TLDR – A digest of our new report Supporting Carbon Pricing

With the signing of the Pan-Canadian Framework on Climate Change and Clean Growth in December 2016, nationwide carbon pricing is on its way in Canada. In addition, the provinces and the federal government are putting a range of other, non-pricing climate policies on the table. But how can they ensure that these policies genuinely complement carbon pricing? In our latest report, Supporting Carbon Pricing, we take a deep dive into complementary climate policies. This blog lays out the highlights.

Identifying effective and cost-effective policies to support carbon pricing

As Ecofiscal has argued extensively, carbon pricing makes sense because it can reduce GHG emissions at lowest cost. Our new report outlines how—if they’re chosen and designed well—additional, non-pricing policies can support carbon pricing in driving low-cost emissions reductions. But it also shows that the wrong non-pricing policies can raise the costs of a policy package overall.

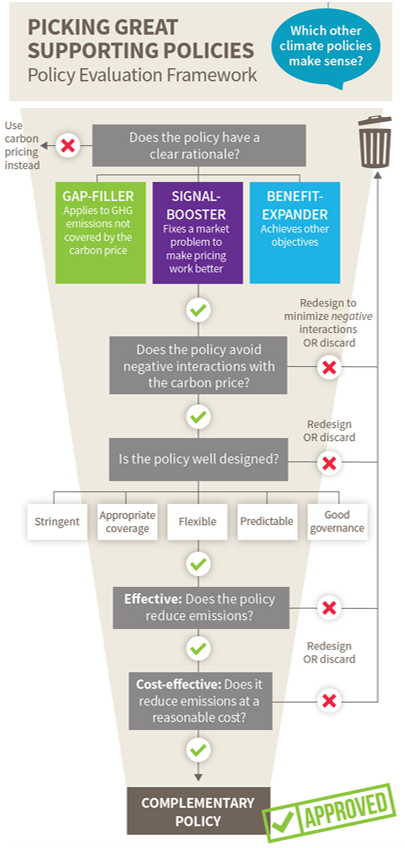

The report provides a framework for identifying genuinely complementary policies. The figure below provides a visual of the framework. It sorts and categorizes policies so that only genuine complements to carbon pricing make it out the bottom.

1. Does the policy fill a role that carbon pricing can’t?

We first ask: does the policy have a clear rationale? In other words, why is carbon pricing alone insufficient?

We first ask: does the policy have a clear rationale? In other words, why is carbon pricing alone insufficient?

Non-pricing policies can complement a carbon price in three different ways:

- They can be gap-fillers. By covering emissions not covered by the carbon price, gap-filling policies can broaden coverage and lower the overall cost of reducing emissions.

- They can be signal-boosters. By addressing market problems that interfere with the carbon price signal, signal-boosting policies can help carbon pricing to work better.

- They can be benefit-expanders. By achieving objectives in addition to reducing GHG emissions, benefit-expanding policies can achieve outcomes that carbon pricing can’t on its own.

If a policy doesn’t have one of these three rationales, carbon pricing would be a lower-cost way to achieve those same emissions reductions.

2. Does the policy adversely interact with carbon pricing?

A policy that overlaps with carbon pricing will interact with carbon tax and a cap-and-trade instruments in different ways. Negative interactions reduce a policy’s effectiveness, cost-effectiveness or both. In particular, policies that overlap with a cap-and-trade system might not drive additional emissions reductions. Instead, they might simply displace cheaper reductions (For more details see our report).

3. Is it well-designed?

Even if a policy does something that carbon pricing can’t and doesn’t interact with the carbon price, its design will still have big implications for its performance. Five particular design features matter here. A non-pricing policy should: 1) be stringent 2) have appropriate coverage 3) be flexible 4) be predictable, and 5) have good governance. These design features can pull in different directions at times—for example, increasing the flexibility of a policy might compromise its stringency. So the key is to create a reasonable balance across them.

4. How much does it reduce emissions, and at what cost?

All of this comes back to the environmental and economic performance of a policy:

- How effective is the policy? Does it reduce GHGs? By how much? An ineffective policy cannot complement carbon pricing.

- Similarly, is the policy cost-effective? What are the costs of those emission reductions on a per-tonne basis? Are these costs reasonable? As we show in the report, what’s “reasonable” can be a matter of perspective. Still, the lower the costs, the better.

In the end, only policies that that are both effective and cost-effective can truly complement carbon pricing. If a policy can’t make it all the way through our framework, it should be re-designed or abandoned in favour of genuinely complementary climate policies (or a greater reliance on carbon pricing).

Three case studies

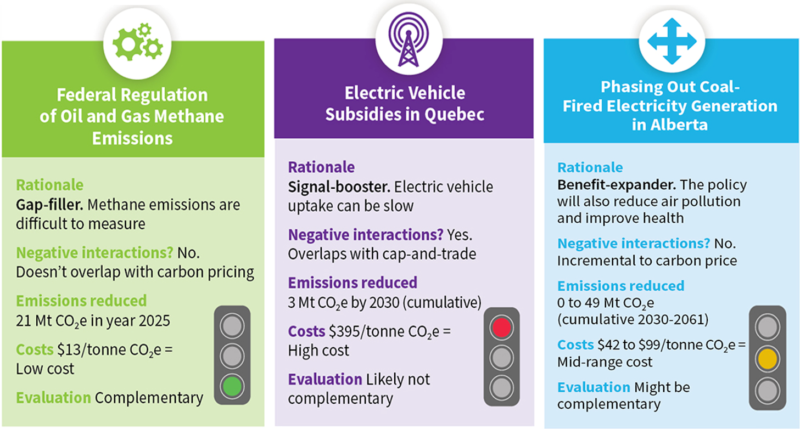

To illustrate the framework, in our report we explore three case studies of existing or proposed non-pricing policies. Each case study exemplifies a different rationale. For a gap-filler, we look at the federal government’s recently proposed regulation of methane emissions in the oil and gas sector. For a signal-booster, we look at electric vehicle (EV) subsidies in Quebec. And for a benefit-expander, we look at Alberta’s planned phase-out of coal-fired electricity. The figure below provides a summary of the results.

