Abstract

This report makes the economic case for a new suite of Canadian policies—ecofiscal policies—that align our municipal, provincial and national economic ambitions with environmental imperatives. It demonstrates the opportunity for Canada to modernize its fiscal system in a way that drives innovation, investment, growth and better protection for our natural wealth. Drawing from the growing body of international examples and case studies, the report also presents uniquely Canadian successes and considerations for achieving smart, practical and attainable ecofiscal policy solutions.

Key findings

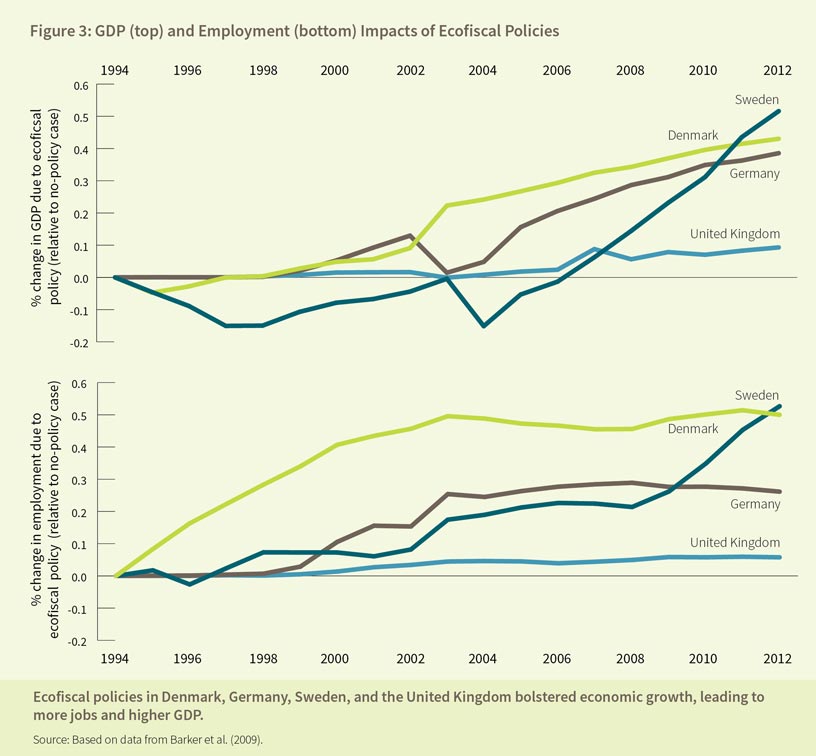

Ecofiscal policies use market forces to re-balance this equation. They align economic and environmental priorities, creating incentives for conservation, but allowing flexibility in how firms and individuals reduce their pollution. They enable reductions in other taxes such as corporate and personal income taxes. For example, ecofiscal reforms in Denmark that target air, carbon and water pollution were used to lower personal income-tax rates, reduce employer contributions to social security and pensions, while supporting investment in energy efficiency.

Acting fairly also means making decisions that respect and accommodate the diversity of Canada’s regions, sectors, and families. Well-designed ecofiscal policies can recognize the differences between regions and need not involve wealth transfers between them. They can also ensure that additional burdens are not placed on the most vulnerable. For example, research suggests that only 10% of the revenue generated by a Canadian carbon tax would be required to offset the impact of the tax for low-income Canadians. Similarly, several policy options exist to address the potential impact of ecofiscal policies on firms’ competitiveness.

Canadian competitiveness concerns require making smart ecofiscal decisions, not delaying them.

Deeper Dive into the Evidence

The Executive Summary

Canada’s Ecofiscal Commission will examine practical fiscal solutions for Canada that spark the innovation required for increased economic and environmental prosperity. We believe that aligning Canada’s economic and environmental aspirations is both critical and possible for our country’s continuing prosperity.

Smart environmental policy is smart economic policy. Canada’s current and future economic prosperity depends on protecting our clean air, water, and land, and also reducing our greenhouse gas emissions. It depends on ramping up Canadian innovation to respond not only to today’s demands, but also to the emerging environmental realities that will shape the markets of tomorrow. We can no longer afford to silo our economic and environmental agendas. The sustained well-being of Canadians requires new policies that align our aspirations for a thriving economy and a clean environment. Current evidence suggests that we can achieve this by using ecofiscal policies.

Ecofiscal reform is a critical opportunity for the country. Canada is fortunate, both in terms of its economic prosperity and its unparalleled natural assets. It has maintained this prosperity not by accident, but through deliberate policy choices. Just as Canada successfully tackled high government budget deficits and embraced freer international trade, implementing ecofiscal policies is our next ambitious, and critical, policy opportunity.

