How does carbon pricing compare to other ways of reducing emissions?

All other policy approaches that reduce GHG emissions will cost more than carbon pricing

- Regulations that require specific outcomes or technologies in particular sectors are less flexible, and thus have higher costs.

- Ecofiscal Commission research estimated that Canada’s GDP would be up to 3.8% higher by 2020 if we relied on carbon pricing starting in 2015 instead of inflexible regulations to meet emissions targets.

- Subsidies also cost more than carbon pricing

- Subsidies to clean technologies require prioritizing specific technologies (i.e., “picking winners”).

- They are often paid to businesses or individuals who would have adopted the clean technology anyway, without a subsidy or with a smaller subsidy.

- Ecofiscal research found that Quebec’s electric vehicle subsidies cost around $400 per tonne of GHG emission reduced. This is more than 10 to 20 times the cost of existing carbon prices in Canada.

- Carbon pricing does not require governments and businesses to determine where in the economy or the country the lowest-cost opportunities for emissions reductions exist.

- The flexibility of carbon pricing also creates a powerful incentive for clean technology innovation, and there are economic advantages to adopting these technologies earlier rather than later.

Doing nothing to reduce GHG emissions is also costly

- There are significant economic costs associated with policy inaction

- The National Round Table on the Environment and the Economy estimates that climate change will cost Canada’s economy $5 billion in 2020 and between $21 billion and $43 billion in 2050 (in 2006 dollars).

- Adopting carbon pricing and low-cost complementary climate policies will help mitigate these costs without significantly harming economic growth.

The overall economic impacts of carbon pricing are small

- The impacts of carbon pricing for economic growth are and will be small.

- Even with a carbon price rising to $100 per tonne, Canada’s Ecofiscal Commission estimates that GDP growth would still be strong and positive, though slightly lower.

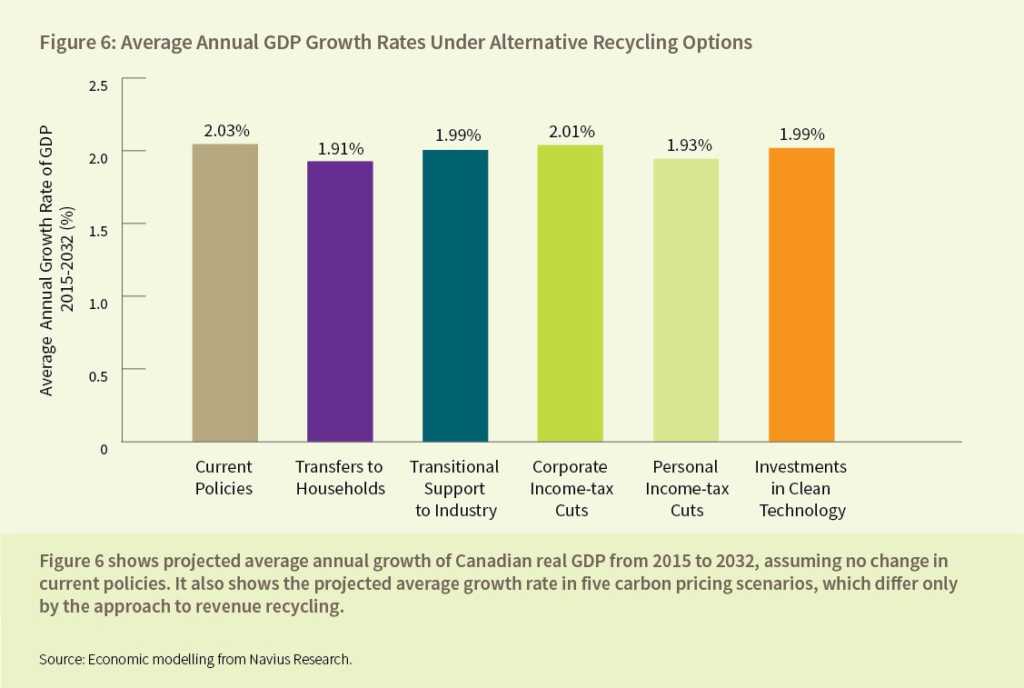

- At most, carbon pricing would reduce growth rates by 0.1 percentage points, and if revenues were used to cut income taxes (as provinces have discretion to do, under the Pan-Canadian Framework), the impacts on growth would be even smaller (see Figure 6, below, from our report Choose Wisely).

Other Resources

More Fast Facts on Carbon Pricing