Federal methane regulations drive significant reductions in an area that carbon pricing doesn’t touch. And they do so at a cost-per-tonne that’s lower than current carbon prices, suggesting they’re a good complement to carbon pricing. EV subsidies in Quebec, on the other hand, may interact negatively with its cap-and-trade program, and the mitigation that they drive comes at a very high cost. This suggests that they’re likely not complementary. Alberta’s planned coal phase-out has significant health co-benefits that lower its costs. The mitigation it delivers comes at a mid-range cost—more than the current carbon price, but less than where carbon prices will need to go in the future. Its complementarity is therefore a matter of perspective: some might say it’s too costly, while others might simply say its simply forward-looking.

Our analysis isn’t meant to be the last word on any of these policies. Rather, it’s meant to illustrate the questions that need to be asked of any non-pricing climate policy. The case studies show that whether a policy is complementary or not will depend on the role it plays, the context it’s implemented in, and how it is designed.

For more on how these case studies break down across our framework, and for details on the methods and assumptions that we used to assess them, see our report.

Fishing for complements

The best non-pricing policies complement carbon pricing, and improve the effectiveness and cost-effectiveness of the overall climate policy package. But simply adding more policies won’t necessarily improve performance. As Canadian governments continue to move forward with climate policy, it’s critical that they identify and design policies that are genuine complements to their carbon prices. Our framework aims to help them do just that.

Read the Report Check out our Events

Join us today at 1pm EST for Achieving the Right Balance, an online discussion of the role complementary policies should play in our climate packages.

2 comments

Thanks for throwing red meat to opponents of clean transportation. No one is reporting on your policy analysis framework. Instead, the Globe and Mail focused on this, “Quebec’s strategy on electric vehicles is too expensive, Ecofiscal says.”

Everyone is ignoring your disclaimers that, “these case studies are not intended to be conclusive” or that, ” the case studies presented here are merely intended to illustrate the application of the framework and to unpack key factors likely to affect the performance of the specific policies assessed.”

According to Fig. 10 in your report, the entire cost of Quebec’s EV incentive program is due to a single factor: Market Barriers. Yet there is limited context or even a measure of uncertainty despite admitting that, “While the analysis is based on survey data that captures driver preferences, the extent to which these preferences are driven by market barriers or market failures is highly uncertain.”

I don’t know if this is just a failure of journalism or you willfully including controversial fodder for clickbait headlines. Either way it diminishes your credibility and obscures your important work on designing and evaluating climate policies.

Hi Michael. Thanks for your comment.

While I understand your perspective, I believe that our analysis is ultimately supportive of clean transportation policies. To make meaningful, lasting strides in decarbonization, it’s important that environmental policies be durable. When policies have limited economic credibility, they’re more likely to be terminated by future governments. Further, there’s a risk that they will undermine future policy action. Ontario’s feed-in-tariff provides an example. Because costs weren’t as contained as they could have been (perhaps by holding auctions), the policy got a bad reputation, and now, unfairly, it gets much of the blame for Ontario’s high electricity prices. The spectre of this policy is now raised in other jurisdictions looking to support renewables in the electricity sector (e.g., Alberta), even when the comparison is unfair. We believe that, due to their excessive costs, there is a similar risk with EV subsidies. If governments are looking to support EVs, then other policies, like support for charging infrastructure and, in particular, ZEV mandates would likely offer far better ways to support the sector. We explicitly say so in our report.

Second, we stand behind our analysis. You’re incorrect to say that market barriers are the main cost driver. A careful read of Figure 10 will show that market barrier costs are offset by the benefit of addressing market failures, the last arrow seen in the figure. The two arrows, taken together, express the net cost of market barriers. We’ve separated them in this way to explicitly show the benefit that the policy is estimated to create. Combining them reduces the size of the market barriers figure by approximately 80%.

The most significant cost driver in our estimate is the cost of raising public funds, which you do not mention. Raising funds through taxation to pay for EV subsidies leads to economic costs, which we have estimated using an integrated economy model. This cost driver raises the policy’s estimated costs by over $300/tonne. So even if we ignored the effect of market barriers and failures, the cost of raising public funds would still put the policy’s estimated costs above $250/tonne, where it would exceed all benchmarks for cost-effectiveness. We included estimates of market barriers’ and failures’ significance in order to try to capture a key facet of policy costs and benefits. While we acknowledge the uncertainty surrounding them, they are based on studies of consumers’ preferences surrounding EVs, and so have an empirical basis.

We stand by our estimate of the cost of EV subsidies. Even if market barrier costs weren’t included, subsidies would still be an expensive approach. The policy is up for review in Quebec this year, and we believe policy-makers should think very carefully about whether they want to renew it. A greater reliance on Quebec’s existing EV support policies (which include a ZEV mandate) would likely offer a much more cost-effective path forward for greater uptake of EVs in the province. It would also limit the risk of the pendulum swinging the other way on support for clean transportation policies.

Comments are closed.