Abstract

A $30 carbon price in Canadian provinces would impose small costs on households (even before considering the benefits of revenue recycling). Our analysis suggests that the impact could be slightly regressive or slightly progressive, depending on the precise measures used. It is essential for provincial governments to consider household fairness when designing carbon pricing policy. It is equally important to recognize that fairness concerns can be successfully addressed through revenue recycling. As a result, fairness concerns should not be an obstacle to implementing carbon pricing.

Executive Summary

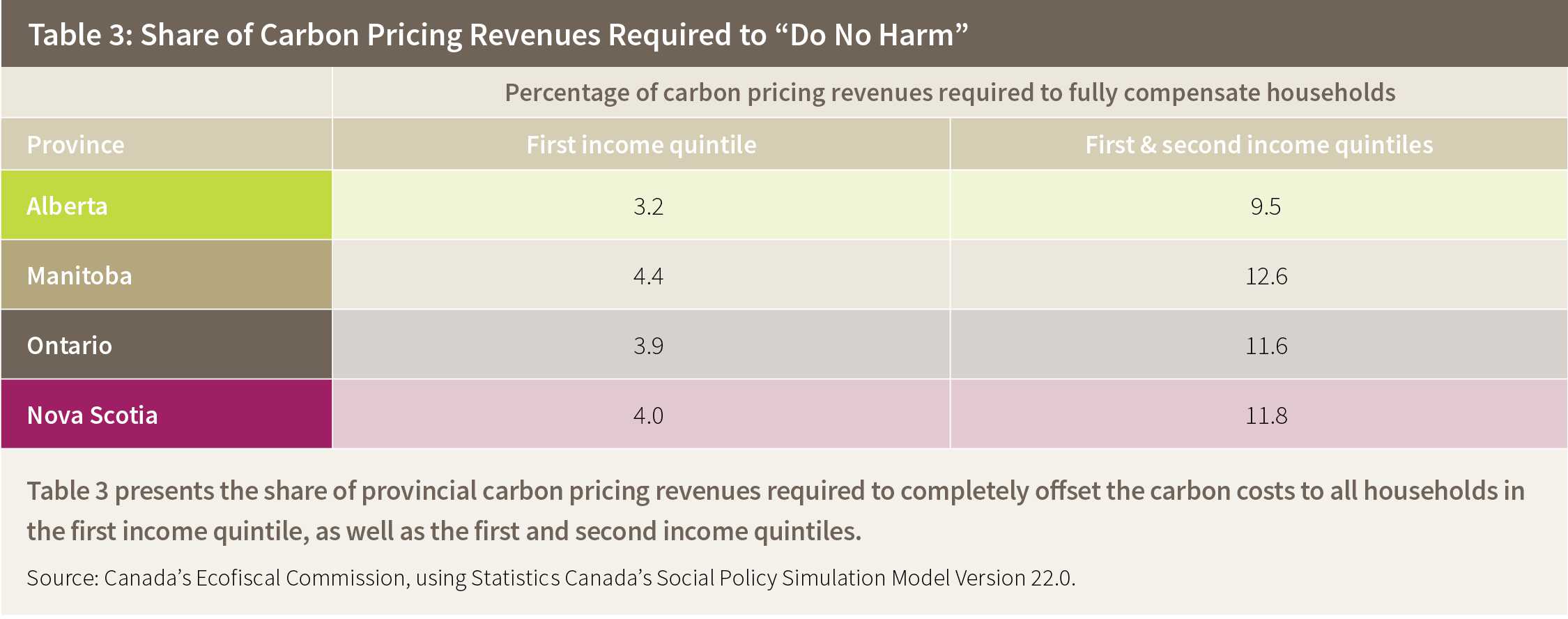

Well-designed carbon pricing policy must consider the costs imposed on households of different incomes, and ensure overall fairness. Recycling revenue generated from the policy back to the economy is the central way to design fair policy. This paper assesses the extent to which a carbon price—on its own, without considering revenue recycling—could be unfair for lower-income households. It then identifies the share of carbon revenue required to address these concerns.

