Abstract

Provinces need the portfolio of revenue recycling options that works best for them.

The primary objective of carbon pricing is to reduce greenhouse gas emissions. But the price is only half the story. Carbon pricing can generate substantial revenue for provincial governments. How this revenue is recycled back into the economy can affect both economic and environmental objectives. This report focuses on the costs and benefits of six revenue recycling options: transferring revenue to households; reducing existing tax rates; investing in emissions-reducing innovation and technology; investing in critical public infrastructure; reducing government debt; and providing transitional support to industry. As priorities differ across provinces, revenue-recycling choices will differ across the country. The authors conclude that household fairness and business competitiveness challenges can both be addressed with good policy, and therefore need not be an obstacle to designing and implementing carbon pricing policies.

Four Recommendations

#1: Governments should use revenue recycling to address fairness and competitiveness concerns around carbon pricing.

Carbon pricing is the economically sensible way forward for Canadian provinces. Potential challenges associated with pricing carbon—disproportionate costs for low-income households and competitiveness pressures for vulnerable industries—should not preclude implementing carbon pricing policies. These issues can be effectively addressed through well-designed revenue recycling.

#2: Governments should clearly define their objectives for revenue recycling.

Provinces will have different objectives, depending on their own context and priorities. Identifying priorities is a crucial for defining optimal province-specific approaches to revenue recycling.

#3: Governments should use a portfolio of approaches to revenue recycling.

Genuine trade-offs exist across the different approaches to revenue recycling. No single approach examined here can improve household fairness, address business competitiveness, and improve broad economic and environmental performance as well. Multiple priorities can justify multiple approaches to revenue recycling. Provincial priorities will naturally vary.

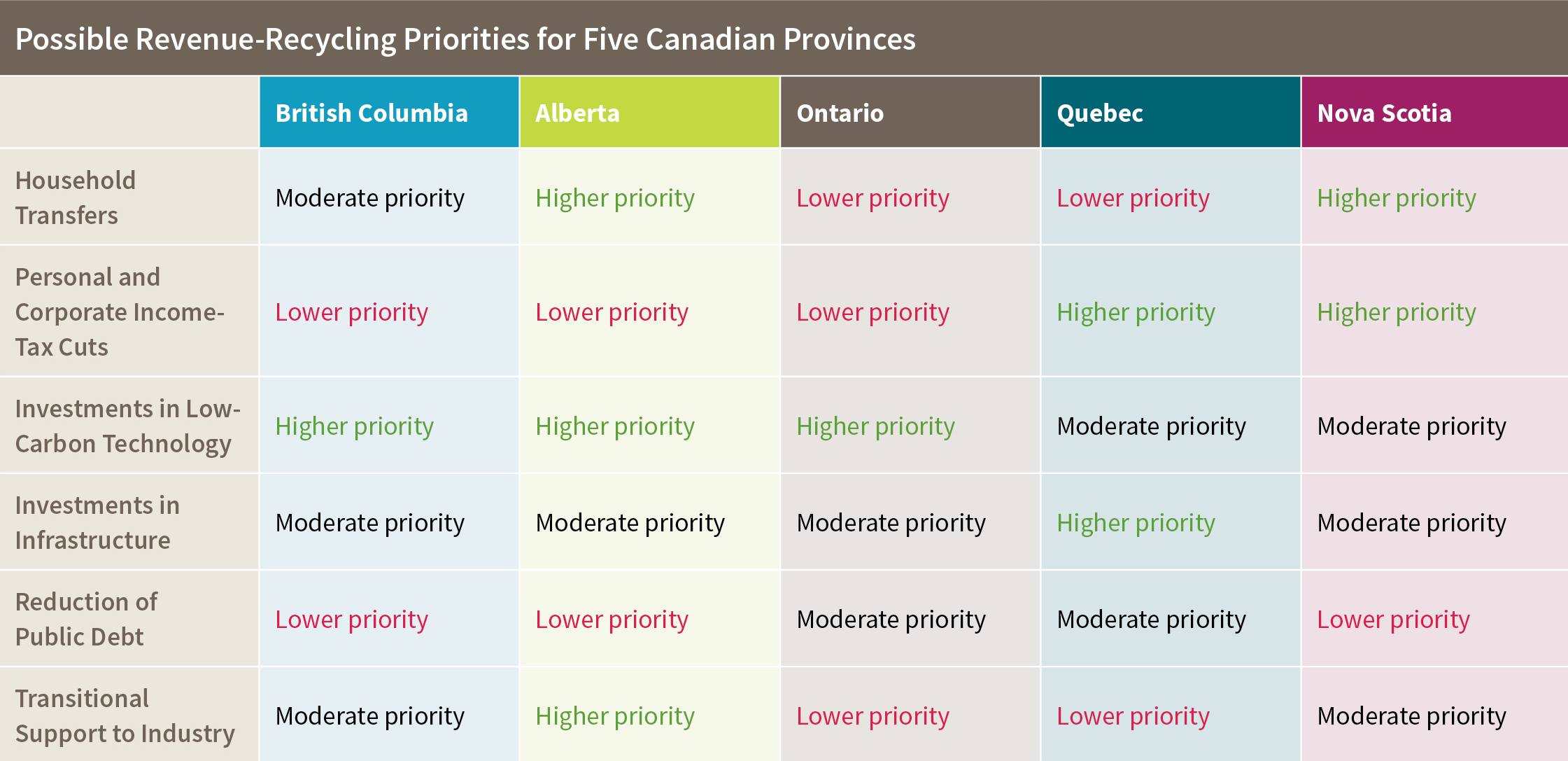

Choosing priorities is the task of governments, and beyond the mandate of the Ecofiscal Commission. However, our analysis of the various recycling options, when combined with the various provincial contexts, allows us to identify the possible higher, moderate, and lower priorities for each of five Canadian provinces:

#4: Revenue-recycling priorities should be adjusted over time.

Provincial priorities generally change over time, and revenue-recycling approaches should similarly evolve. Some changes in circumstances will be predictable, while others will be unexpected. Like other fiscal decisions, revenue-recycling choices can and should be revisited periodically.

Read the Report Check out our Events