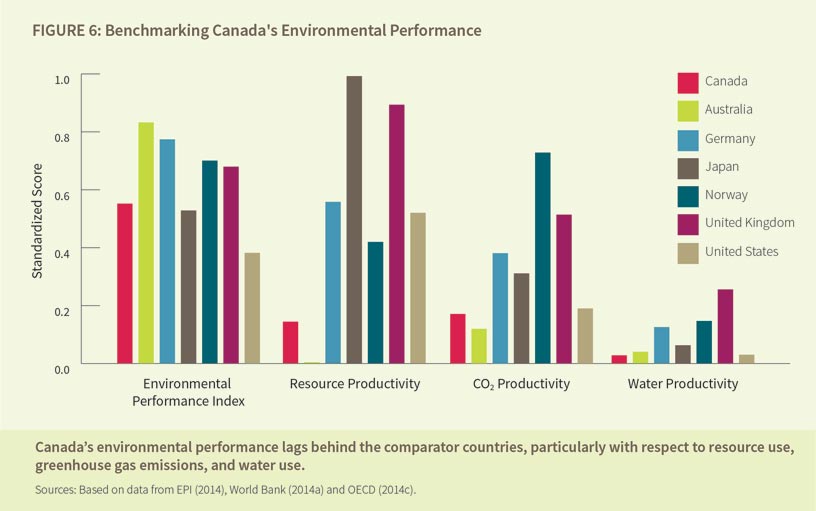

Among its peers, Canada ranks third worst on the Environmental Performance Index. It depletes more natural assets and produces more waste per unit of GDP than comparator countries.

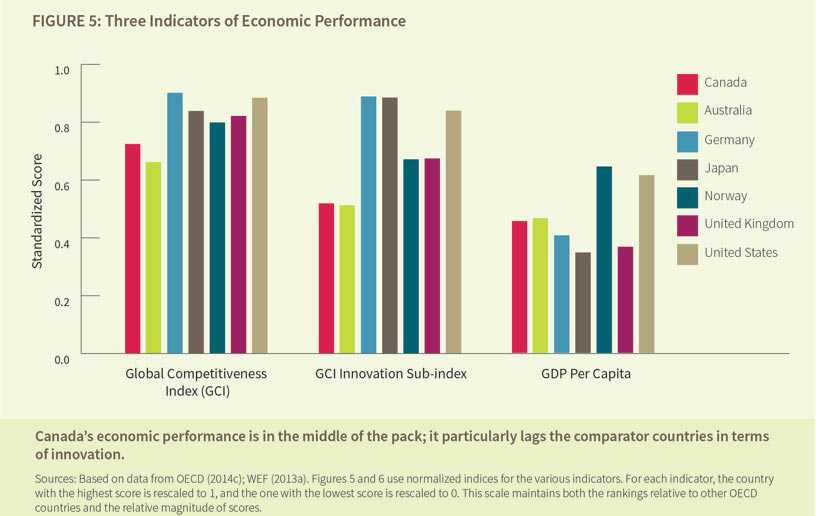

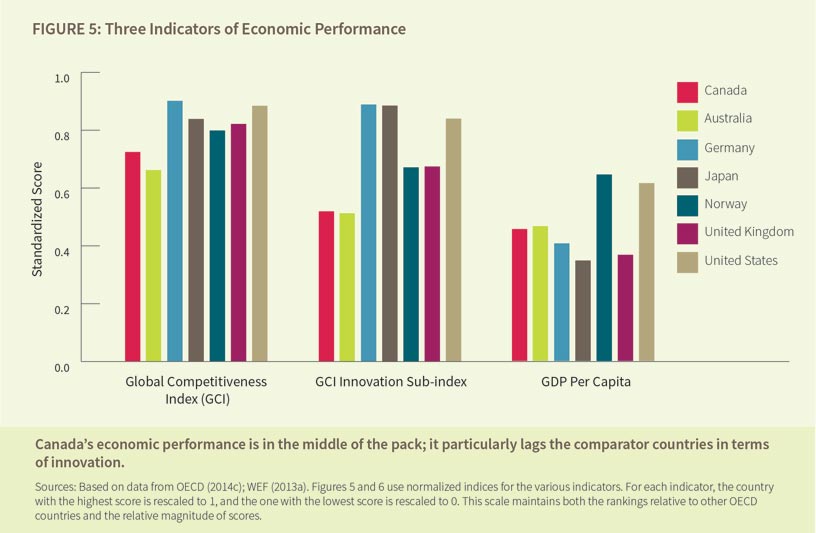

At the same time, Canada also lags behind our peers in innovation—a key driver of long-term economic performance.

A growing body of evidence supports the link between ecofiscal policies and innovation. If pollution has a price, innovations to reduce pollution are valuable. A global price on carbon that stabilizes greenhouse gas emissions would quadruple global investment in energy-related research and development, according to OECD analysis. At the same time, reducing other taxes like corporate income taxes can also lead to improvements in innovation and productivity.

Over the longer term, increased innovation—particularly with respect to clean technologies and processes—will put Canada in a more secure and advantageous position, particularly as our trading partners implement more of their own ecofiscal policies.

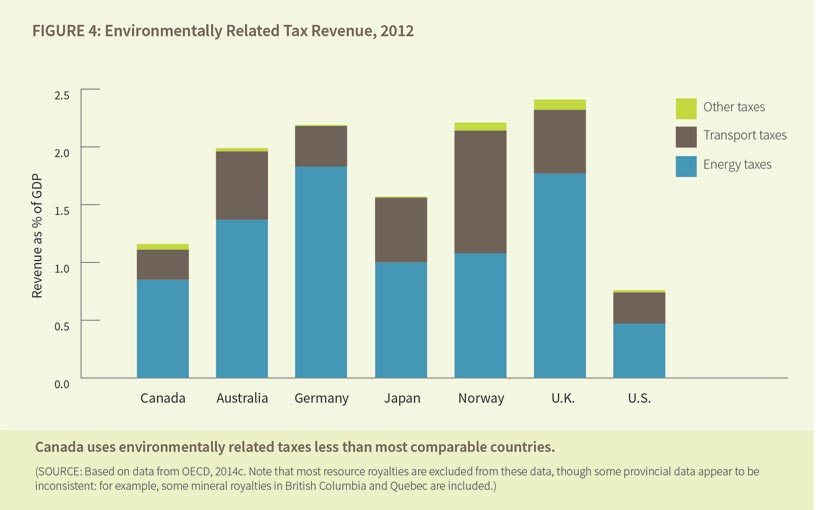

Right now, Canada lags most OECD countries in implementing ecofiscal policies.

While important progress—particularly at the provincial level—shows that these policies can and do work in Canada, Canadian governments at all levels have a clear opportunity to do more to to protect Canadian prosperity both now and in the future.

Canada Can Seize this Opportunity Now—And Do it Thoughtfully

Ecofiscal policies are increasingly part of global trends towards a clean economy. More and more, pricing pollution is becoming part of mainstream economic policy thinking. Canada would be well served by actively participating in this transition. But doing so means facing a number of big issues in our uniquely Canadian context: from the competitiveness concerns of businesses, to regional economic differences, to the impact on low-income households.

Evidence suggests that these issues can be addressed through smart policy design. Over the next 5 years, Canada’s Ecofiscal Commission, will undertake the research and analysis needed to put practical ecofiscal policy opportunities on the table for all Canadian governments.

Stay tuned.

About the Author

Dale Beugin is the Research Director for Canada’s Ecofiscal Commission

Comments are closed.