TLDR: Choose wisely when recycling revenue from carbon pricing

The Ecofiscal Commission’s new report takes a look at how provinces could use revenues generated by a carbon tax or cap-and-trade system. In case you don’t have time to read the report in full, here are the essentials.

Provinces are moving forward with carbon pricing to reduce their greenhouse gas emissions in a cost-effective way. Yet a price on carbon is only half of the policy story. While the purpose of the carbon price is to create incentives for reducing emissions, carbon pricing can also generate revenue for governments. How should governments best “recycle” this revenue back to the economy?

Opportunities and trade-offs of revenue recycling choices

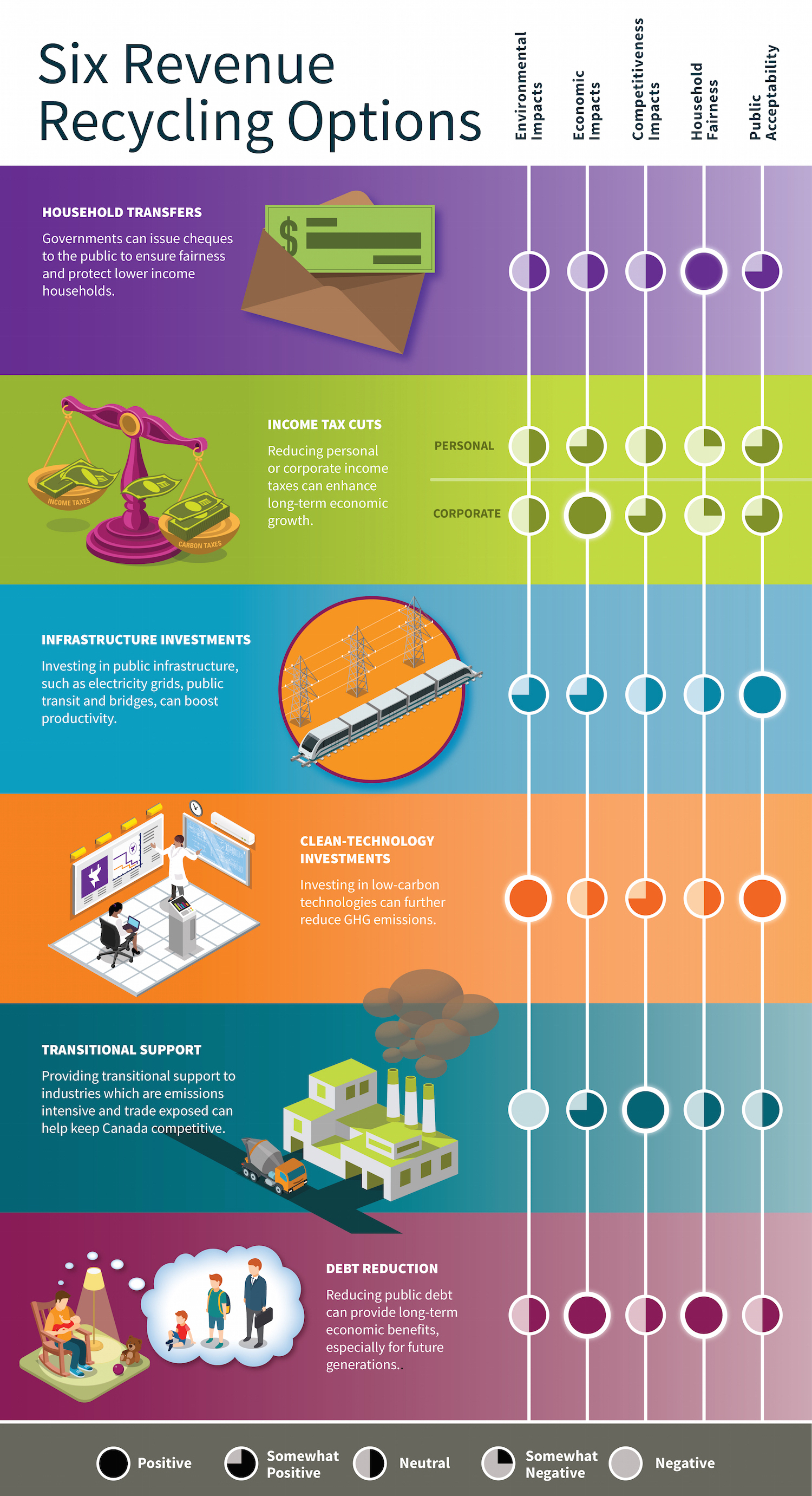

Our new report explores the options for provinces to recycle revenue from carbon pricing policies. The report is called Choose Wisely for a reason: the trade-offs between options are complex. No single option out-performs the others on all dimensions. Some approaches to revenue recycling are better for economic efficiency, while others can drive more emissions reductions, above and beyond those from the carbon price itself. Some approaches address concerns around the fairness of carbon pricing and concerns around the competitiveness of emissions-intensive and trade-exposed industries. And some approaches might make carbon pricing more politically practical.

We considered six main options for revenue recycling. This menu of options isn’t exhaustive, but provides a good cross-section of the approaches that policy-makers might consider.

Quantitative and qualitative assessment of trade-offs

To assess these trade-offs, we considered multiple analytical tools. We estimate implications for competitiveness, GHG emissions, and economic growth using economic modelling, and assessed implications for fairness using a second modelling framework. We considered new public opinion polling across the provinces to help gauge levels of public support for each revenue recycling option. And finally, to frame the range of policy perspectives, we commissioned six position papers from policy experts across the country, each making the case for a different approach to revenue recycling.

