Climate Roulette: Risks too big to ignore

It’s a sobering time for anthropogenic climate change. Heatwaves, wildfires, droughts, and hurricanes continue to make headlines around the globe. At the same time, major reports are reminding us that the world is a long way from its climate commitments. We’re even further from limiting global temperature rise to the international target of 1.5ºC. Without unprecedented and urgent action, current climate events—like Australia’s searing heatwave—could seem trivial in hindsight.

When it comes to climate science, we’ll defer to scientists who use the best available data and analysis. But as economists, we do know something about risk. And as we explore in this new blog series, failing to act on climate change (or worse yet, backsliding) isn’t a viable risk management strategy. In no other circumstances would we casually shrug off such overwhelming evidence or such enormous risk. Business as usual is a risk we can’t afford to take.

Rolling the dice

The science is clear: the future damages from climate change will increase significantly as we emit more greenhouse gases (GHGs) into the atmosphere. The most recent report by the International Panel of Climate Change, for example, finds a huge difference between warming of 2ºC compared to 1.5ºC. The seemingly small 0.5ºC difference will mean extreme weather events will become more frequent, stronger, nastier, and costlier. Warming above and beyond 2ºC would be categorically worse.

The exact timing and severity of climate change, however, is less certain. Estimating the impacts from climate change is difficult, and for good reason. Climate models try and replicate the complexity of the earth’s natural systems. They also try to predict where GHG emissions will be in 10, 50, or 100 years, which depends on how much individuals, communities, and countries reduce emissions between now and then.

This is where risk comes into the picture. Scientists and economists use the best available evidence to estimate the likelihood and severity of future climate damage. Just as it’s impossible for insurers to know whether your car will be stolen or whether your house will catch fire, all they can do is look at the relative probability of something bad happening, along with how much it might cost.

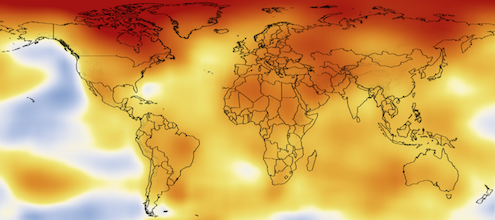

The graphic below shows the relative risk of different climate impacts from rising global temperatures. So far, human activity has warmed the earth by about 1ºC above pre-industrial levels. This puts us into the “high-risk” category for coral die-off and coastal flooding (which is already happening). Our risks increase dramatically with an additional 0.5ºC of warming, which could happen by 2030.

Source: IPCC (2018), published in the Guardian

Playing with fire

Estimating and understanding risk is complicated, especially when we’re talking about such destabilizing threats. Here are five big takeaways:

- The impacts from climate risk are happening in real time and are faster and more severe than predicted. In 2017, insured losses from weather-related events were $134 billion globally, about the size of Manitoba and Saskatchewan’s economies combined. This was the second most expensive year on record after 2011. For some Canadian perspective, the 2016 wildfire in Fort McMurray caused $3.7 billion in damages.

- The probability of catastrophic (and gradual) climate events will increase over time. As the figure above illustrates, extreme weather events, sea-level rise, forest fires will become more frequent and severe over time. A recent report by the US Government estimates that, on our current trajectory, climate change could shrink the U.S. economy by as much as 10% by 2100. Future costs could make the financial losses from the Great Recession look like peanuts.

