Carbon Pricing and Innovation

“Innovation” is buzzy these days, with lots of smart people thinking and writing about the role of policy in driving innovation to improve productivity and economic growth. And yes, innovation is great. It lets us use inputs—like capital, labour, and resources—more efficiently. It’s especially important in our efforts to reduce GHG emissions: innovation around new technologies and processes can help us reduce GHG emissions at lower costs.

In the midst of this growing conversation around innovation, let’s just take a few minutes to remind ourselves of a key innovation policy that’s right in front of us: carbon pricing. As David Popp noted in a recent piece from the C.D. Howe Institute, carbon pricing isn’t just mitigation policy—it’s also the most important policy to drive low-carbon innovation. Similarly, Carolyn Fischer at Resources for the Future writes, “Carbon pricing is a technology policy.”

This blog takes a closer look at the mechanism that links carbon pricing and innovation.

Expectations of future carbon prices

First, it’s important to differentiate between the ways in which carbon pricing drives cost-effective emissions reductions now but also in the future.

Ecofiscal has talked a lot about the benefits of flexibility from carbon pricing: it allows emitters to respond to the price of carbon by reducing GHG emissions however they choose, and in ways that minimize their own costs. That is, they take whatever actions to reduce emissions that cost less than the carbon price. With a higher carbon price, emitters implement more of these actions.

But that’s not the only incentive that carbon pricing creates. A good carbon pricing policy also creates expectations around the price of carbon in the future. That means that technologies that reduce emissions at lower cost will have value in the future. And in turn, that means that clever engineers and inventors have incentives to develop those technologies of the future.

The net impact? The costs of reducing emissions will get lower and lower over time. As new technologies emerge, new options for reducing emissions become available. And the costs of driving emissions reductions—and of achieving targets—decline further. (As a side benefit, those innovators might also be able to sell their products and ideas internationally, reducing even more emissions globally).

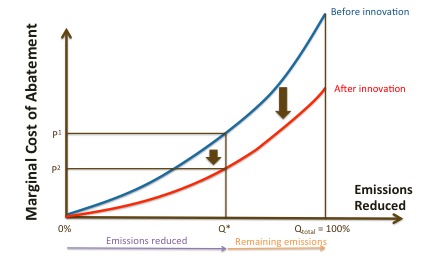

In other words, carbon pricing doesn’t just help us to “climb up” the marginal abatement cost curve, implementing more low-cost approaches to reducing GHG emissions as the price of carbon rises. It will also cause the curve to shift downward as per the figure below, as new technologies emerge or old ones get cheaper. And that means more emissions reductions will happen at a lower carbon price, and at a lower overall cost.

Certainty, flexibility, and stringency

It’s not only carbon pricing that can create strong incentives for low-carbon innovation. Other policy instruments also establish expectations around future incentives, as long as they meet three conditions.

First, policies must be flexible. A command-and-control regulation that requires emitters to use specific technologies (e.g., building codes) or achieve a specific threshold for emissions performance (e.g., vehicle efficiency standards) only provides incentives to up that threshold (and no further). Flexible policies provide a continuous incentive to improve performance.

Second, policies need to provide certainty. If emitters aren’t confident that the policy will be around in the future—i.e., a future government will back away from the policy—the incentive to innovate is diluted. That’s one of the benefits of B.C.’s carbon tax: because it is revenue-neutral, it’s hard to undo. Axing the tax would require increasing other taxes (or cutting program spending) to make up the budget shortfall.

Third, policies must be stringent, or at least set the expectations for future stringency. If policies are easy to comply with because they won’t drive much in the way of emissions reductions, incentives to innovate are weaker.

Carbon pricing is clearly flexible. But it can also set clear, and predictable expectations for stringency now and in the future if implemented well. That means establishing the trajectory for a declining emissions cap for an emission trading system or a rising price of carbon for a carbon tax. And in fact, this is the approach applied in the recent federal announcement: the price of carbon in Canadian provinces must rise, by $10 per tonne each year, to at least $50 per tonne in 2022. In the context of predictable stringency, the message here isn’t just the level of the price, but the rate at which it rises. Will the price continue to rise past 2022? More low-carbon innovation will take place if the market thinks that’s the case.

Still, smart regulations can meet these requirements too. Performance standards with trading mechanisms (e.g., B.C.’s low-carbon fuel standard) can provide this flexibility, at least across different technologies. But for smart regulations to create incentives for innovation, they need to also establish a predictable pathway of increasing stringency. In other words, the level of performance they require—the emissions per unit output, or emissions per kilometre travelled—must not be static, but steadily and predictably increasing through time. And defining that trajectory for performance standards can be tricky, raising challenges for the long-term predictability of smart regulations.

Policies for clean innovation

There’s probably still a need for complementary policies to support carbon pricing in driving innovation. But predictable, flexible, stringent mitigation policy should still be the backbone of that strategy. And carbon pricing is still the policy that best checks those boxes. In that C.D. Howe study I noted above, Popp finds, “while combining both R&D subsidies and carbon prices yields the largest economic benefit, a policy using only the carbon tax achieves 95 percent of the benefits of the combined policy. In contrast, using only a R&D subsidy attains just 11 percent of the benefits of the combined policy.”

At the end of the day, a low-cost path to emissions reductions (especially deep ones) depends on clean innovation. Want low-carbon innovation? Smart climate policy that drives mitigation for today can also drive innovation for tomorrow.

5 comments

Everyone touts carbon pricing as a panacea for reducing GHG emissions. Theoretically, I can accept this approach. However, from my own observations of clients in the oil & gas sector in BC, I know of none that have made investments in efficiency or fuel switching to reduce fuel gas use. I think there were 2 reasons for this: 1) $5/tonne/year is so gradual that each year seems the same as the previous year when it comes to budgeting. I doubt $10/tonne will achieve much more, but I am hoping. 2) $30/tonne is not enough incentive to invest capital in tough economic times – maybe any times. Most would try to keep investments down, so even $50/tonne will only spur some to act. The price needs to reach $100/tonne and more.

For consumers, even $100/tonne is only 20 cents at the pump. Its just a few dollars per month for heating. Most spend way more of coffee! That is not going to spur much investment upfront, to reduce these limited increased costs in the future. Also, when it happens at the $10/tonne pace, I hardly notice it. Its a tickle when I need a slap. (or do I need a punch? a real kick in the pants?)

I would start at $20/tonne rising $20/tonne/year for 5 years minimum and possibly 10 years or more if the desired changes were not happening. Recall where we need to be in 2030 and 2050. We need to sharply reduce emissions by 2030 and even more sharply reduce them by 2050. $10/tonne is window dressing – white wash!

On the other hand, an offset program can incent industry when they recoup their costs commensurate with investments. I have seen many client investments in Alberta with an offset market (though still far too few at the low market prices). Also, if all companies and citizens covered their carbon footprint with offsets, now that would really make a difference! And why not we pick-up after our dogs. Should we not clean-up after ourselves as well?

You say fuel price will inc & heating costs, but you neglect all of our consumables will rise, everything on normal day to day living costs will increase, the only thing that will decrease is your bank account, our stadard of living will decrease one new price increase after another

[…] When governments have priced carbon, the policy cuts pollution and spurs innovation. […]

[…] means 95 per cent of our economy has little to fear—and, potentially, much to gain—from pricing carbon pollution. And for sectors with more on the line, there are many ways […]

[…] When governments have priced carbon, the policy cuts pollution and spurs innovation. […]

Comments are closed.