The importance of provincial context

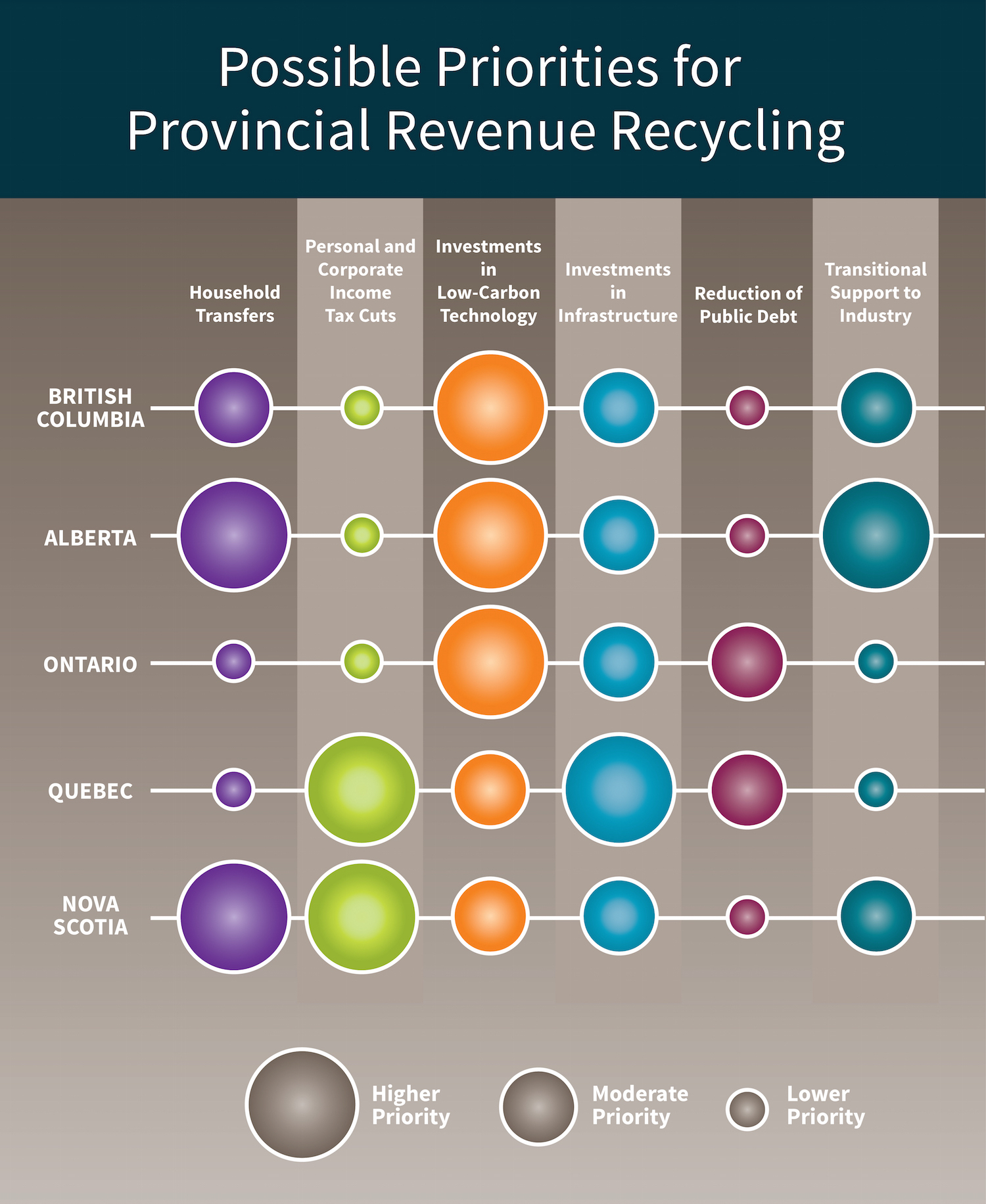

Provinces have different contexts and different priorities. That means that the right mix of revenue recycling in one province will not necessarily work best for another. The Ecofiscal Commission does not make specific recommendations for individual provinces as to how they should recycle revenue from carbon pricing. Provincial governments are best positioned to make those choices based on their own provincial contexts.

The report, does, however, consider how local context might make an option a higher or lower priority. Some provinces, for example, are more exposed to competitiveness pressures created by carbon pricing (e.g., Alberta and Saskatchewan). Fairness concerns could be heightened in provinces with carbon-intensive electricity systems (e.g., Alberta and Nova Scotia). Some provinces have much higher provincial debt (e.g., Ontario and Quebec), while others face more immediate fiscal challenges (e.g., Alberta). Still others have economic challenges associated with high income-tax rates (e.g., Quebec and Nova Scotia). Additional investments in emissions-reducing technology can make it possible to achieve ambitious targets (e.g., British Columbia and Ontario).

The bottom line: Revenue recycling choices matter

The bottom line: Revenue recycling choices matter

Revenue recycling choices are a key part of designing smart carbon pricing policies. Revenue recycling can ensure carbon pricing is fair for lower income households. It can ensure that emissions-intensive industries aren’t disadvantaged in international markets, while maintaining incentives for these industries to reduce their emissions. But revenue recycling also has implications for the overall environmental and economic performance of a carbon pricing policy. As a result, governments should clearly define their objectives. They should also consider a portfolio of approaches to revenue recycling. They should transparently adjust revenue recycling over time, as priorities change and evolve. In short, they should choose wisely. See the report for more details on our analysis and findings.

Read the full Infographic Check out our Events

Comments are closed.