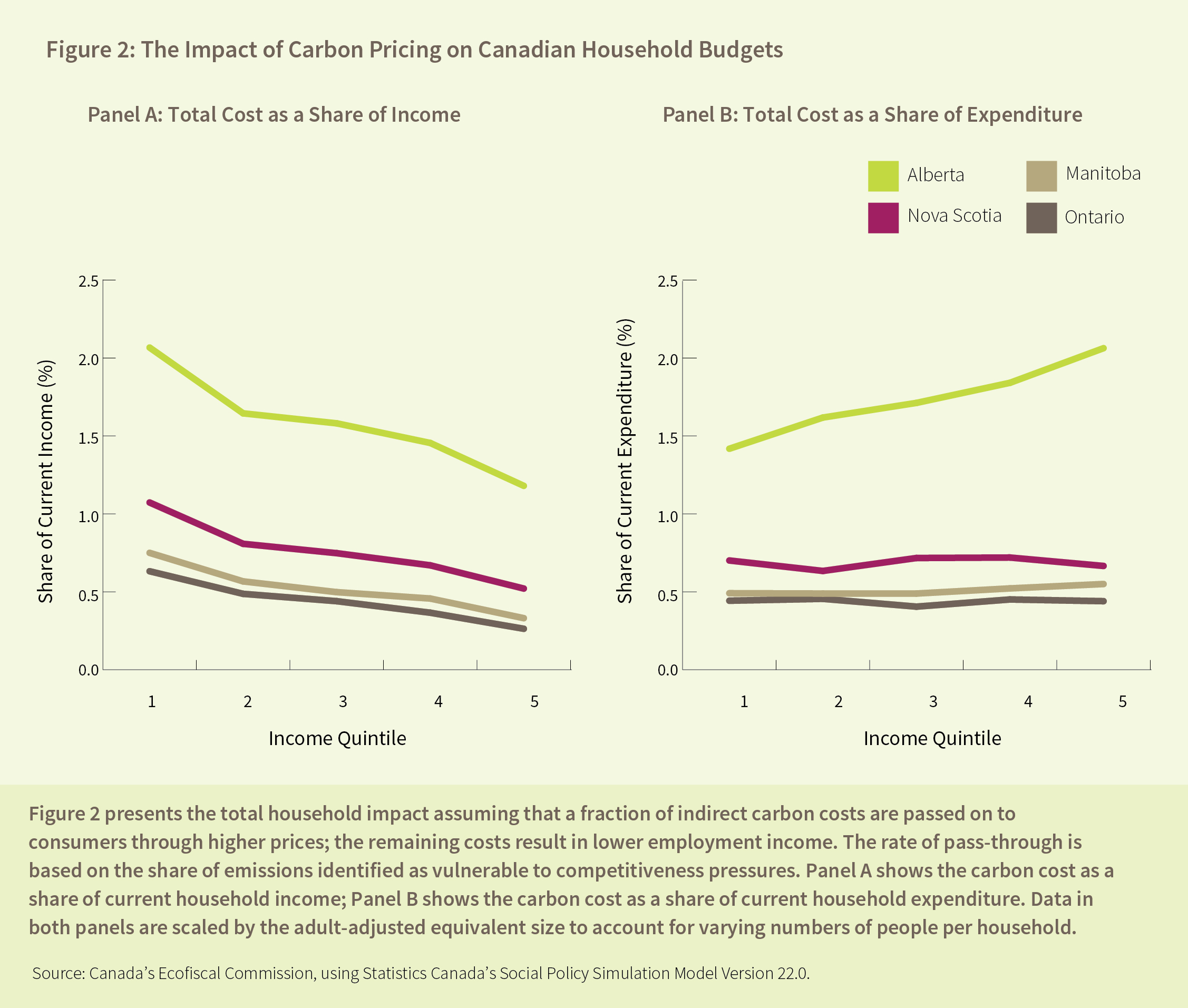

A carbon price can affect household budgets in different ways. It increases the prices of emission intensive goods and services, which represent a larger share of expenditure for lower-income households. A carbon price can also reduce household employment or investment income, which are more important income sources for higher-income households. Assessing the overall fairness of carbon pricing on households therefore requires looking at these two effects together.

Economic modelling for Alberta, Ontario, Manitoba, and Nova Scotia suggests that carbon pricing would impose small overall costs on households, and the impact could be slightly regressive or slightly progressive, depending on the income measure used to assess relative costs. In either case, our analysis finds that the costs imposed on lower-income households can be entirely offset by using a relatively small proportion of the revenues generated by carbon pricing policies.

In addition, analysis of the impact of carbon pricing on households residing in areas of different sizes for the four provinces suggests that carbon costs for households do not vary significantly across rural and urban areas.

Finally, the estimates presented in this report should be viewed as overestimates of the true costs for households. As discussed, they do not consider the benefits for households from recycling carbon pricing revenues back to the economy. They also exclude changes in household and firm behaviour in response to the carbon price, which will reduce the overall household cost.

Carbon pricing policies implemented in Canadian provinces should certainly be designed to be fair across households of different incomes. However, the analysis here suggests that concerns for household fairness need not preclude policy action, given that smart recycling of revenue can significantly improve the fairness of carbon pricing policy in all provinces.

Deeper Dive