Does carbon pricing mean bigger government?

The main objective of carbon pricing is reducing GHG emissions by changing incentives, not generating revenue

- Carbon pricing works. As Ecofiscal Commission research shows, carbon pricing has successfully reduced GHG emissions in the jurisdictions it has been implemented.

- People and businesses respond to prices, including carbon prices. As the price of emissions-intensive goods and services rise, people change their behaviour and their choices in ways that reduce GHG emissions.

- Carbon pricing need not be about bigger government, but rather better government—it puts a price on pollution, which is harmful to society and something we want less of.

The question of how revenues get used is separate from the carbon price itself

- Under the Pan-Canadian Framework, provincial governments can choose how to use carbon pricing revenues generated within their province.

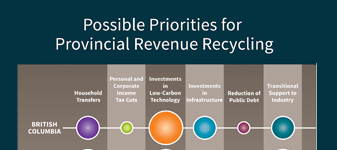

- Provinces have multiple options for recycling revenue, and different choices can make sense in different contexts (see our infographic on revenue recycling options).

- For example, governments can use the revenues to lower other taxes or transfer the revenues directly to households. They could also use the revenue to build infrastructure, pay down debt, bring in “complementary” climate policies, or fund climate change adaptation.

- Revenue recycling choices should be evaluated separately from carbon pricing, based on their costs and benefits.

Carbon pricing does not mean the size of government has to grow

- Carbon pricing can be “revenue neutral”, where revenues are used to finance other tax cuts (BC’s tax was revenue neutral until March 2018; 85% of revenues are still returned via tax cuts).

- Governments have choices. Carbon pricing can even be “revenue negative,” where more than the amount collected under the carbon price is returned in the form of tax cuts (as was the case under the BC carbon tax when it was originally implemented as well as the now-defunct proposal in the Ontario Progressive Conservative Party’s People’s Guarantee).

- Governments that disagree with the revenue recycling priorities of their predecessors can change them, and do not necessarily require legislation to do so. For example, Alberta’s current carbon tax legislation states that the government can use the revenues for climate change mitigation or adaptation or to return them to citizens, businesses and communities via rebates, tax credits or tax cuts.

Other Resources

More Fast Facts on Carbon Pricing