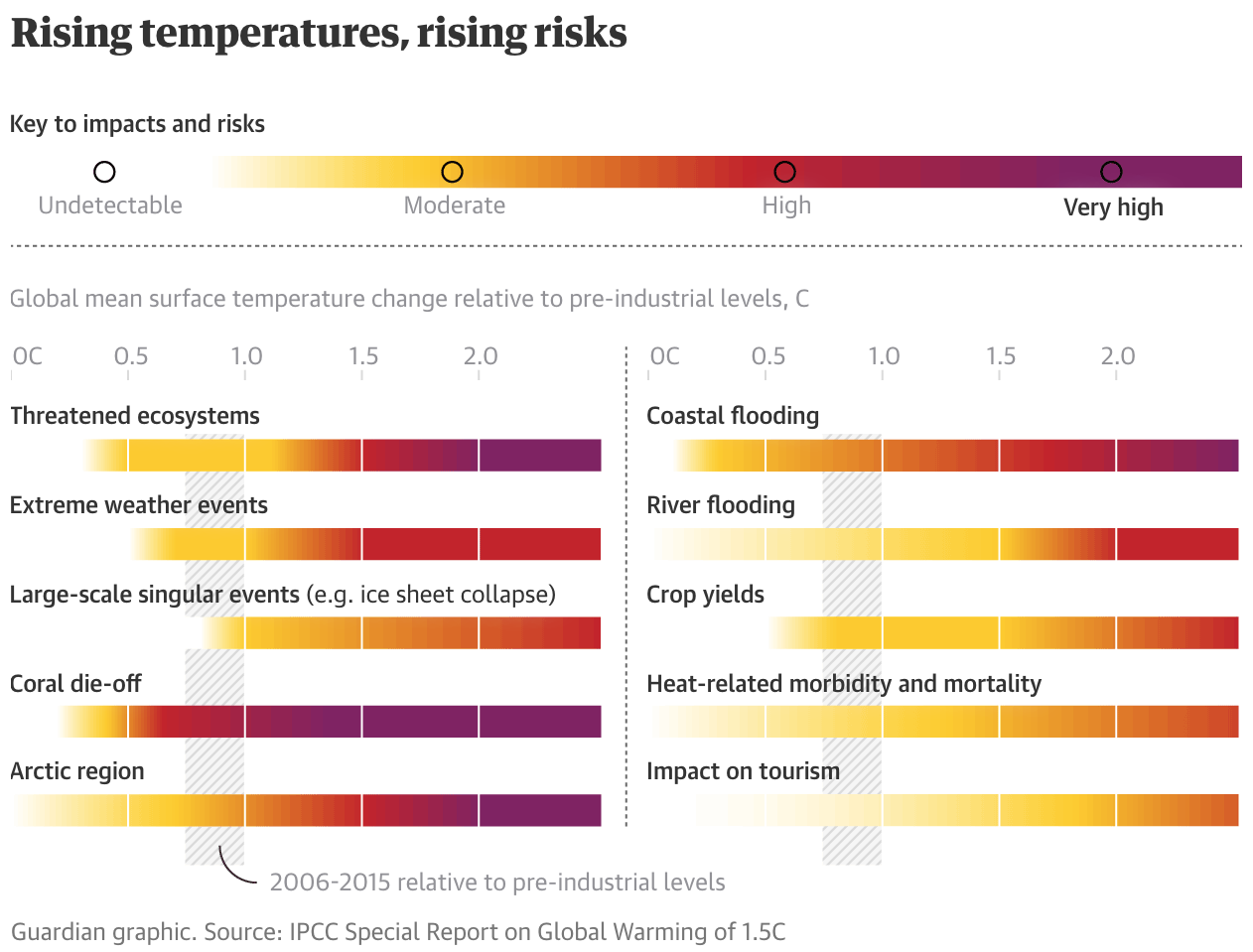

- Another analysis by the World Economic Forum concluded that the biggest risk factors that could destabilize the world economy were either directly or indirectly related to climate change (see figure). Corporate America is also worried that climate risk will threaten infrastructure, supply chains, and consumer demand.

Source: World Economic Forum

- Our level of climate risk depends on our choices. Reducing our emissions today can reduce the future risk of climate change. It can, in other words, get us off the high-risk, high-cost trajectory that we’re currently on (more on this later in our blog series).

- Delay is costly. Reducing emissions gradually over time is way cheaper and easier than delaying and needing to cut the same emissions over a shorter time frame. Each decade of delaying climate policy in the US is estimated to increase the costs of the eventual policy actions by 40%. The same is true in Canada. Waiting will cost more.

- Uncertainty in modelling means we’re underestimating climate risk. Climate and economic models aren’t great at estimating “worst case” scenarios. There’s simply too much uncertainty. Climate change could, for example, cause devastating and irreversible impacts, such as abruptly slowing the North Atlantic Current or pushing us toward a “Hothouse Earth”.

These “non-linearities” make the future costs of climate change infinitely large. What is the cost of species extinction or mass migration? What is the cost of causing irreparable harm to future generations? Just as we struggle to grasp these existential questions, so do climate models.

Your everyday type of risk

Thinking about climate risk can be overwhelming, even paralyzing. But it’s important to not get stuck in the weeds. We can and should treat climate risk like any other type of risk. It makes it easier to digest and manage.

We confront risks every day, from driving, walking, working, smoking, drinking, to travelling. We manage all of these risks according to how much damage they could cause to our health, wellbeing, or finances. Few of us try base jumping or other extreme sports because it’s foolishly dangerous (see figure). But even for less risky activities, like biking to work, we reduce our risk exposure by wearing a helmet and avoiding busy roads.

Source: Daily Infographic

The insurance industry is built on our collective desire to hedge against risk. We buy insurance for all types of things (cars, homes, and even our own lives), even when the risk of something happening is pretty small. It’s no surprise the insurance industry is so worried about climate change.

Why risk it?

The risks of climate change are way too big to ignore. We’re already seeing the costly damages from a warming planet. And the best available evidence tells us that things will get much worse without additional actions. We risk leaving future generations with a far less hospitable planet.

Taking bold steps to reduce these risks is both reasonable and prudent. Cutting GHGs in Canada, for example, can help reduce global emissions and contribute to international efforts to reduce our collective risk. Just the same, adaptation policies can make our communities more resilient and reduce our exposure to costly damages in the future.

This blog series will eventually tackle these policy solutions in detail. Our next blog explores the human side—what climate risks means for our bodies, our communities, our institutions, and our economy.

1 comment

What if I’m going to be ‘6 feet under’ when the worst hits? As an older Canadian, when voting for policy solutions, should I be thinking about just myself? There’s something called ‘generational externalities’. That’s when one generation agrees amongst itself to do something that impacts a future generation. Impacts can be positive. Handing the next generation a great economy is a positive generational externality. Handing the next generation large public debt is a negative generational externality. And handing the next generation a damaged planet is a negative generational externality. How to fix the negative generational externailities? If it was possible, bringing future generations back in time to vote in todays elections should help find the right balance between environment, public debt and economy. Another fix: weight votes inversely with age, since youth have a bigger interest / stake in the deep future – including economy and environment. Even simpler: ask youth you know what they think on issues of the deep future – such as climate change and preferred action – and vote accordingly. (Hint: polls show youth are much more unanimous in wanting the climate problem fixed. And having an interest in the economy deep into the future, I suspect they would want the problem fixed the cheapest way, so the economy is still great. And hint: economists at ecofiscal.ca have been saying broad based carbon pricing is the most efficient way / _cheapest_ as measured in $/tonne abated, and start early, signal future carbon pricing early, and ramp up pricing gradually to minimize stranded asset costs, till you hit your Paris targets.)

Comments are closed.