The Curious Case of Counterfactuals

We’ve consistently made the case that carbon taxes work. But what does it mean if emissions rise over time, even with a carbon tax in place? It might mean that the price is too low, but it sure doesn’t mean the tax isn’t working. Interestingly, there’s a Canadian case that reflects this exact trend. B.C. implemented its carbon tax in 2008, and although emissions have fallen per capita, they’ve risen overall. What’s up? Does the B.C. carbon tax mean we should change our tune on carbon pricing? Short answer: No.

What’s a counterfactual?

For starters, we’re not quite asking the right question. When we measure the impacts of carbon pricing in B.C. (or any other jurisdiction, for that matter), what we really care about is what would have happened without the price. This is called the counterfactual case. Contrary to some opinions, the effectiveness of the tax isn’t about absolute emissions; it’s about what happens to emissions relative to counterfactual.

B.C.’s emissions rose after 2008, yes, but that doesn’t mean that its carbon tax hasn’t been effective. It instead suggests that at $30/tonne, the stringency of the tax may be too low to drive behavioural changes sufficient to reduce absolute emission levels. I’ll come back to stringency in a moment.

It’s a gas

It’s obviously a complex task try to isolate the effects of just one factor (in this case, B.C.’s carbon tax). This is an econometrics-free blog, but looking at what happened in other provinces (i.e., those that didn’t tax carbon) can help shed some light. Smart Prosperity has already written extensively on this issue, but I’ll take a slightly different angle here.

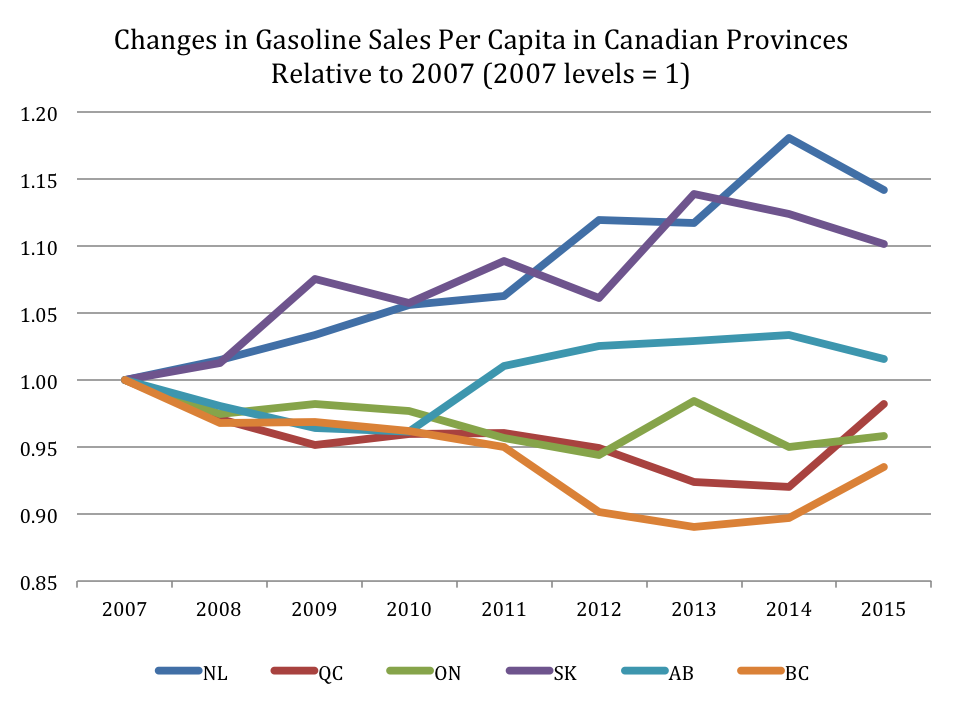

The figure below considers per capita consumption of fossil fuels (i.e., fuels covered by the carbon tax). But it compares trends in B.C. to trends in other provinces since the carbon tax kicked in in 2008. Sure enough, we see fuel demand in B.C. has fallen, both overall and relative to the rest of Canada’s largest provinces.

Source: Analysis based on CANSIM table 405-0002 and CANSIM table 051-0001

The carbon tax is only one—of many—factors that matter

There’s a lot going on here, with multiple factors affecting both trends through time and across provinces. We need to interpret this kind of figure very carefully.

B.C.’s increase in gasoline sales between 2013 and 2015, for example, isn’t necessarily a failure of the carbon tax either. In fact, it is an excellent illustration of why counterfactuals matter, and why context is important.

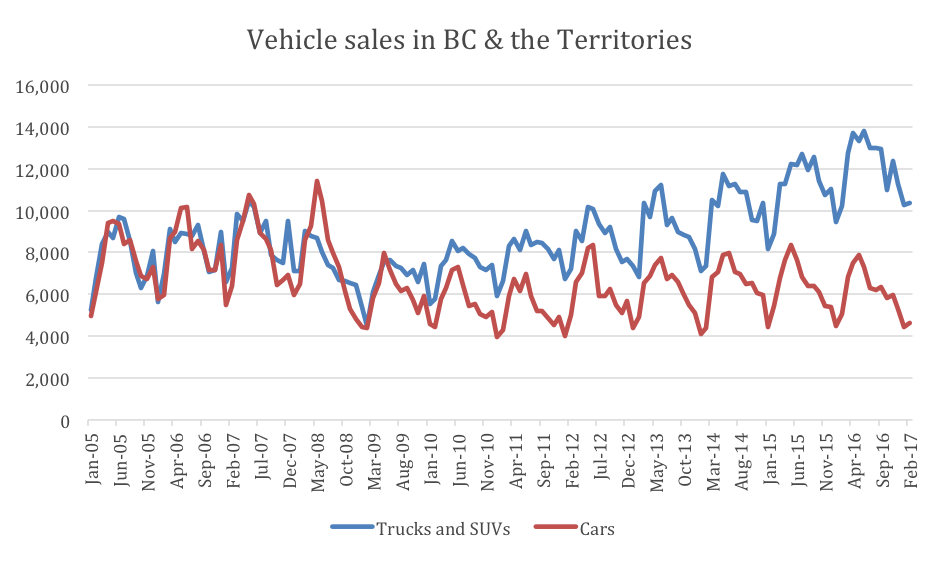

Gasoline prices have tumbled over the past 3 years along with the price of oil. In the short-run, motorists will respond to carbon taxes by driving less. In the long run, they’ll switch to more efficient vehicles. But when gasoline is cheap, demand for fuel efficiency drops, which can offset the signal provided by the carbon price. We see this play out in the types of vehicles British Columbians are buying, as the data below illustrates.

Source: CANSIM table 079-0003

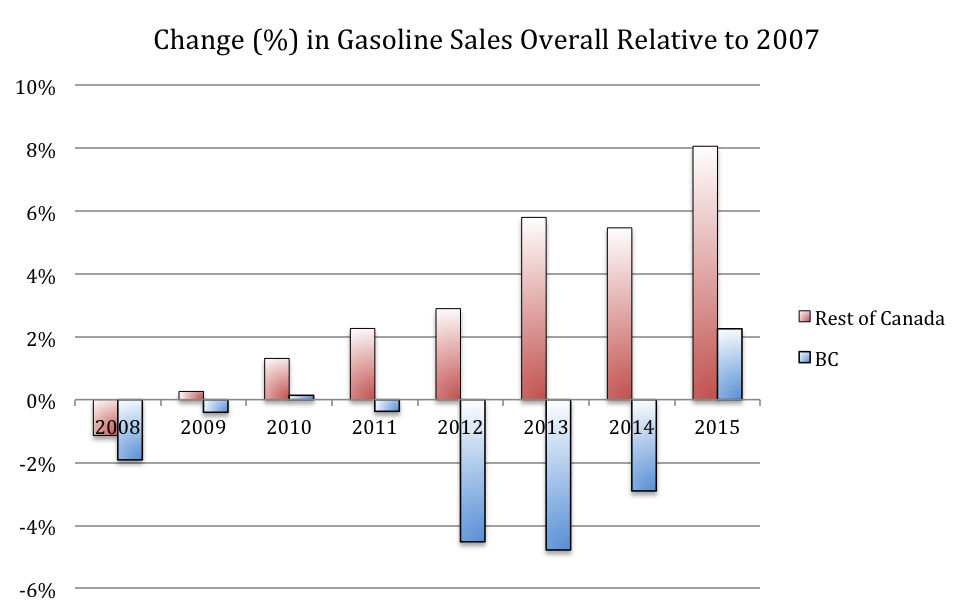

It’s also worth noting that even when people began to buy less fuel-efficient vehicles and more vehicles overall, B.C. kept a lid on overall gasoline demand. With the exception of 2015, gas sales in B.C. have been held at or below 2007 levels. Aggregate sales in the rest of Canada – which until recently has largely operated without carbon pricing – have continued to grow. And as other provinces catch up on carbon pricing, we can expect similar results.

Source: Analysis based on CANSIM table 405-0002

More stringent policy, more changes in behaviour

Prices influence how we think about our purchases, how we weigh trade-offs and alternatives, and how we feel about them afterwards. Put another way, prices change behaviours. When you put price on something, you’re signalling the cost of consuming it, which affects how much of it people will want to consume.

That means if you want more emissions reductions, you need a higher carbon price. In other words, the data we’ve looked at here doesn’t point to failure of carbon pricing. But it may point to the need for more stringent policy.

B.C.’s $30 carbon tax may not spur widespread changes in driving habits (although some drivers clearly have responded to this price). At $50, however, we could expect to see more carpools, or higher demand for public transit and fuel-efficient vehicles. And in the longer-term, we’d expect more demand for vehicles that produce fewer GHG emissions.

As far as meeting Canada’s 2030 emissions reduction targets, it matters if emissions are falling. But when measuring the impacts of carbon pricing, we really care about what’s happening versus what would have happened. That means looking carefully at comprehensive analyses that try to isolate the impacts of the carbon tax (see here, here, and here, for example). To drive deeper emissions reductions, the price needs to rise. If emissions are rising, keep in mind: it’s not the instrument, it’s how well you play the music.

2 comments

In future articles, please explain with the help of concrete examples if necessary the difference between the words”price”, “cost” , “fee” and “tax” as they relate to our national revenue neutral carbon tax. I want to make sure I use the right language as I notice that that the word “tax” turns people off . Citizens in general, and business owners in particular, say to me they do not want to pay more taxes.

Hello Carole,

Thanks for your comment and for the opportunity to clarify, as there is indeed some confusion around these terms. For everyone’s reference, here is what we mean by these terms.

A “price” is what you pay for something. A “cost” is more comprehensive. It also captures anything that is not included in the price. When someone buys a litre of gasoline, they pay a price for it, but the public incurs the “cost” of burning that gasoline. The objective of a carbon tax is to ensure that the price and the cost are better aligned, and that the user pays for both.

A “fee” is typically for a service, while “taxes” are typically for general revenues, but carbon taxes are a little unusual. If your carbon tax is revenue-neutral, that means you are cutting other types of taxes. Essentially, you are just raising revenues in a different way. However, the objective of a carbon tax is not to raise revenues; the objective is to discourage certain activities and behaviours and encourage others. The fact that it also offers a source of revenue is an opportunity to cut other forms of taxation (income taxes, sales taxes, corporate taxes, etc).

Comments are closed.