Total Canadian government revenues now represent over one-third of our Gross Domestic Product (GDP), yet our ecofiscal revenues are only 1% of GDP, a significantly lower share than in other major OECD countries. The International Monetary Fund recently suggested that by using ecofiscal policies reflecting damages caused by fossil fuel consumption and traffic congestion, Canada could generate revenues of roughly $26 billion. This would provide an opportunity to achieve further benefits by recycling these revenues back into the economy. Ecofiscal reform thus presents a tremendous untapped opportunity for Canada.

The aim of this report is to start the conversation required to examine these opportunities. The evidence presented here highlights the success of ecofiscal policies already implemented in Canada and the rest of the world—evidence that makes a strong and reasoned argument for greater use of these tools across Canada.

Here are the five pillars of that argument:

1. Canada’s natural wealth is fundamental to our economy; damaging it is costly.

Sectors such as tourism, forestry, and agriculture rely directly on the health of our ecosystems; most others rely indirectly on the same. The costs of repairing environmental damage use funds that could be fruitfully invested elsewhere in the economy. Increased health problems caused by pollution, the remediation of contaminated sites, and climate-change impacts will cost taxpayers dearly. Estimates suggest, for example, that air pollutants in Canada will impose health costs of roughly $230 billion between 2008 and 2031. Ongoing climate change is also expected to have major economic implications for Canada, with estimated costs rising from around $5 billion annually in 2020 to between $21 and $43 billion annually by 2050. The Insurance Bureau of Canada noted that the “terrible effects of new weather extremes” cost insurers a record-breaking $3.2 billion in 2013.

2. Canadians deserve a better fiscal system.

Canada’s current fiscal system—the entire collection of taxes, subsidies, and spending policies used by government—is working against our well-being by holding back innovation and productivity while inadvertently promoting greenhouse gas emissions and pollution of our land, air, and water. Taxes are crucial for financing essential government services, but all taxes are not created equal. Income taxes, which Canada uses extensively, reduce incentives for investment and job creation and tend to reduce economic growth. In contrast, taxes on pollution, which we use sparingly, create incentives for activities that improve the health of our environment.

Ecofiscal policies use market forces to re-balance this equation. They align economic and environmental priorities, creating incentives for conservation, but allowing flexibility in how firms and individuals reduce their pollution. They enable reductions in other taxes such as corporate and personal income taxes. For example, ecofiscal reforms in Denmark that target air, carbon and water pollution were used to lower personal income-tax rates, reduce employer contributions to social security and pensions, while supporting investment in energy efficiency.

3. Ecofiscal policies can be designed to ensure fairness in multiple ways.

Fairness is intrinsic to the use of ecofiscal policies since they require polluters to pay for the environmental damage they cause. Fairness also means ensuring that our grandchildren inherit Canada’s natural wealth, not its ecological debt. Failure to invest in clean energy now will cost Canadians many times over down the line. According to estimates by the OECD, for example, every dollar invested now in a low-carbon electricity sector results in more than four dollars saved by future generations (who would otherwise be required to reduce emissions at much higher costs).

Acting fairly also means making decisions that respect and accommodate the diversity of Canada’s regions, sectors, and families. Well-designed ecofiscal policies can recognize the differences between regions and need not involve wealth transfers between them. They can also ensure that additional burdens are not placed on the most vulnerable. For example, research suggests that only 10% of the revenue generated by a Canadian carbon tax would be required to offset the impact of the tax for low-income Canadians. Similarly, several policy options exist to address the potential impact of ecofiscal policies on firms’ competitiveness.

4. Improving innovation is critical for Canada’s future.

Ecofiscal policies drive innovation by creating incentives for the development of new technologies that reduce pollution and environmental damage. In Sweden, for example, a price on emissions of nitrogen oxides coincided with a seven-fold increase in patents on pollution-reducing technology from 1988 to 1993. Over the longer term, this innovation will put Canada in a more secure and advantageous position, particularly as our trading partners implement more of their own ecofiscal policies.

5. Canadians can seize an opportunity for long-term, clean prosperity.

Right now, however, we’re behind the curve. We lag behind most OECD countries in innovation and productivity growth; we also lag behind them in environmental performance. Perhaps not surprisingly, we are close to the bottom of the list in the use of ecofiscal policies. However, important progress—particularly at the provincial level—shows that these policies can and do work in Canada.

This report is the starting point for Canada’s Ecofiscal Commission. Future research by the Commission will focus on practical policy solutions that can drive the innovative economy we need to succeed in the 21st century. The Commission’s future reports will explore these opportunities for pragmatic Canadian policy. Policy issues will likely include: