Gear shift: Alberta’s climate policies poised for big changes

Today, Alberta’s newly-elected government will table the Carbon Tax Repeal Act. If the bill proceeds as expected, the carbon levy could be gone as early as next week. However, that doesn’t mean the end of the province’s climate policy discussion. We’ll use this blog to explain what the changes mean within and beyond Alberta.

The carbon levy will disappear… and reappear

Much like the federal backstop, Alberta’s carbon price has two parts. First is an economy-wide levy that adds a fee to gasoline, diesel, propane, and natural gas. Second is a pricing system for large industrial emitters: the Carbon Competitiveness Incentive Regulation. Both will see significant changes over the next several months. We’ll analyze each in turn.

The Carbon Tax Repeal Act eliminates Alberta’s carbon levy, which took effect January 2017. Repeal will move the price of carbon from $30/tonne to $0/tonne, taking 6.7 cents off a litre of gasoline, 8 cents off a litre of diesel, and $1.52 off a gigajoule of natural gas.

The absence of an economy-wide carbon price is temporary. By abandoning its own system, Alberta opens itself up to the federal backstop already in place in Ontario, Manitoba, Saskatchewan, and New Brunswick. Once the backstop takes effect, the price of carbon will move to $20/tonne, and back to $30/tonne in 2020.

The move from Alberta’s carbon levy to the federal backstop has a few important implications. Alberta is exposing a number of small oil and gas producers that were temporarily exempt from the provincial levy to the federal backstop. Emissions covered by carbon pricing will rise from 72 percent to 79 percent.

Alberta is, in essence, exchanging an immediate increase in coverage for a temporary decrease in stringency.

Source: Dobson, Winter & Boyd, 2019

Source: Dobson, Winter & Boyd, 2019

Goodbye programming, hello rebates

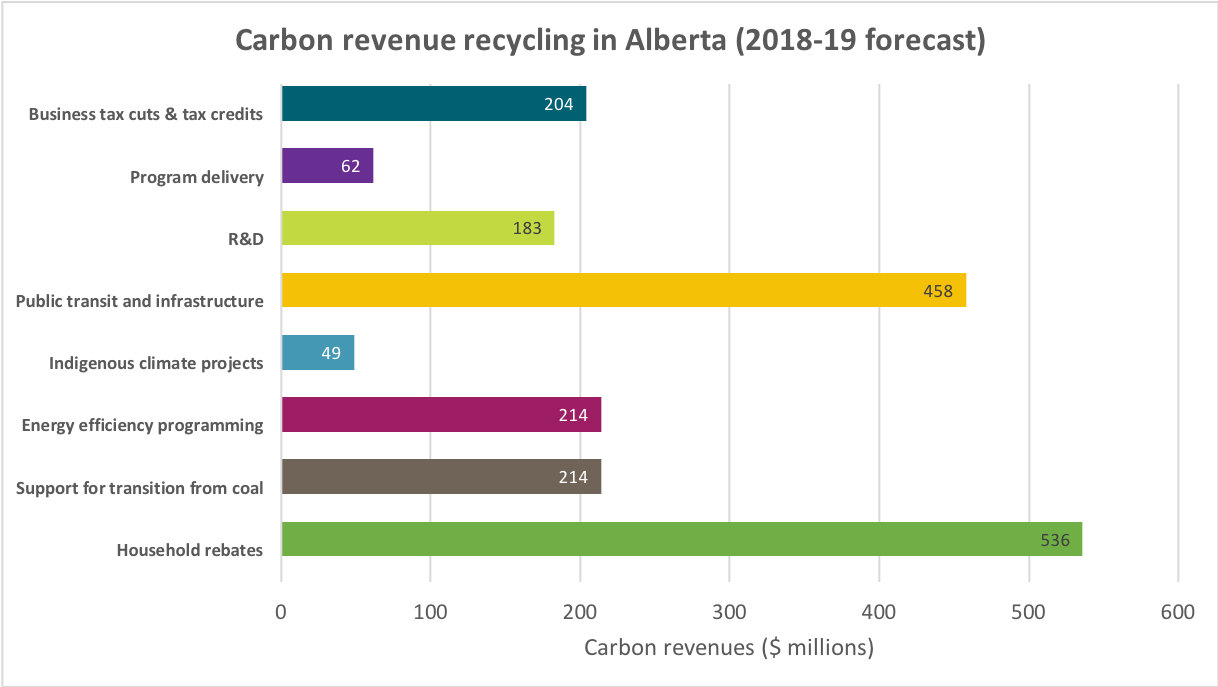

Alberta will surrender control of the revenues generated from the carbon price. All carbon revenues raised in Alberta will still stay in Alberta, but the allocation will look very different. Starting in 2020, every Albertan will receive a carbon rebate just like households in other backstopped provinces.

Alberta is foregoing $1.38 billion for the 2019-20 fiscal year and $1.526 billion for 2020-21. These carbon revenues fund a range of initiatives, many of them focused on economic diversification. Alberta must discontinue these programs or find another revenue source.

Source: Government of Alberta, 2018

Source: Government of Alberta, 2018

A few programs—Energy Efficiency Alberta, household rebates, and various R&D projects—will be relatively straightforward to wind down in an orderly manner. Some are trickier to reverse or cancel, such as tax cuts or public transit expansion projects already underway in Calgary ($33.5 million in carbon revenues) and Edmonton ($230 million).

Then there’s the $214 million dedicated to coal communities, which is worth unpacking. A key plank of Alberta’s 2015 Climate Leadership Plan was the phase-out of coal-fired power by 2030. Alberta’s new premier hasn’t committed to proceeding with this policy, but Alberta is still subject to the 2030 federal coal phase-out. The province now has fewer resources to compensate and retrain these communities. How Alberta’s new government will navigate the federal phase-out—be it an equivalency agreement or revenue reallocation—is unclear.

Alberta’s current laws permit different approaches to revenue recycling. While wholesale repeal appears inevitable, there is nothing stopping the government from winding down existing programs and using carbon revenues to cut corporate or personal income taxes instead. (See here for how Alberta’s revenue recycling stacks up against other Canadian plans.)

More changes for large emitters

Alberta pioneered North America’s first carbon price—the Specified Gas Emitters Regulation (SGER)—in 2007. SGER required large emitters (>100 kilotonnes annually) to improve their emissions performance over time. Standards were based on historic emissions performance on a facility-by-facility basis. Any emitter exceeding its assigned threshold had to purchase offsets or pay $15/tonne into a technology fund that invested in emissions reductions technologies within Alberta.

The Carbon Competitiveness Incentive Regulation (CCIR) replaced SGER in 2018. It raised the carbon price to $30/tonne and set benchmarks based on sector-level performance rather than facility-level performance.

In January 2020, the Technology Innovation and Emissions Reduction (TIER) will replace the CCIR. It will lower the carbon price to $20/tonne and return to facility-level standards (except for electricity). Large emitters must improve their emissions intensities by 1% annually until 2030, either through operational improvements or compliance trading. The first $100 million in revenues and 50 cents on the dollar thereafter will flow to a new technology fund much like SGER’s. Remaining revenues will fund deficit reduction and two-thirds of Alberta’s new energy war room.

Would TIER meet the criteria to avoid the federal output-based pricing system? What are the trade-offs between TIER and the federal system? Those are bigger questions. We’ll return to them in a later blog.

The end of the beginning

This week’s developments represent a gear shift for Alberta. But they aren’t the end of carbon pricing and climate change policy in Alberta.

In the medium-term, Alberta must reckon with stringent climate policy no matter what. Climate change is an increasingly important issue in Canada, and Alberta has a key role to play in reducing emissions and contributing to Canada’s national target.

In the very short-term, carbon pricing will continue in Alberta: The federal backstop will replace Alberta’s system, which means the province will lose control over the design details and the revenues—just as Ontario did when they repealed their cap-and-trade system last year.

There are more chapters in this story. The Carbon Tax Repeal Act signals the end of the beginning rather than the beginning of the end.

1 comment

Some in AB like/prefer the fed backstop: bigger equal rebates. “Don’t use (the c-tax revenue) to fund new LRT or subsidize LED lightbulbs. Just give me the biggest rebate you can and I’ll find my own way to work, and pick my own lightbulbs”. And that’s the way carbon pricing works best: sending a signal / giving incentive to abate, and leaving it up to individual actors to decide how best to abate. Unlike other provinces, AB currently has no PST/HST and so has that as an option to raise revenue to cover stranded programs.

Comments are closed.